Financial Planning | Personal Finance | Article

What Can You Do With Your CPF Ordinary Account Savings?

by Valery Tan | 10 Mar 2022 | 5 mins read

As a working Singaporean, 20% of your salary will be channelled into your Central Provident Fund (CPF) every month.

But do you know what happens to your money after it is transferred to your CPF? And what you can do with it?

The first thing you need to know is that your monthly CPF contributions will be split across your Ordinary Account (OA), Special Account (SA), and Medisave Account (MA) based on a certain percentage, or allocation rate.

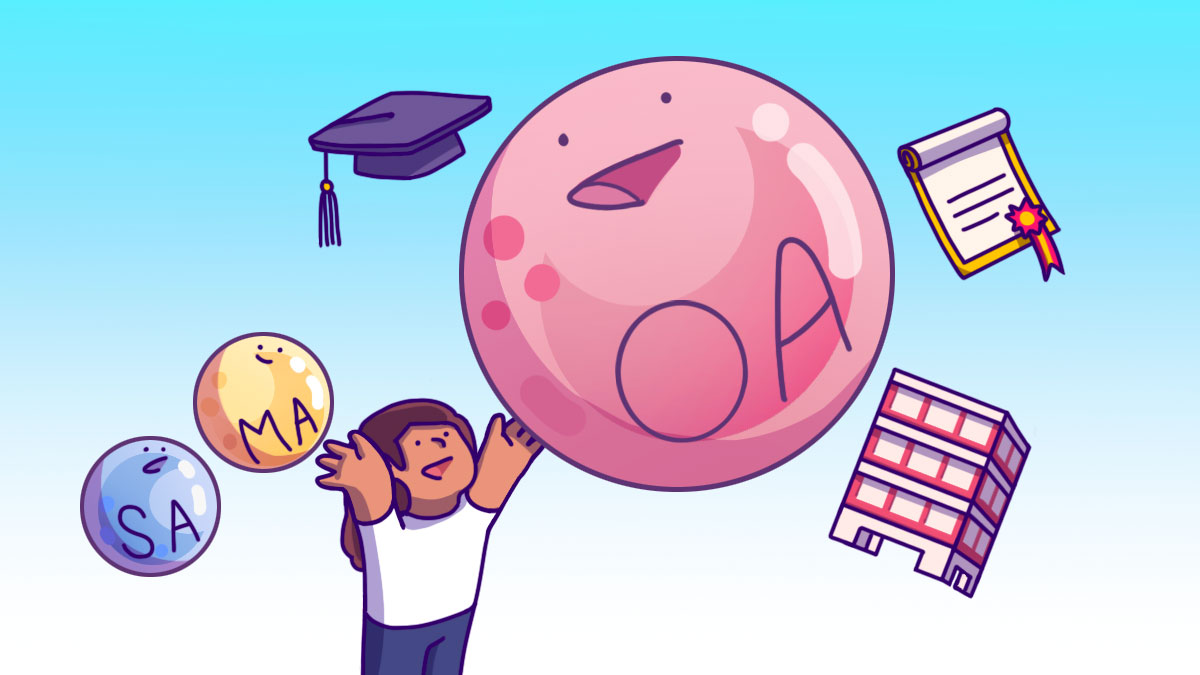

Among all the accounts, your OA is the most flexible as you can use your OA savings to pay for your education, housing, and investments.

Use CPF OA savings for tertiary education

Tertiary education is expensive. So, the CPF Education Loan Scheme was created to help defray its costs.

Under the CPF Education Loan Scheme, you can use your CPF OA funds to pay for your:

- Own tuition fees

- Children’s tuition fees

- Spouse’s tuition fees

- Sibling’s tuition fees (on a case-by-case basis)

Your OA funds can be used for a full-time subsidised diploma or degree course at approved education institutions covered under the CPF Education Loan Scheme.

The list of approved education institutions are:

- Universities: National University of Singapore; Nanyang Technological University, Singapore Management University; Singapore Institute of Technology; Singapore University of Social Sciences, and Singapore University of Technology and Design

- Art colleges: Nanyang Academy of Fine Arts and LASALLE College of the Arts

- Polytechnics: Nanyang Polytechnic; Ngee Ann Polytechnic; Republic Polytechnic; Singapore Polytechnic, and Temasek Polytechnic

- Technical: Institute of Technical Education (for students pursuing a Technical Engineer Diploma or a Technical Diploma in Culinary Arts)

However, if you’re looking to pursue a part-time diploma or degree course, you won’t be eligible for the CPF Education Loan Scheme. You also won’t be eligible for the loan if you don’t qualify for the Ministry of Education’s subsidised tuition fees.

If your available CPF OA funds can’t cover all the costs of your tertiary education, you may need to make up for the shortfall in cash, or with other financial aid.

The withdrawn amount and the accrued interest must be repaid back to the CPF account one year after graduation or upon termination of studies, whichever is earlier.

Use CPF OA savings for housing

Buying a house is probably the biggest purchase you’ll make in your life. Fortunately, you can use your CPF OA funds to pay for it.

Whether you are buying a HDB flat or private property, the funds in your CPF OA can be used for:

- Property down payment, with the amount subject to the type of loan and property

- Monthly home loan repayments

- Stamp duty, survey and legal fees

- Home Protection Scheme premiums (for HDB flats only)

- Loan taken for the construction of your house or the purchase of vacant land (for private properties only)

When paying for your housing downpayment with CPF OA, do note that:

- HDB flat buyers taking a HDB loan: Up to 100% of the down payment can be paid using CPF OA savings. And if either you or your spouse is under 30 years old at the time of application, you can opt for the Staggered Down Payment Scheme, which allows you to pay for your down payment in two instalments.

- HDB flat buyers taking a bank loan: Up to 15% of the down payment can be paid with CPF OA savings.

- Private property buyers taking a bank loan: Up to 20% of the down payment can be paid with CPF OA savings.

Using CPF OA savings for investments

Under the CPF Investment Scheme, you can use the extra funds to invest in schemes approved by the CPF Board, after setting aside $20,000 in your OA and/or $40,000 in your SA.

You can invest in investment-linked insurance, Singapore Government Bonds, ETFs, Unit Trusts, and shares. However, there’s no guarantee that you’ll be able to beat CPF’s interest rates.

Related

Other things to know about your CPF Ordinary Account

How much interest you get on your OA savings

The savings in your OA account earns at least 2.5% per annum, and if you retain a balance of at least $20,000 in your OA, you can earn up to 3.5%* per annum on that amount.

Reduced monthly contribution allocation to your OA as you age

The allocation rates differ as you age – a higher percentage of your income will be allocated into your OA in your early adult life because that’s when you are most likely to be paying for your education, buying a house, and investing.

| Age | Contribution Rate (%) for Monthly Wages ≥$750 | CPF Allocation | ||||

| Employer’s contribution | Employees’ Contribution | Total | Ordinary Account | Special Account | Medisave Account | |

| 35 and below | 17% | 20% | 37% | 23% | 6% | 8% |

| Above 35 to 45 | 21% | 7% | 9% | |||

| Above 45 to 50 | 19% | 8% | 10% | |||

| Above 50 to 55 | 15% | 11.5% | 10.5% | |||

| Above 55 to 60 | 13% | 13% | 26% | 12% | 3.5% | 10.5% |

| Above 60 to 65 | 9% | 7.5% | 16.5% | 3.5% | 2.5% | 10.5% |

| Above 65 | 7.5% | 5% | 12.5% | 1% | 1% | 10.5% |

OA savings can be transferred to your SA

Your SA earns an interest of up to 5%* per annum. So, if you don’t intend to use all your OA for your housing, education, or investments, you can opt to transfer a portion of your OA into your SA to earn a higher interest rate.

Keep in mind that the transfer is irreversible so you must be sure that you don’t intend to use the money that you are transferring until age 55.

*The first $60,000 of your combined CPF balances, of which up to $20,000 comes from your OA, earns an additional 1% interest per year.

Related

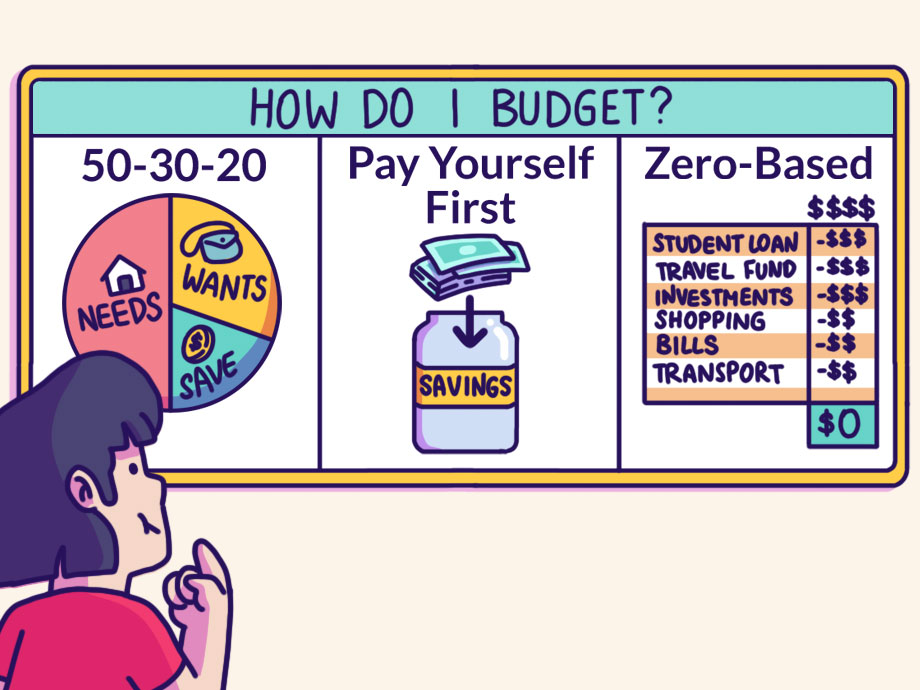

Maximise your CPF OA savings the right way

Like a building block, your CPF OA exists to help you build a strong financial foundation for the rest of your life.

Your CPF OA allows you to fund intermediate financial goals such as buying a home, or pursuing a degree, while also growing your retirement savings, so be sure to use your OA savings wisely.