Investing | Article

How to Save the World With Sustainable Investing

by Sophia | 16 Sep 2020 | 6 mins read

Sustainable investments and strategies have been rapidly growing and may grow into over USD $1 trillion by 2028 as projected by Blackrock. This means that people are putting more and more money behind companies dedicated to solving world issues and building a better future. In other words, sustainable investing adds new meaning to the phrase, “Be the change you want to see in the world.”

There are two ways that one can use to align themselves with sustainability.

The first one is avoiding companies or sectors that directly go against our values for a better future, undermining environmental protection or even animal rights. Think about all the big brand boycotts we’ve seen over the years that have to do with unethical treatment of workers, harming the environment, or perpetuating animal cruelty!

The second way is directly investing in companies with characteristics and business goals that have to do with making the world a better place. Here are some ways you can start that journey into sustainable (and ethical!) investing.

Invest in Companies You Believe In

Brands and companies dedicated to doing good for the world may include creating new technology that helps to improve the current state of things or innovating in order to help save the environment.

But that’s not all you should consider — there are socially responsible companies that manage to do what they do without damaging or harming the environment, and are seen as sustainable companies as well.

Look up the top 100 indexes of sustainable companies and you might find familiar names like Cisco Systems, Hewlett Packard, Unilever, and Siemens!

Invest in Sustainability Indices

For those who aren’t sure which companies to pick or are intimidated by stock picking, investing in indices on exchanges is a good way to get started. Locally, SGX lists the following sustainability indices for investors to consider:

- iEdge SG ESG Indices

Some interesting points to note:

- Companies listed in these indices have an ESG score, researched and published by Sustainalytics

- This means that they have to meet certain requirements, by putting in effort to transparently report on their sustainability practices

- Sustainalytics annually assesses these companies and will refresh ESG scores yearly to keep the integrity of these indices intact

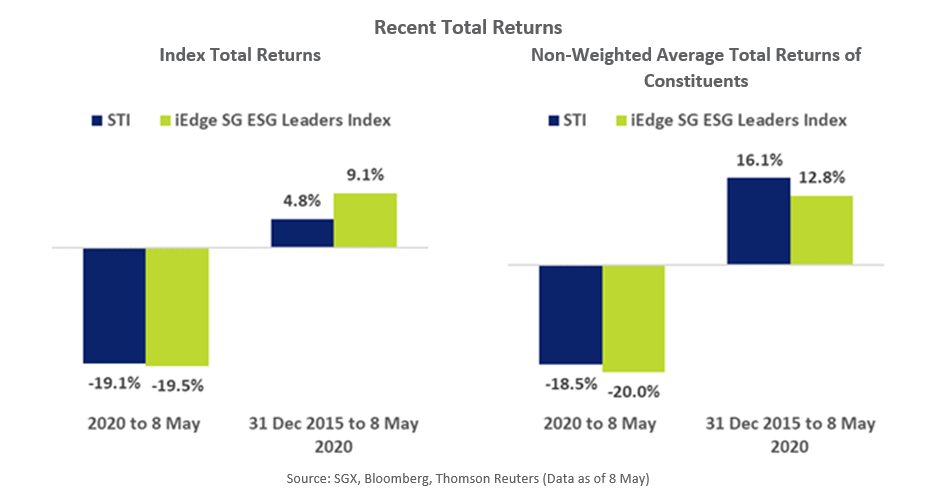

If you like the ubiquitous Straits Times Index fund but are interested in sustainability investing, the iEdge SG ESG Leaders Index might interest you — iEdge’s flagship sustainability-themed index includes 25 of 30 constituents within the STI. But it is far more diversified than the STI, with 76 constituents in total.

Constituents also have a 15% cap — meaning no company can make up more than 15% of the index.

As for how the index is actually performing? According to the above, the ESG Leaders Index has actually outperformed the Straits Times Index over the last five years. It’s clocked in 9.1% in total returns compared to the 4.8% generated by the STI index.

However, we have to mention that we weren’t able to find the index listed on the Exchange. This possibly means that the index is only accessible as an institutional fund and not a retail one. Translation: you can’t buy it yourself off the stock market, but you might be able to ask for it through a bank or your financial advisor.

Go Green or Go Home: Sustainable Bonds

Bonds are a great way to finance projects, initiatives and goals to a greener, more socially responsible future. Locally, there are a handful of green bonds that Singaporean investors can consider, along with their bond ratings:

- DBS Green Bond, which raises funds for environmental projects as part of DBS’ sustainable development goals, with a coupon rate of roughly ~1%.

- Rating: Aa2/AA- (Low Risk)

- Star Energy Geothermal Green Bond, which helps to refinance debt for funding

geothermal assets in Indonesia, with a coupon rate of 6.75% for 15 years till April 2033.- Rating: Ba3/BB- (High Risk)

- Vena Energy Green Bond, to refinance corporate loans for the development and operation of green projects dedicated to pure renewable energy, with a coupon rate of 3.133% for the five-year bond.

- Rating: BBB- (Medium Risk)

Islamic Finance: Shariah-Compliant Stocks, Funds, Indices

This is a huge component of Islamic finance that entails avoiding investing in businesses that deal with pork, casinos, alcohol, entertainment, non-Islamic banking (i.e. charging interest, which is forbidden in Islamic finance), and even weaponry.

How do we know what stocks to look at and what stocks to avoid? The average (beginner) investor might not even have time to sift through all the companies on the market to figure out what’s halal and what’s haram.

There are Shariah compliant screening methodologies led by Islamic finance scholars that have led to the creation of Shariah-compliant index funds.

These scholars work to continually determine whether companies and stocks remain Shariah-compliant. For investors, this means that not every Shariah-compliant company will remain that way forever, and so will fall in and out of these indexes and portfolios.

These global indexes include the following:

- Dow Jones Islamic Market Asia/Pacific Developed Index (Ticker: DJIADUUP, 8.75% YTD*)

- Dow Jones Islamic Market Emerging Markets Ex-Frontier Index (Ticker: DJIEXUUP, 18.18% YTD)

- Dow Jones Islamic Market World Index (Ticker: DJIM, 24.13% YTD)

*YTD = Year to Date, which refers to the period of time beginning with the first day of the calendar OR fiscal year up to the current date. YTD figures are used to monitor the financial health of a company in the short-term (interim basis) rather than auditing all of its historical data.

Locally, we have the FTSE ST Singapore Shariah Index that tracks 48 Shariah-compliant companies listed on the Singapore Exchange, based on the FTSE ST All Share Index (which represents 98% of Singapore market capitalisation). These companies include Singtel, Keppel, ComfortDelGro, SIA, and Singapore Press Holdings. The more you know!

By backing companies and organisations that operate sustainably for the future of the environment and the rest of the world, we are playing a part — though small — in realising that future. For the young investor who also wants to do good while earning a profit, sustainable investing could be the way forward in the right direction.

So, the next time someone asks you what you’ve done to help save the world, start a conversation about sustainable investing.