Financial Planning | Managing Debt | Personal Finance | Article

Why You Should Refinance or Reprice Your Home Loan in a High Interest Rate Environment

by Lionel Lee | 15 May 2023 | 8 mins read

This article is brought to you by PropertyGuru Finance

If you had purchased property or refinanced your home in the last few years, it’s likely that your home loan interest rates were low, or at the very least much friendlier than they are currently.

The near-zero interest rates took a turn in 2022 and rose to the highest they have been in recent years — in April 2023, competitive fixed home rates rose to up to 3.6%.

This increase in his home loan rates was what 33-year-old Clement Chia found himself facing late last year. But nearing the end of the lock-in period for his floating home loan, he realised his mortgage instalments had increased from $2,396 to $3,447 a month – that’s $1,051!

Hence, he started exploring options to manage his home loan without stretching himself or his budget too thin, so as to better manage his cash flow.

If you are in a similar situation as Clement, here are some things to consider when looking to refinance your home loan in the current high-interest-rate environment.

Understanding fixed vs floating home loans

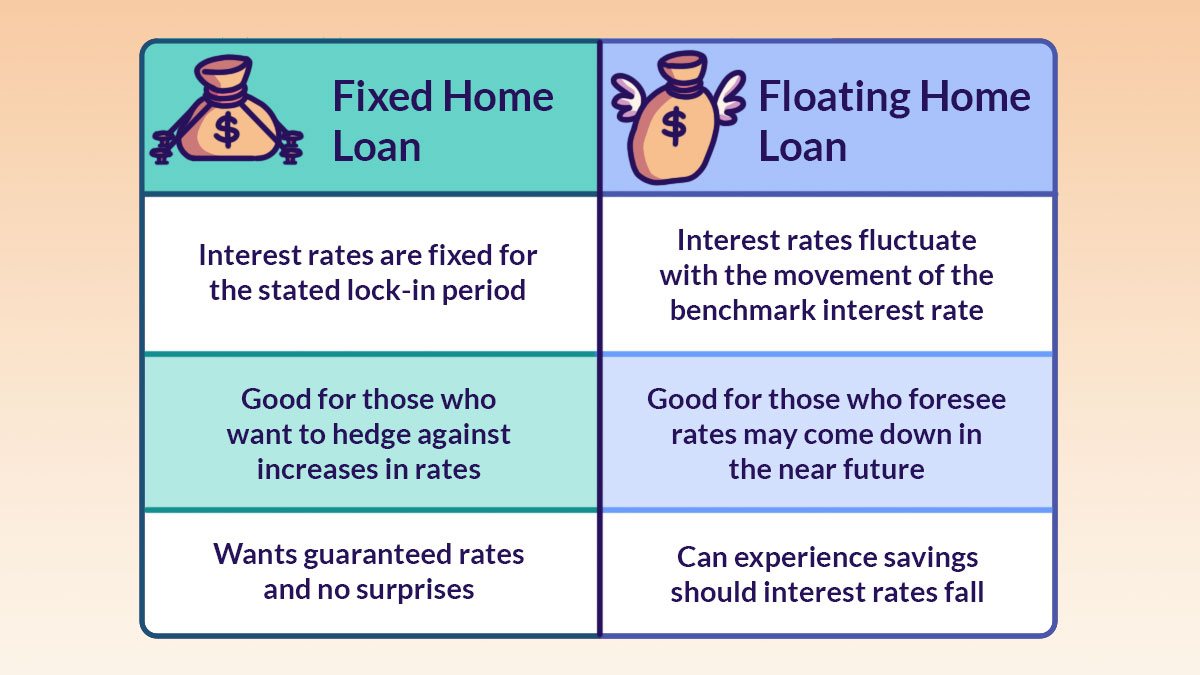

Typically, there are two types of home loans offered in Singapore: fixed rate home loans and floating rate home loans.

A fixed rate home loan, as the name implies, has a fixed interest rate that doesn’t change during the lock-in period, which typically range between two to five years.

If you prefer certainty in how much you would pay for your home loan every month, a fixed rate home loan would give you just that. This gives you better control over your monthly budget, and if interest rates do still go up, you’ll be protected against the hike for the duration of the lock-in period. But the reverse is also true, if interest rates drop, you may be paying rates higher than the market.

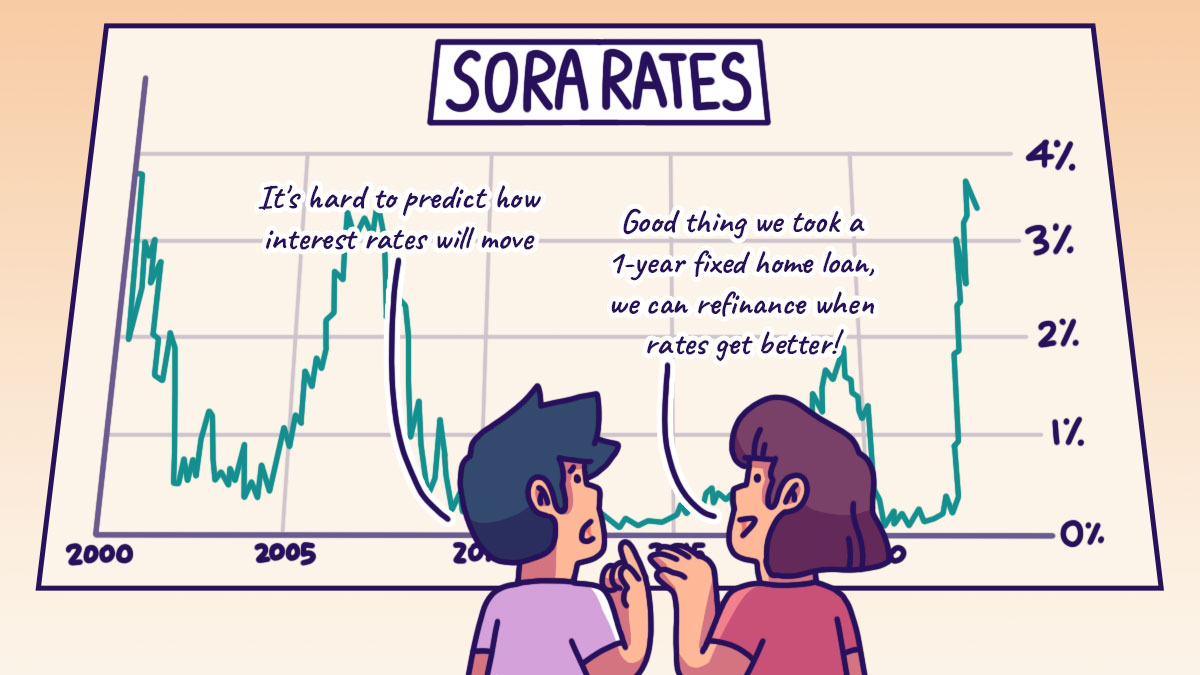

On the other hand, a floating rate home loan has a variable interest rate. This type of home loan is tied to a reference rate such as the Singapore Overnight Rate Average (SORA) or Singapore Interbank Offered Rates (SIBOR). These reference rates can increase or decrease and tend to move in tandem with market conditions. For example, SIBOR and SORA rates went up quickly in 2022, alongside the series of interest rate hikes made by the Federal Reserve.

So what does this mean for those who take a floating rate home loan? If you have a SORA-pegged home loan and the SORA rates go up, so does your monthly repayment amount.

Floating home loans are an option to consider if you’re comfortable with handling changes to your monthly mortgage repayments. And the key advantage is that you could be paying less the following month if your mortgage interest rate dips.

For Clement and his wife, they first got a floating-rate home loan with a 2-year lock-in period in 2020 as interest rates were near-zero. When interest rates were at their lowest point, his mortgage rates were about 1.25% p.a. But as interest rates hiked up in 2022, the couple found they were paying a mortgage rate of 4.85% p.a., forking out $3,447 a month!

As they were reaching the end of their lock-in period in late 2022, they started exploring the available loan options available to them and found a suitable refinancing option.

And because he refinanced his home loan, he is now paying a loan with an interest rate of 3.35% p.a. His monthly instalments have gone down considerably and are now $2,711 per month. By refinancing his home loan, Clement saved himself $736 a month. Imagine if he had not refinanced his home loan!

Consider the interest rate outlook

Clement and his wife chose to go with a fixed-rate home loan when they refinanced their mortgage as they felt that it would “curb our long-term risk, while remaining competitively priced after considering the mortgage interest rate outlook for 2023”.

Market factors suggest that the chances of mortgage rates going down in the next couple of months are low. In fact, it is predicted that interest rate hikes will only moderate in H2 2023.

This can be attributed to the following reasons:

- In 2023, mortgage rates are expected to remain high but the Federal Reserve rate hikes are expected to be less aggressive

- In September 2022, the Monetary Authority of Singapore (MAS) raised the interest rate used to calculate the Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR) up from the previous 3.5% to the current 4% for residential property loans.

Even though interest rates are currently high they may not stay this way forever. As the saying goes, “What goes up, must come down.”

If you think that interest rates are likely to come down soon, you may not want to lock yourself up in a fixed rate home loan with a long lock-in period. This is because you may be paying a higher interest rate on your fixed rate home loan than those with a floating rate home loan are paying when interest rates fall.

That’s why Clement settled on a one-year fixed home loan. This puts him in good stead to secure a lower rate at the end of 2023, should market conditions change.

Is there a better mortgage deal out there?

As in Clement’s case, one of the key reasons why anyone refinances their home loan is to find a way to pay less for their home and maximise their savings.

By browsing what offerings are available on the market, you could secure a more competitive mortgage package than if you had simply stayed with your current home loan provider. For instance, you could score a lower mortgage interest rate or switch from a SIBOR-pegged to SORA-pegged home loan. And in the process, you could potentially refinance your home loan and save hundreds, if not save thousands of dollars (depending on the size of your home loan).

If you aren’t sure where to start, this is where a mortgage expert can come in. Thanks to their intimate understanding of the mortgage market in Singapore, they can guide you on your home loan refinancing journey and streamline the process.

Clement and his wife had tried looking around themselves but there were “too many things to compare”. They found that with the help of a PropertyGuru Finance Mortgage Expert, the figures and terms related to home loans were simplified, enabling them to make an informed decision easily. And if they had any questions, all they needed to do was ask.

Other things to watch out for when refinancing your home loan: managing cashflow

For those who want to improve their cash flow to have more cash on hand, you can adjust your loan tenure. A longer loan term would mean a reduced monthly mortgage payment, but a longer loan term also means you’ll technically be paying more interest overall.

If you’re in the business of paying off your home in the shortest time possible, consider reducing your loan tenure by making larger monthly payments. This will reduce the amount of interest that you pay overall.

However, do exercise financial responsibility and ensure that you can afford the extra payments. You don’t want to be in a situation where you’re financially stretched.

Bear in mind that refinancing your home loan comes with conditions. For instance, if you refinance within your lock-in period, you will incur pre-payment penalties and possibly subsidy clawbacks. Ideally, you can start exploring refinancing options three to four months before your lock-in period ends. This way, you can ‘seamlessly transfer’ to your new home loan.

During these tougher economic times when inflation and interest rates are high, it is prudent to actively manage your home loan. Whether through refinancing your home loan or the various mortgage repayment strategies, you want to ensure you’re getting the ‘best’ deal out there.

And being able to save even a few hundreds of dollars a month adds up and helps you in staying on track with your long-term financial goals.

Content sponsored by PropertyGuru Finance

If you want to learn more about refinancing your home loan, check out PropertyGuru Finance.

With an array of refinancing content, online guides, and tools, PropertyGuru Finance will help make your mortgage journey hassle-free. From comparing interest rates to getting up to speed with what’s happening in the mortgage market, you’ll learn how to manage your home loan better. And if you need additional help, PropertyGuru Finance Mortgage Experts can give you unbiased, tailored home financing advice. The best part? It’s at no cost!