Career & Education | Life | Article

Retrenched at 30

by YuanDuan | 19 Feb 2019 | 7 mins read

It started with a Slack message from my supervisor.

“Can we have a meeting tomorrow morning?”After seeing the message, I could not sleep that night. No, meetings do not excite me that much. The company was going through a retrenchment exercise, would tomorrow be my turn to get the axe?

In bed, in the dark, I spoke to my wife about my fears. We both tried to downplay our worries.“You just got confirmed last week, how can they be retrenching you?

“Yeah, my manager told me I’m doing a good job, I should be fine.”Anyway, the word through the office grapevine was that the retrenchment exercise was wrapping up. Everyone who survived thus far was probably going to be safe.

Probably. The next day’s meeting would most likely be to reassure remaining employees and shore up morale.

Spoiler alert: Nope.

Pivoted out the door

Pivot: a startup buzzword that masks harsh truths, for example, “the company is moving towards a new direction.” Read: Sorry, we don’t need you anymore.

“It was nice working with you. Thanks for the opportunity,” I mumbled, as I shook hands mechanically with the CEO first, then with my supervisor.

A young HR executive, with an ashen expression, handed me the papers. She’d been through a lot the past week.

I signed the papers, received my severance, and in an instant, I was jobless.

The emotional cost of retrenchment

Then the really tough part came — having to explain the situation to those near and dear to you.

“Yes, it happened, babe. I’m okay. No worries, I’m sure I can get a job soon.”

But the demon inside whispers, “didn’t it take you a long time to get that job you just lost?”

“Don’t worry, I got some money, ma. Anyway, I can freelance while job-hunting.”

“You’ve never really freelanced before. You won’t make it work.”

“Yeah, it’s just bad luck, bro. My boss said I was doing good work.”

“How good was I, really? Not everyone was retrenched, would people think I sucked at my job?”

As you can imagine, getting retrenched lured out the demons of insecurity.

Being unemployed throws one’s self-worth into doubt — and this bit really cannot be undermined — even the way you introduce yourself flips on its head.“I work as a video producer.

” Versus, “I’m unemployed at the moment.”

“I draw a good salary.” Versus, “I have six months left before I start begging.”

But that was the silver lining: I had cash savings buffer to survive for six months without income.

Imagine how much more emotionally unstable I would have been if my bank account had been completely empty.

Start with an emergency fund

I began investing in stocks on a monthly basis — just a year before the retrenchment.

The first thing any financial advisor or content platform worth their salt would advise before investing is to build your damn emergency fund first.

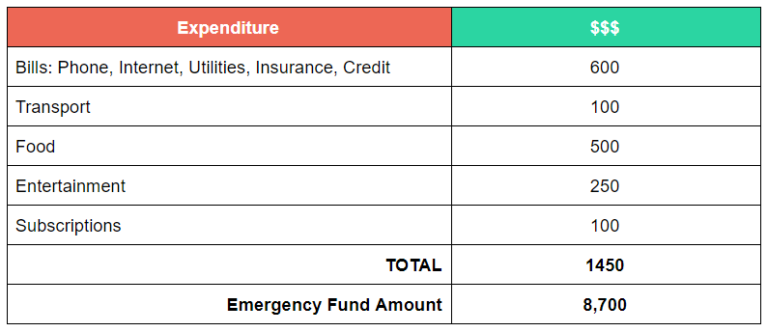

An emergency fund is, in essence, six months’ worth of expenditure in cash. It has to be liquid — meaning it can be accessed instantly, so park it away in a savings account.

No, a sneaker collection worth $5,000 does not count.

“Why six months?” you might ask. In general, that’s how long it can take —statistically speaking — before you get re-employed.

With my emergency fund, I could still pay for my bills. I could still eat.

If I did not have cash prepped and available, I would have been forced to sell the small trove of shares I had slowly accumulated.

After all, you can’t pay for prawn noodles with shares.

If I didn’t have an emergency fund and the stock market decided to start tanking, I’d have to sell and realise paper losses.

That would have been even more demoralising. It took a lot of commitment to squirrel money into investments consistently.

Being forced to turn those efforts into losses would have been such a bitter pill.

I Don’t Need an Emergency Fund

When I first read about the concept of an emergency fund, I thought, “Getting retrenched or hospitalised only happens to old people. I’m only 30!”

But that’s the thing with emergencies, unpredictability is a feature, not a bug. Nobody can plan for when an emergency strikes. You can only plan for what to do when it happens.

Despite my initial misguided mindset, thankfully, I still built the fund, so mark me a believer and evangelist now.

Living Retrenched

The good thing about being a freelancer (read: being unemployed) is that your expenditure drops. Home-cooked meals or food in the heartlands are significantly cheaper compared to eating in town.

The daily commute between work and home morphed into low-traffic commutes between the fridge and the living room. My travel costs effectively became zero.

But while costs are indeed lower compared to “normal life”, that doesn’t mean that you should plan to save less for your emergency fund. Stick to that six-month sum — it’s not inconceivable to take up to a year to get re-employed.

But anyway, my emergency fund kept me going. Here’s a rundown of how things went.

The first month of being fun-employed

The bad thing about not having to maintain a 9-to-6 schedule is that time gets a bit distorted.

Is it Wednesday or Thursday? Feels like a Tuesday, though. Does it really matter? Time is but a construct.

Second month

Not having to groom for work, I gave myself a shock when I walked by the mirror one day.

How did that bearded man get into my house?

Third month

Having no colleagues to interact with caused my social skills to suffer, just a little bit. Alexa, tell me another joke. Please, Alexa.

Yes, it took me exactly three months to find a new job. Go figure.

Another benefit of an emergency fund? Not being desperate for a paycheck meant I didn’t feel the pressure to take on any job that came my way. I was able to take my time to search for the most suitable position.

Especially during interviews, the sum in my bank account gave me the psychological steel to negotiate for fair compensation. I didn’t have to leap at whatever was dangled in front of me.

Family First

The final and most important point of an emergency fund? I didn’t have to leech off my friends and family. Throughout my unemployment period, finances did not have to become a source of friction between the wife and me.

Even though she was very supportive, I am sure that if I started relying on her for an allowance, it would have brought strain upon our relationship. Or at the very least, changed our dynamics.

Essentially, I escaped the fate of becoming a man-infant.

So don’t be a man-fant. It’s time to be an adult. We all need to realise shit happens – and more importantly, it can happen to any of us.

So, find out how to build an emergency fund.