Financial Planning | Personal Finance | Article

The One Thing You Need To Make Retirement Planning Easy

by The Simple Sum Team | 9 Dec 2021 | 7 mins read

This article is brought to you by CPF Board.

By textbook definition, retirement means “leaving the workforce” to live out your golden years.

For many of us, living out our golden years means not having to work, travelling the world, enjoying the company of our family or simply pursuing our interests — the things that we wanted to do all along but could never find the time to.

But none of these can be achieved without having a healthy balance in your bank that you can draw to fund your pursuits. And the key to achieving this starts with good planning right now.

Identify your purpose so you can outline your plan

Having a goal or end in mind will let you formulate your plan more effectively. Start by thinking about what you’ll do with your days if you don’t have to work.

If you already have passions that you’re currently exploring, you might want to pursue them even further during retirement. Life in retirement can be an extension of your life right now.

For example, on your days off and weekends, you may love playing tennis, travelling to watch tennis tournaments, and participating in friendly tennis competitions. When planned properly, you can continue pursuing your passion for tennis in retirement without worrying about whether you can afford to sustain your lifestyle without a job.

Or you could be like 61-year-old Becky Chang, who wishes to keep pursuing her thirst for knowledge when she retires.

“I enjoy learning and have enrolled in a Professional Conversion Programme and a SGUnited training course to create new opportunities for myself……Whether it’s in the shipping industry or if I do something new, a positive mindset and the right attitude are the most important. I’m a person who never says die till I try.”

Whatever your purpose is, it becomes easier to plan once you’ve identified it.

Put a number to your purpose

Once your purpose is identified, you need to figure out how much it will cost to make it a reality.

For example, if your purpose in retirement is to discover the world, think about how long, or how often you’d like to travel in a year, and how much you’d like to spend when you travel.

Some people might want to spend six months travelling in Europe while others might be content with a weekend beach vacation in Bali.

A six-month trip to Europe will definitely cost more than a weekend in Bali, so calculate and write down how much you’ll need based on what you want to achieve.

Consider other expenses you’ll need during retirement

Your overarching purpose or goal in retirement isn’t the only expense you need to factor for when you’re retired. You’ll still have the everyday expenses you have now such as food, transport, and personal care.

If you already have a budget, you can base your expenses in retirement on it. Here’s an example of what your monthly retirement expenses might look like:

| Monthly Expenses | Amount |

| Food | $600 |

| Personal care / healthcare* | $500 |

| Home maintenance | $300 |

| Public transport | $200 |

| Utilities | $200 |

| Travel funds/savings | $1,000 |

| Hobbies | $200 |

| Total | $3,000 |

*You can also tap on your CPF to pay for medical expenses and health insurance premiums.

You’ll notice that your expenses may not be that different in the future, minus a few expenses that you may not need to pay for like your housing loans (that should already be paid off by the time you retire).

Other things that you might want to factor for is increased medical expenses as you get older, and expenses for other goals and hobbies you might have in retirement.

Once you have an estimate of how much your monthly retirement expenses will be, multiply that by the average life expectancy in your country. The average life expectancy in Singapore is currently 83 years old, and may increase in future too. This means that if you retire at age 65 you’d have at least 18 years in retirement. Add a buffer of 5 to 6 years, and you’re looking at about 24 years or more of living without an income.

Of course, you’d also need to account for inflation. Cost of living will increase over time, and you’ll need to save more now in order to maintain your spending power in the future.

Put your plan in action now

When you know the amount that you need for your retirement, you can work out how much money you need to start setting aside now based on your age, and current (or projected income).

Realising that you may need a large sum of money to achieve your dream retirement lifestyle can be intimidating. But the good news is that when you plan and save early for your retirement, you can leverage compound interest to grow your retirement nest egg with ease.

Your CPF is a source of savings that forms a good foundation for your retirement as it can provide for the basic living expenses you need after you retire, allowing you to focus on saving up (outside of CPF) to pursue your passions without worry.

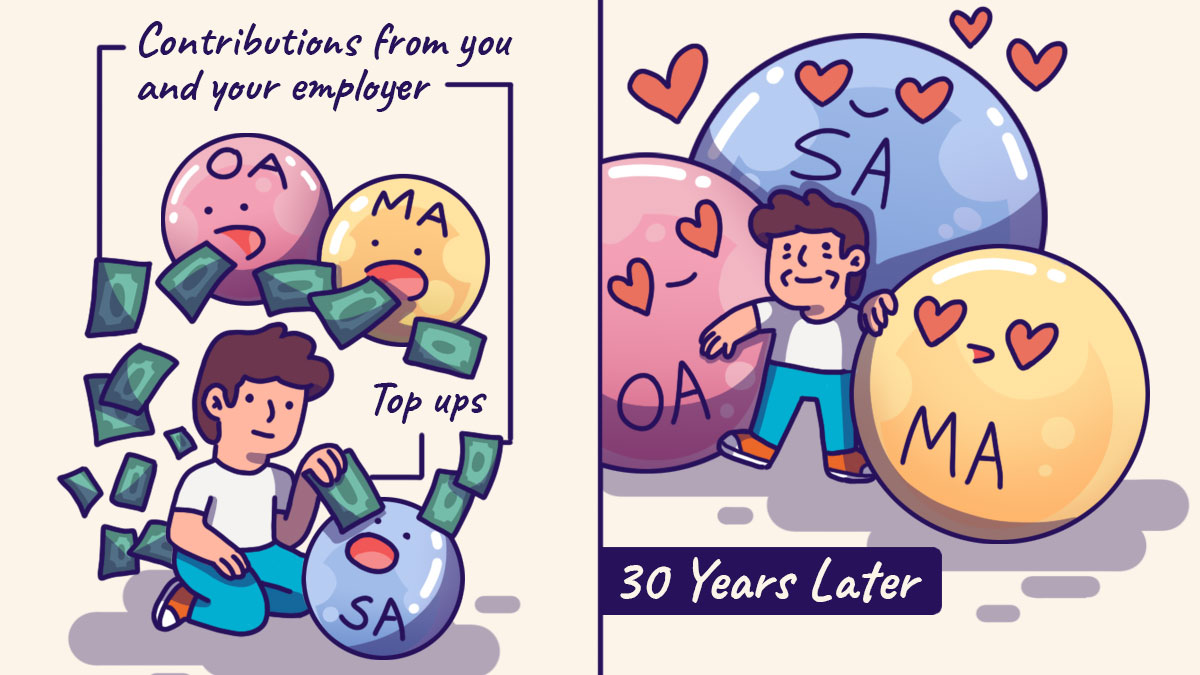

During your working years, you accumulate CPF savings through monthly contributions. With interest rates of up to 5% p.a1 and the help of compound interest, it adds up to a significant amount over time.

With the savings you have accumulated in your CPF, you will receive monthly retirement payouts under CPF LIFE, a national longevity insurance annuity scheme that provides monthly retirement payouts from age 65 for the rest of your life.

Remember the earlier estimation of $3,000 a month for daily expenses in retirement? Here’s how CPF savings can help you achieve a large proportion of this amount:

For example, a person turning age 55 today will need about $415,300 in his Retirement Account by age 65 to get around $2,080 – $2,230 as his CPF LIFE monthly payouts. However, if he sets aside the amount earlier at 55 years old, he would only need to set aside about $279,000 – much lesser than he would need to have at age 65, thanks to CPF interest rates and compound interest.

For those of us in our 20s and 30s, 55 might seem rather distant and calculating how much you’ll have in your CPF sounds complicated, but there’s an easy way to figure it out — with the CPF Retirement Estimator.

And if you find that your current and projected CPF savings aren’t enough to pay for the retirement lifestyle you desire, you can look at increasing your CPF LIFE monthly payouts by doing cash top-ups. As a bonus, you also get to enjoy tax savings when you top up with cash.

You can also supplement your CPF savings with other sources of income, such as investments. However, all investments do carry risks and you should always do your due diligence before making any investment.

Ultimately, we all want to enjoy the freedom to pursue our passions and live life without worrying about our finances, especially when we’re older. By identifying the purpose you would like to pursue in retirement, and calculating how much you would need to achieve it, you can actively start planning.

Content sponsored by CPF

A message from our sponsor:

Every purpose needs a plan. Take this quiz to get personalised tips for your retirement planning!

1Includes extra interest paid on the first $60,000 of a member’s combined CPF balances. Terms and conditions apply.