Investing | Article

Making The REIT Choice For Financial Independence

by Si Jie Lim | 24 Dec 2019 | 8 mins read

The conventional wisdom among Singaporeans is that investing in real estate will not go wrong. And why not? Few can argue the fact that real estate has been soaring ever since Singapore’s independence.

From public to private housing, almost every Pioneer or Merdeka generation member has made a tidy gain in the housing market.

It is no wonder why our parents seem to press into our psyche this winning investing recipe.

Singaporeans Love Real Estate But It Is Expensive

But there’s just one problem. Real estate is much more expensive than it used to be. And in order to profit off property, you first need to first own one.

With bank loans allowing you to only loan 80% of your housing value, this means you will have to fork out 20% as a down payment. While 20% might not sound like a lot, but if you consider that the cheapest property in Singapore starts from $300,000 — that’s still a minimum of $60,000.

How To Invest In Real Estate Without For Cheap?

So, what if you still want to partake in this conventional Singaporean investment wisdom, but don’t have that sum of money lying around?

Enter real estate investment trusts (REITs) and they can be purchased from online stock brokerages with just a few hundred dollars.

What Are REITs?

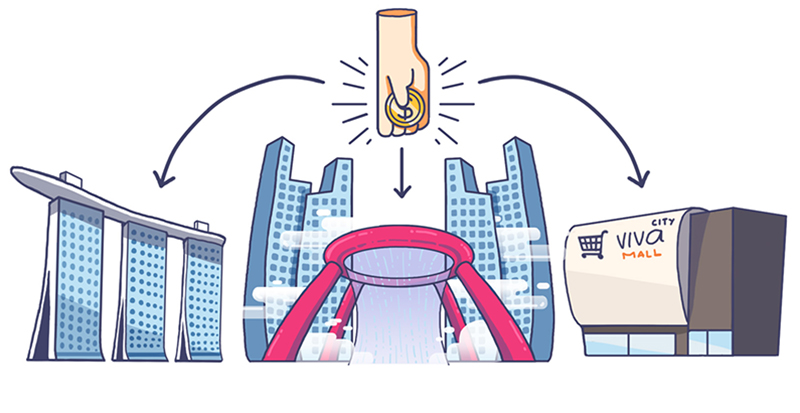

REITs are investment organisations that buy and manage properties on your behalf. Each property in the REIT’s portfolio earns rental income by leasing the space within the building to tenants.

And by law, 90% of REITs’ net income is returned back to unitholders (aka you) as dividends, paid out each year. It’s common to see dividend yields of 4% to even 10% each year, meaning for every $1,000 invested, you can get a cash dividend of $40 to $100.

What Makes REITs Good Investments

1.REITs Lets You Invest In Quality Assets In Low Denominations

REIT is an umbrella term for all types of investment trusts that invests in a portfolio of properties. REITs can also be categorised into various sub-sectors such as:

- Retail (CapitaMall Trust)

- Industrial (A-REIT)

- Office (Frasers Commercial Trust)

- Hospitality (CDL Hospitality Trust)

- Healthcare (Parkway Life REIT)

Each REIT invests in a portfolio of high-quality properties that are worth hundreds of millions or even billions of dollars.

For example, it will only cost you $2.34 to invest in a single share of Mapletree Commercial Trust. By simply forking out ~$$250 for 100 shares, you get to own a stake in prominent malls like Vivocity (valued at $2.6 billion) and Mapletree Business City (valued at $1.83 billion).

2. REITs Play Well With Inflation

If you were to invest in REITs, you have less to worry about inflation. That’s because REITs are considered — compared to other investments — a natural inflation-fighter.

This is because when inflation goes up, landlords typically raise rentals in accordance — resulting in a correspondingly higher REIT dividend payout. So as the cost of goods and services goes up — so will the rental income and valuation of properties held by the REITs.

Fitting REITs Into Your Plan For Financial Independence/Early Retirement

Now that you have a better understanding of REITs, the next step is to find out how do REITs fit into your plan for financial independence, and how do you take advantage of the qualities of REITs?

Inflation hedged payouts

Because of the qualities of consistent dividend payments — coupled with being an investment with an inflation hedge — REITs are well-positioned to be a potential cornerstone of financial independence. Even as the cost of YOUR living rises — you can be shielded from the impact of inflation as your dividend payouts have the ability to inflate in tandem.

Planning For Financial Independence With REITs

And because of this, it’s actually more simple to calculate the amount you need in REITs to secure your retirement.

In order to achieve your desired cash flow during your retirement years, you simply need to ensure the dividend yield generates the source of income that you need today — and REITs inflation-fighting capabilities will handle the rest.

So simply divide your current annual cash flow requirements, by the REITs yield percentage to arrive at the amount you REITs units you need.

Example

| Annual Expenses | Average Dividend Yield From REITs | Amount To Invest In REITs |

| $1,500 per month x 12 = $18,000 | 5% | $18,000 / 5% = $360,000 |

So with $360,000 of investment in REITs, you will be able to preserve your savings while enjoying the inflation-protected cash flow from REIT dividends that are being distributed annually (or bi-annually).

REITs Can Do More Than Beat Inflation

If taking into account the capital gains — or share price increase of REITs — S-REITs (short for Singaporean REITs) have managed to post an average total asset return of 23% in 2019 alone, leaving inflation in the dust — with the consumer price index for 2019 hovering around 1.1% so far.

So not only is it possible your retirement savings to grow in value past inflation — but owning REITs can even quicken your journey towards financial independence.

Additionally, this feature allows you the flexibility — if you choose to do so — to sell some of your units in order to generate additional income.

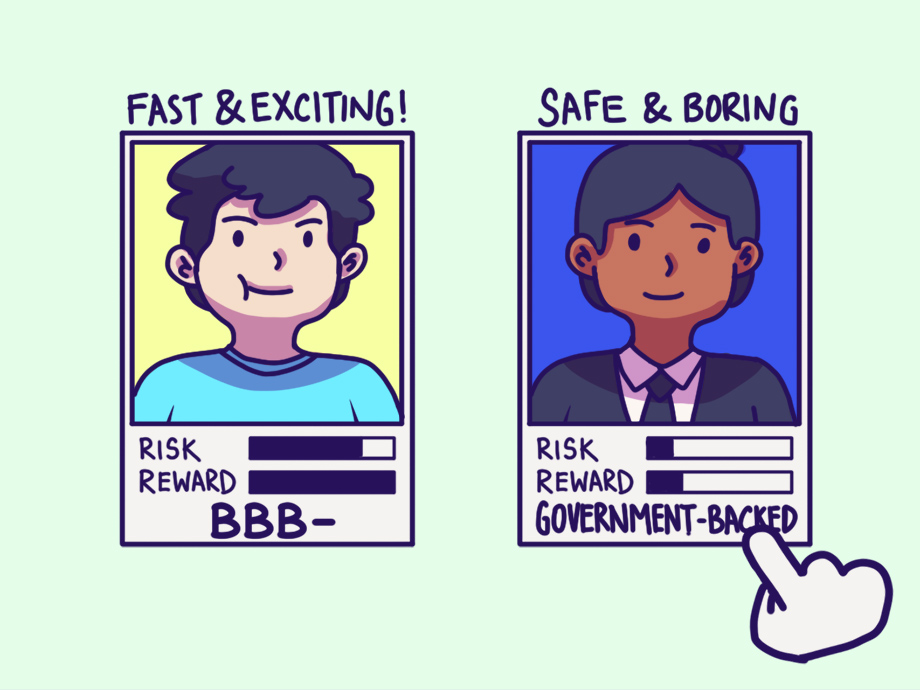

Two REITs That Were In The Headline For The Wrong Reasons

So far REITs sound great right? But of course, it can’t be all a bed of roses. Here are some case studies of REITs that made the headlines for the wrong reasons to show you why investing in REITs isn’t as simple as it sounds.

First REIT

Sponsors are critical to the attractiveness of a REIT. Sponsors are typically large shareholders in a REIT and injects new properties into a REIT. For example, Mapletree Investments sponsors four Reits: Mapletree Logistics Trust, Mapletree Industrial Trust, Mapletree Commercial Trust and Mapletree Greater China Commercial Trust.

Having the right sponsor backing the REIT can elevate its share price while having the wrong sponsor can damage its reputation. The best example to showcase this is First REIT, whose share price plunged over concerns about its sponsor Lippo Karawaci.

Two key issues plagued First REIT’s sponsor Lippo Karawaci: Liquidity risk after its credit rating was downgraded by Fitch Ratings and an alleged bribery case linked to the Lippo Group.

As the REIT’s main revenue contributor and sponsor, the troubles that plagued Lippo Karawaci scathed First REIT. The market became worried about the financial performance and stability of First REIT. Not just that, the plunge in credit rating also forced fund managers to drop their fund’s stake in First REIT, which also contributed to the fall in First REIT’s share price.

As a result, First REIT fell to its lowest share price in the past 5 years despite 2019 being a good year for REITs. If you had invested in First REIT at the start of 2019, your return would have been flat compared to an 18% gain in the S-REIT index for the year.

Eagle Hospitality

The first signs of trouble for Eagle Hospitality Trust was when it IPO-ed with lukewarm interest from investors. Eagle Hospitality Trust didn’t manage to fill its public tranche — The IPO was marred by bad PR regarding one of Eagle Hospitality Trust’s assets, The Queen Mary, which was on the verge of having its lease cut short.

Eagle Hospitality Trust was awarded the lease of Queen Mary because it had promised to shoulder repair works of The Queen Mary. However, much of the repair work that was deemed as urgent still remains uncompleted to date. While the cruise ship was only a slice of a much larger portfolio of properties, the outsized press coverage seemed to have a damper effect on the attractiveness of the REIT.

Eagle Hospitality Trust’s share price has already fallen below its IPO price and sits at US$0.56 today. That’s almost 30% paper loss if you had invested in Eagle Hospitality Trust when it IPO-ed.

REITs Aren’t Risk-Free, So Make Sure You Do Your Own Due Diligence

While REITs have qualities of a good investment, they aren’t risk-free. Just like any other investment, they carry investment risks with them. Plus, strong historical performance doesn’t guarantee that REITs will continue to do well in the future. As an investor, you should always ensure that you have done your due diligence on the REIT before making the decision to invest. Don’t just invest in REITs because of its name, no two REITs are the same and each REIT is unique in its own way.

But if you are now thinking about investing in REITs. Check out this article to find out what are some of the factors you need to consider when evaluating a REIT.