Financial Planning | Personal Finance | Article

What Should My Financial Plan Look Like And How Can I Put One Together?

by The Simple Sum Team | 28 Dec 2021 | 9 mins read

This article is brought to you by OCBC Bank. OCBC Financial OneView, enabled by SGFinDex, allows you to access and manage all your financial information in one place. Try it for yourself.

Everyone knows the importance of financial planning. It helps us evaluate our current financial standing then strategise different approaches to making our money work for us. It also helps us reach our financial goals.

But let’s be honest – how many of us actually sit down at the end of every month and log in all our finances?

The MoneySense Financial Planning Attitudes Survey 2017 found that 3 out of 10 Singaporeans aged 30 to 59 had not started financial planning. Among the reasons given was not having enough money to start financial planning, thinking it was too early and not knowing where or how to start.

Well, the misconception that you have to be wealthy before you can even start financial planning is far from the truth. Irrespective of your financial standing, it is important to start planning as early as possible, as it gives your money more time to ‘grow’.

And, if you are unsure of where to start, we’ve got you covered.

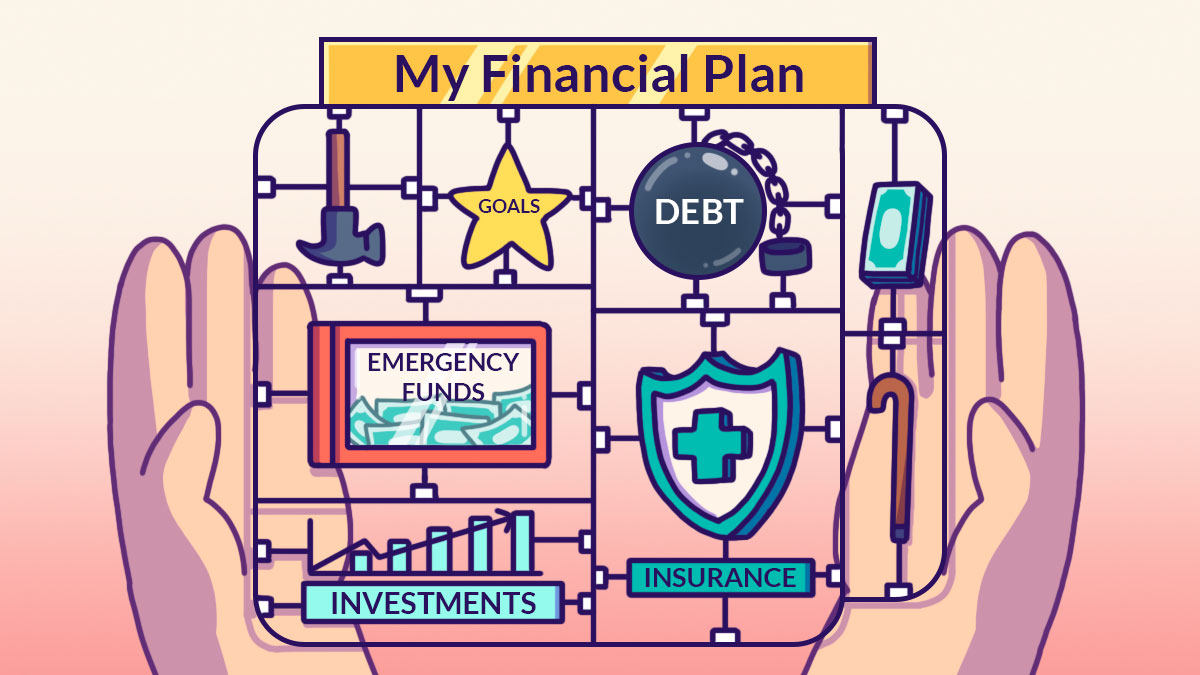

So, what should your financial plan have?

While everyone’s financial situation and targets are unique, a good financial plan should include details about your financial goals, debt, cash flow, investments, insurance, retirement, income tax and net worth. The plan should also be comprehensive and tailored to reflect your expectations and needs.

Here’s a breakdown of each component:

Financial goals

Goals are what guides a financial plan by giving it targets. It is important to know what you would like to accomplish with your money.

Set realistic short-, medium- and long-term goals and map out a date you hope to accomplish these by. For example, one person can have goals such as saving $50,000 for a wedding next year, $100,000 for a home down payment in 5 years, and accumulating $2 million for their retirement in 35 years. Once you know what your goals are, you can then, plan your money around these goals.

Budget

Your budget is the driving force behind your financial plan as it shows you where your money is going. It helps manage your cash flow and identifies which areas of spending you need to cut back or improve on to meet your goals.

Debt management

Understanding and managing your debt is an integral part of a financial plan. You need to know what you owe to be able to calculate a repayment plan. A rule of thumb is to pay off your high-interest debt i.e. credit card debt, as soon as possible.

Proper planning allows you to estimate how long it will take before you are debt-free.

Insurance and emergency funds

All your detailed planning can be derailed if life throws you a curveball and you are unprepared, financially. This may ruin your other goals as you would have to take money from there to pay for an emergency. So having insurance to cover potential large medical expenses and to protect you and your loved ones, as well as an emergency fund gives you financial security for when things go wrong.

Income tax

Given that a percentage of your income goes to taxes, proper tax planning is essential. In your plan, remember to include tax relief expenses to reduce how much tax you end up paying each year.

Plan for retirement

It might seem like a long way off, especially if you’re in your twenties, but it is important to plan and start saving for retirement early.

As your money must sustain you throughout your retirement years, you should have a think about the lifestyle you’ll want after retirement. Calculate the amount you’ll need to achieve that, then create a plan to make it happen.

Investments

Investing is the answer to growing wealth and keeping up with inflation. But before you start, you need to analyse your portfolio and assess your risk tolerance. Based on that, you will know which investments to go for. Once you’ve started, track your investment’s earnings and growth to ensure you are in the green.

Know your net worth

Your net worth is a general overview of your assets and liabilities, at any given point. It tells you about your current financial situation as it calculates what you have versus what you owe. For example, if you owe more than you have, you have a negative net worth.

You can calculate your net worth by combining your total assets then deducting your liabilities. Do note that your net worth changes with time.

For instance, in 30 years, your liability will be zero, after paying off your housing loan. This will increase your net worth.

Err…is there an easier way?

Like a healthy ecosystem, all these categories are interconnected to each other. For example, not managing your debt well will impact your net worth and leave you with less retirement savings. So, it is essential to include all these elements into your financial plan, to get a complete overview of your finances.

“But that is A LOT of things to plan for!”

Thankfully, the government has launched the Singapore Financial Data Exchange (SGFinDex), which is a private-public partnership that integrates all your finances in one platform. This first-of-its-kind industry platform allows you to retrieve and manage your financial information such as deposits, loans, investments, credit card expenditure and CPF balances.

But as SGFinDex is just the underlying digital infrastructure, users need to access and manage their financial plan using a banking app such as OCBC Digital. With seven banks, SGX CDP, and government agencies such as CPF, IRAS and HDB on board the initiative, you can consolidate all your financial information in one platform.

Financial planning has never looked this convenient!

Related

Content sponsored by OCBC Bank

A message from our sponsor:

There are so many elements in a financial plan that the mere thought of starting one can be quite intimidating. OCBC Bank hopes to assist with that.

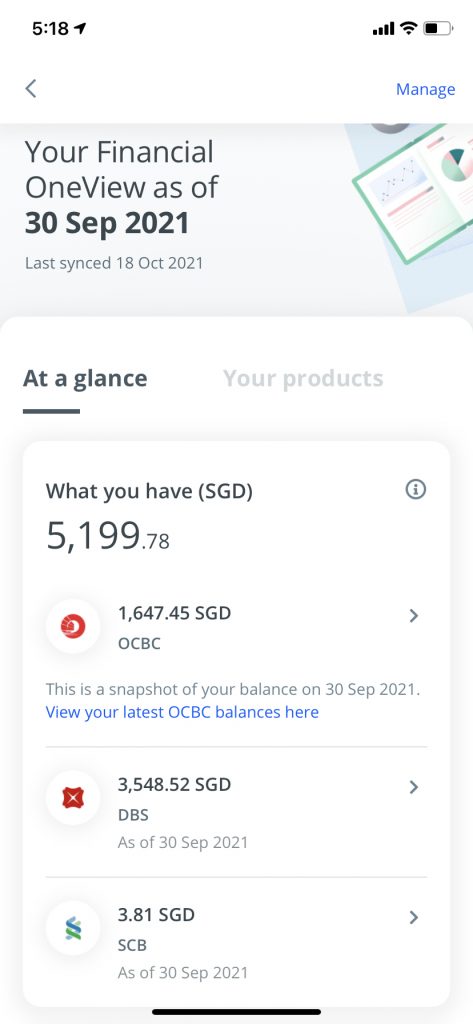

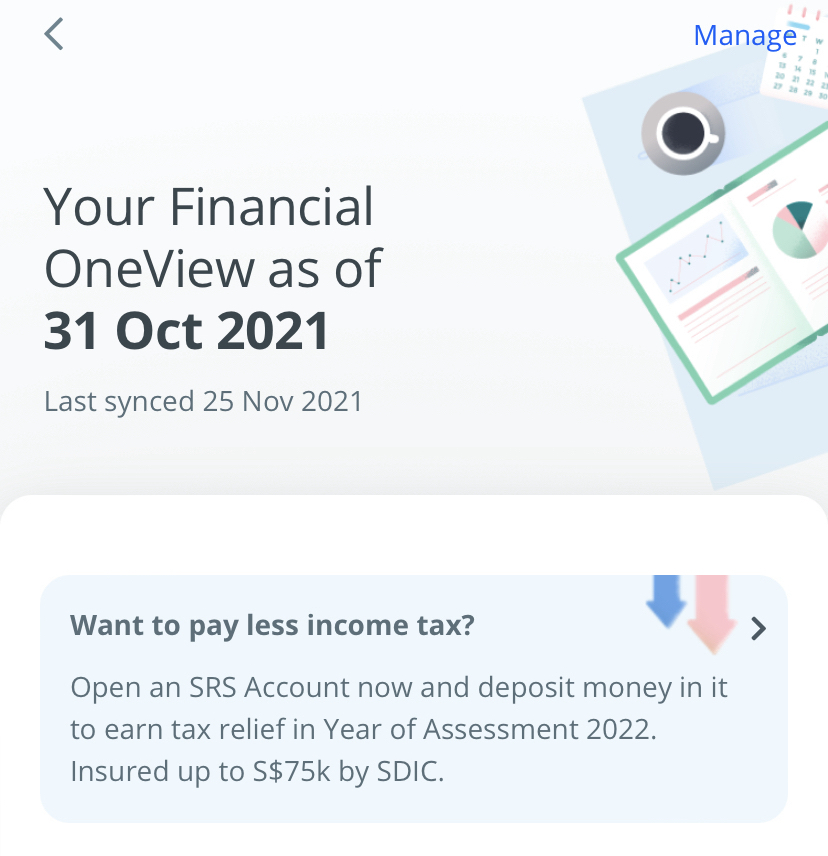

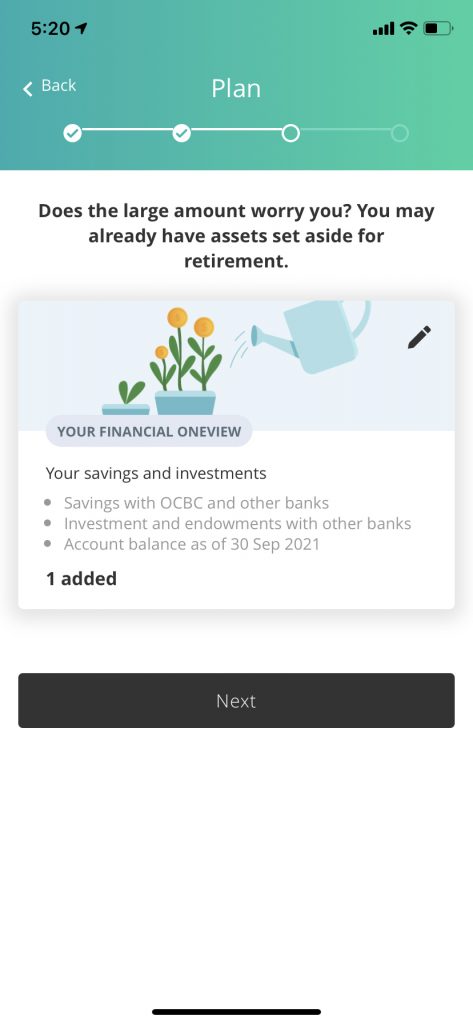

OCBC Financial OneView, enabled by SGFinDex, allows you to consolidate and view all your finances, from your savings, debt and taxes, in 1 place. It saves you the hassle of recording the numbers manually to aid in your planning for retirement and goals setting.

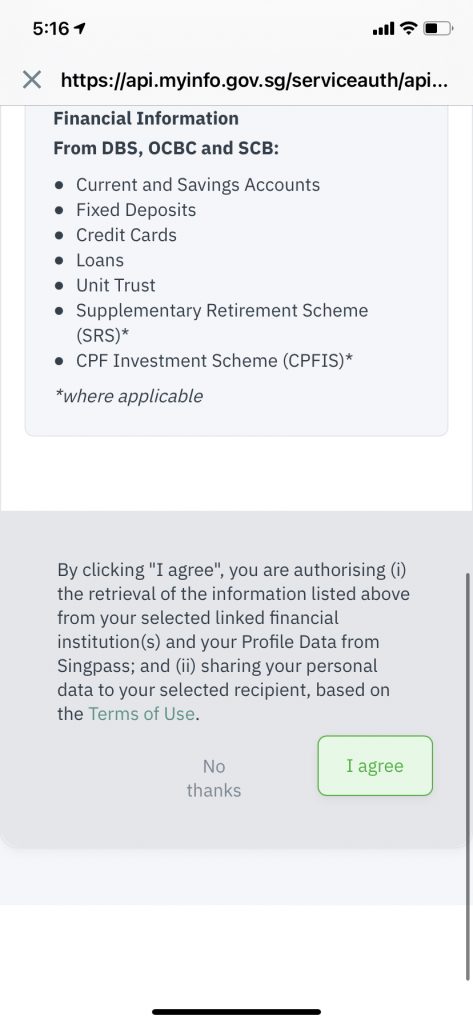

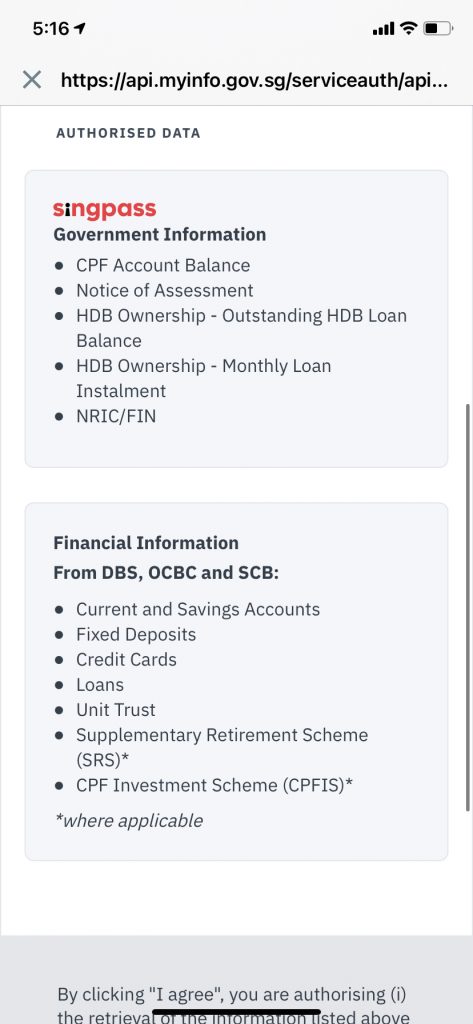

All you have to do is to login to OCBC Digital app or website, go to OCBC Financial OneView then use your Singpass to authorise OCBC Bank to access your bank account details and….

…all your finances will be consolidated automatically! From how much you have in your bank accounts, any investment holdings from SGX CDP, CPF and IRAS, to how much you owe, from your loans and credit card spending. With the SGFinDex integration on OCBC Digital, you don’t have to manually input your data. The app will do it for you! So that’s one less hassle to worry about when planning for your finances!

As a bonus feature, OCBC is also the first bank in Singapore that enables digital access and payment of outstanding tax balances. In partnership with IRAS, you can conveniently view your latest assessable income and tax balances and pay them in one place.

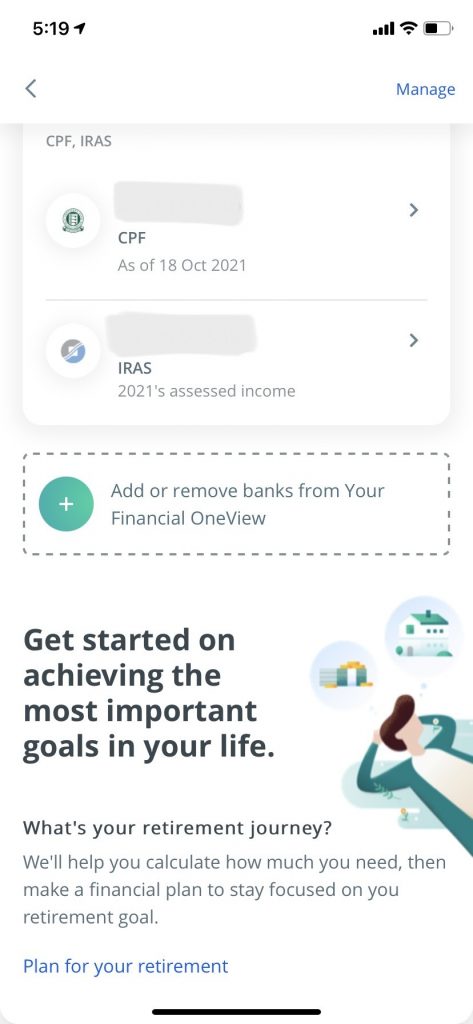

But OCBC Financial OneView doesn’t just display your finances. The feature also helps you make sense of the numbers and map out ways in which you can improve on your finances.

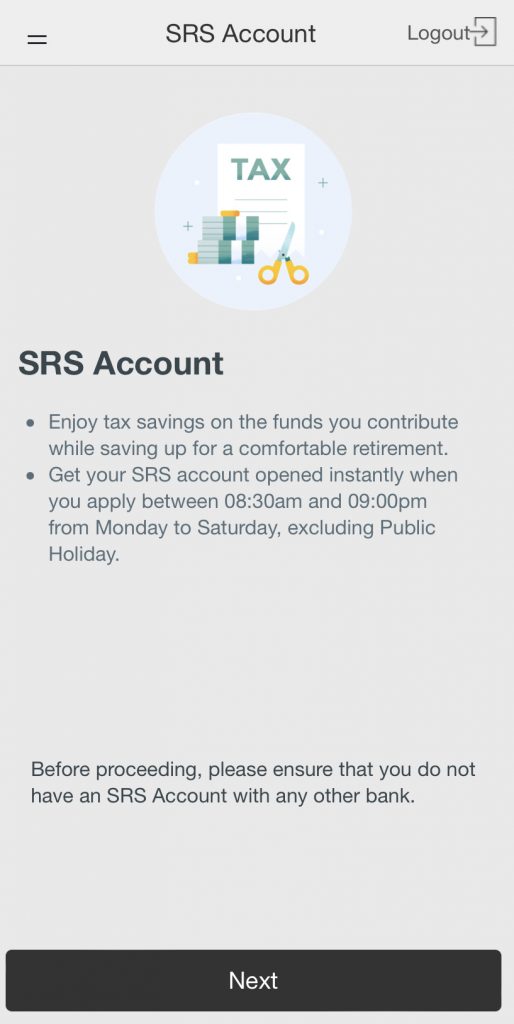

OCBC Financial OneView’s personalised insights analyses your financial data to help you earn more and spend wiser, increase savings, and start investing. For example, your personalised insights could recommend ways you can optimise your taxes such as opening a SRS account.

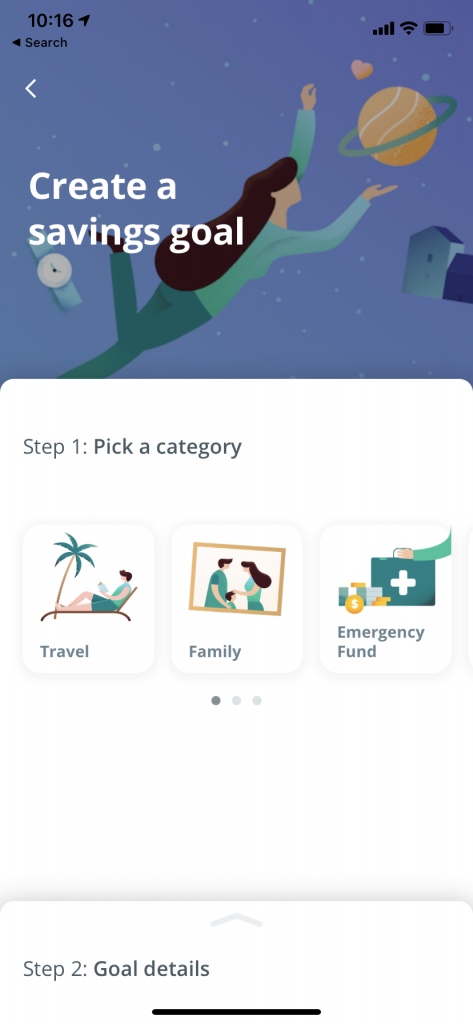

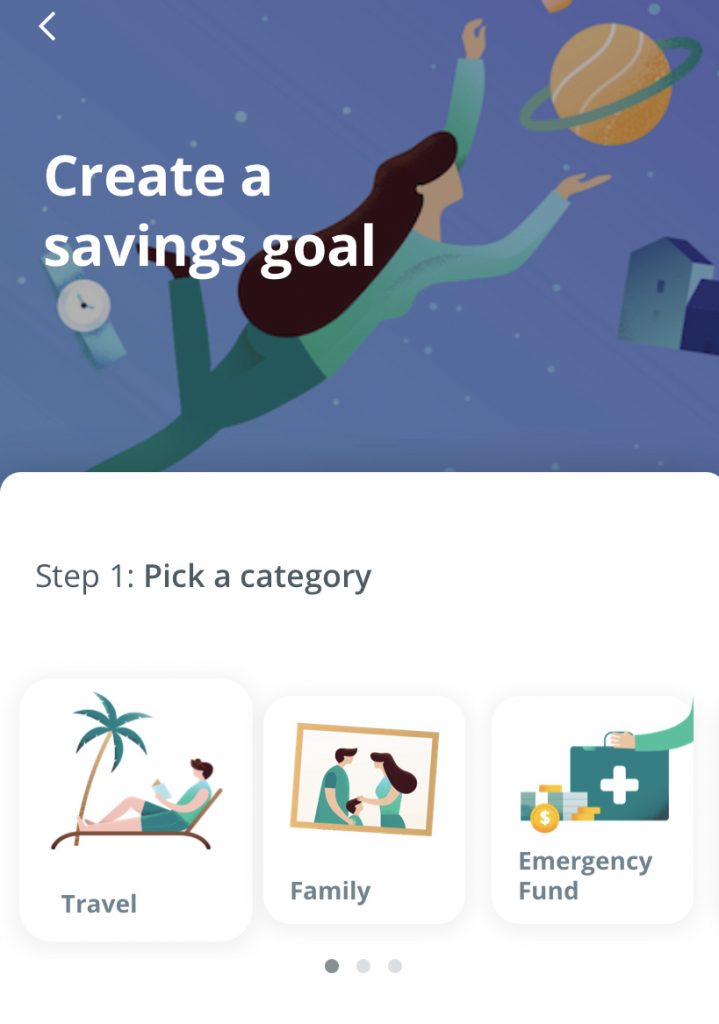

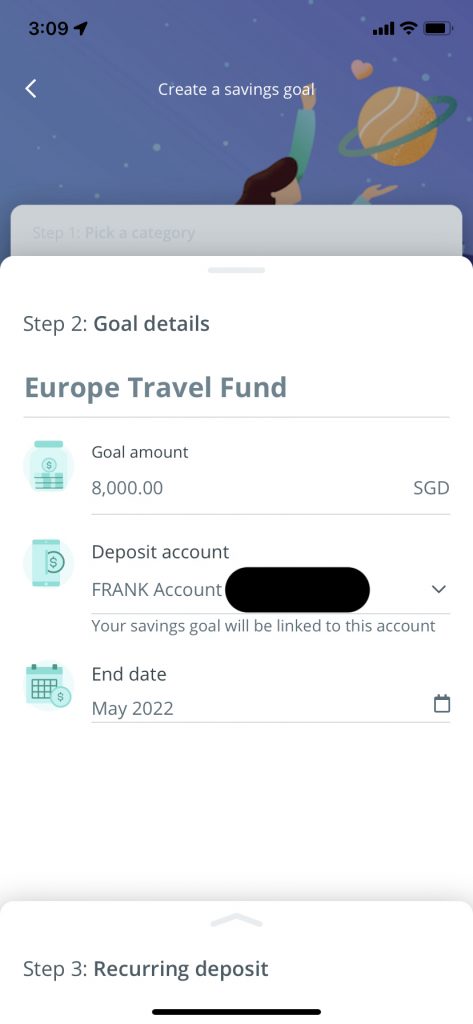

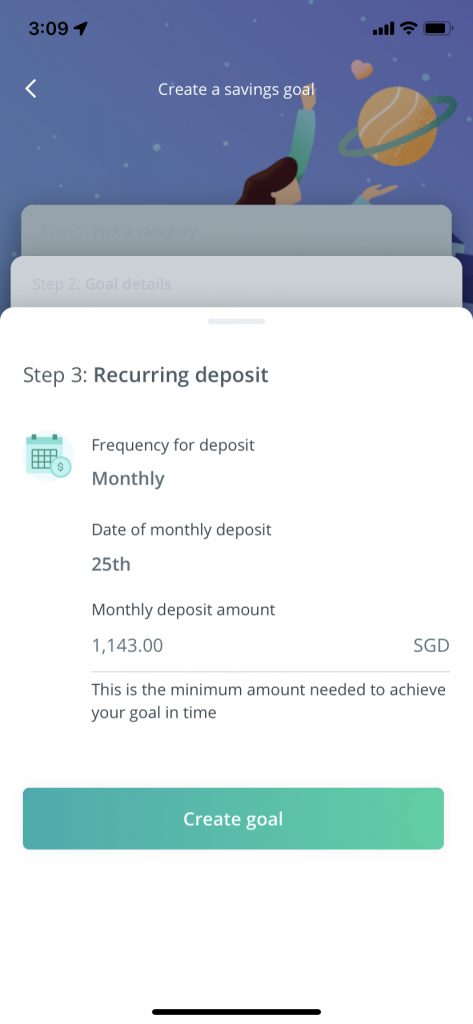

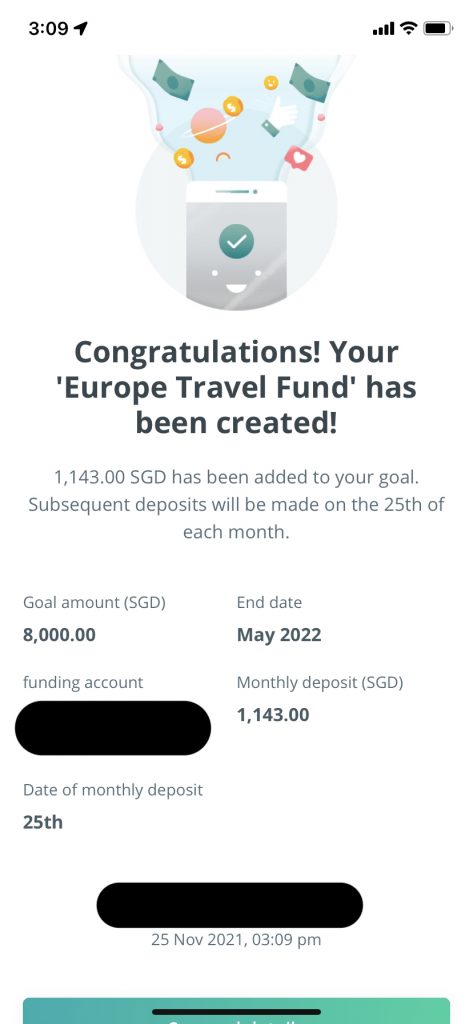

You can also use the app to help plan for your savings and life goals. Under Savings Goal, you can create a fund for travel, family and/or emergency. These are generally plans that you have in the near future.

For example, if you are planning for a VTL trip to Europe next year, you can set a specific amount you target to save by then. The app will calculate the monthly savings needed in order to achieve this target and even help you to set a recurring deposit to ensure you meet your goal.

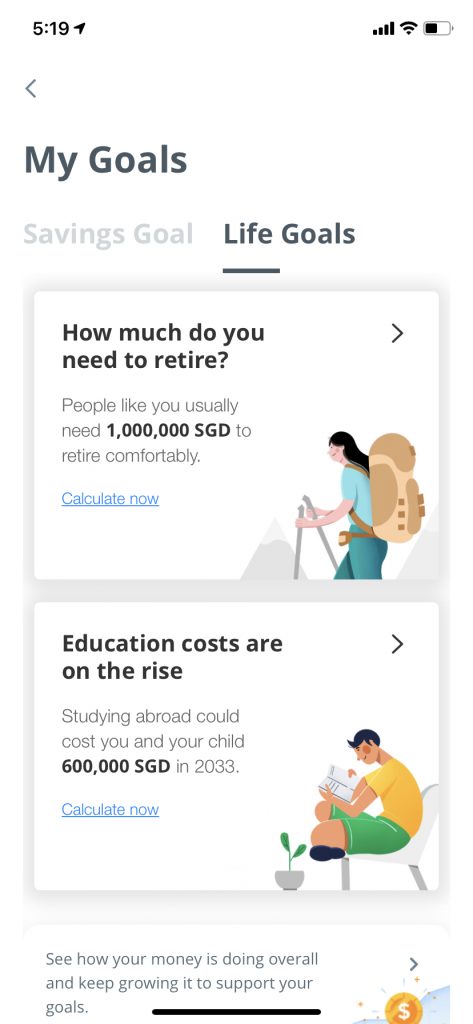

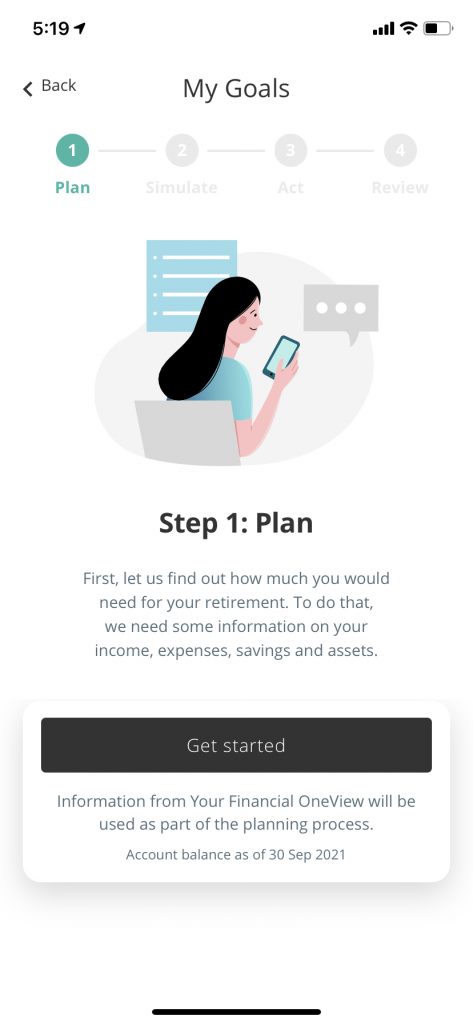

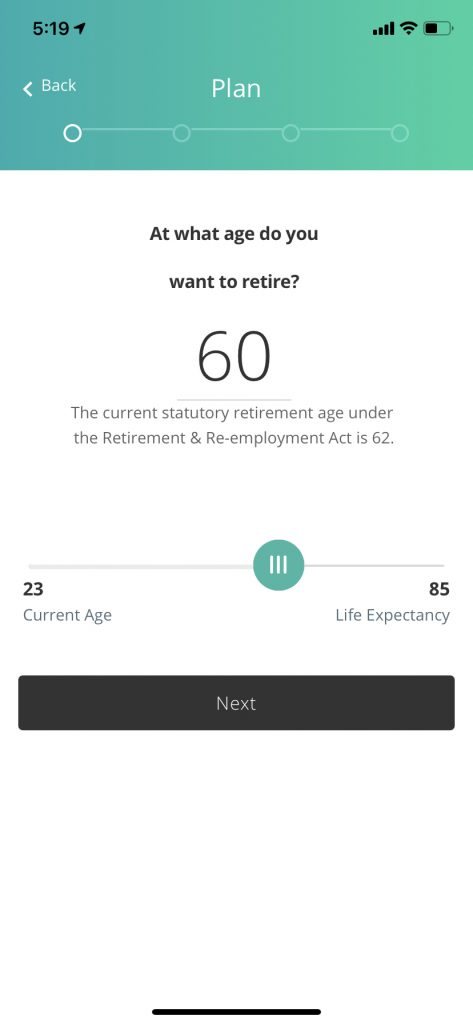

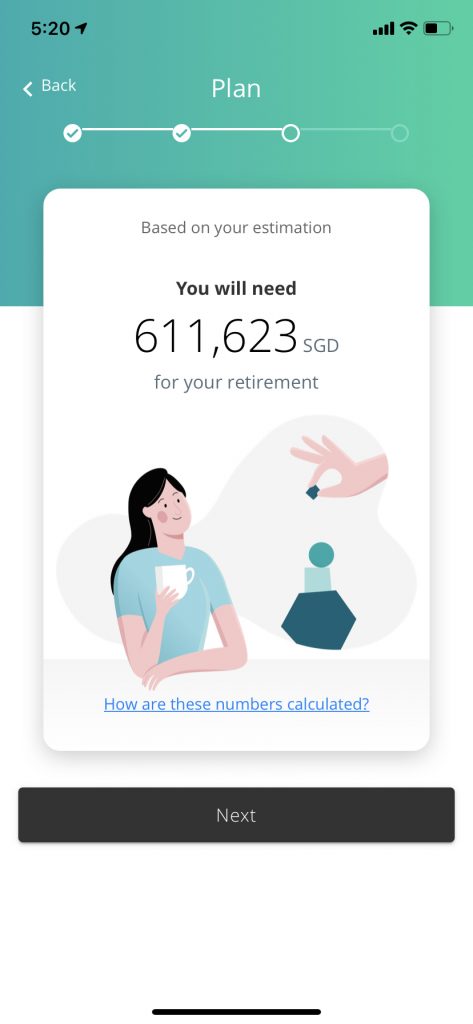

Life Goals allow you to save for longer time plans such as your child’s education, or your retirement. For retirement planning, the intuitive app will auto-populate your current age and ask for the age in which you plan to retire.

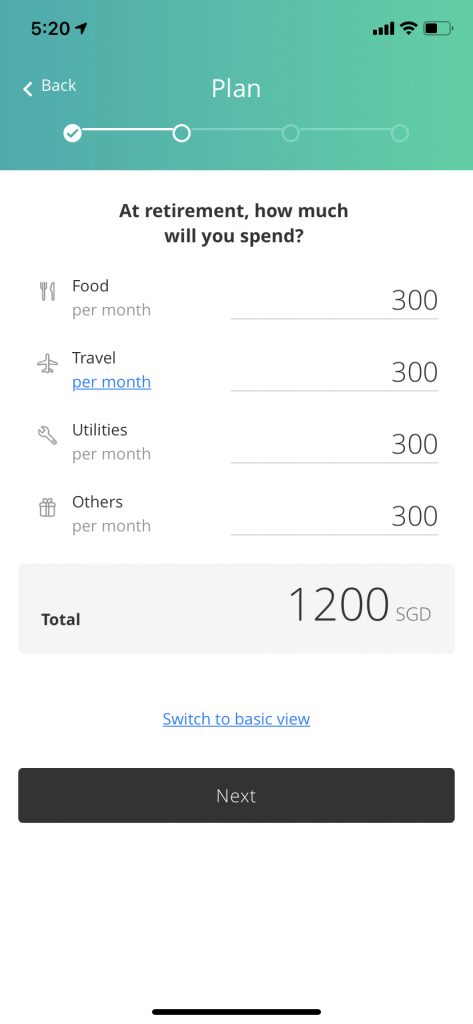

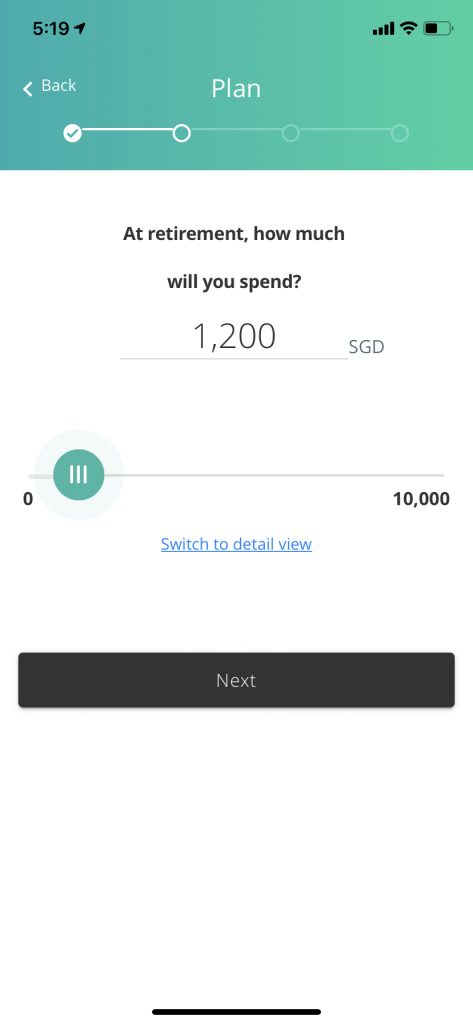

Then, it will ask how much you project you will need each month for retirement. As most of us won’t know the answer to this question, the app will guide you through by breaking down the categories for you – food, travel, utilities, and others.

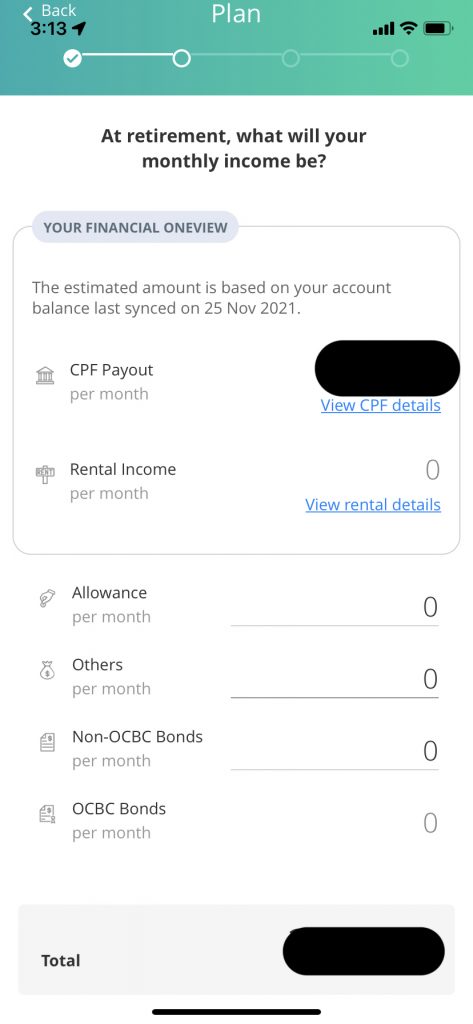

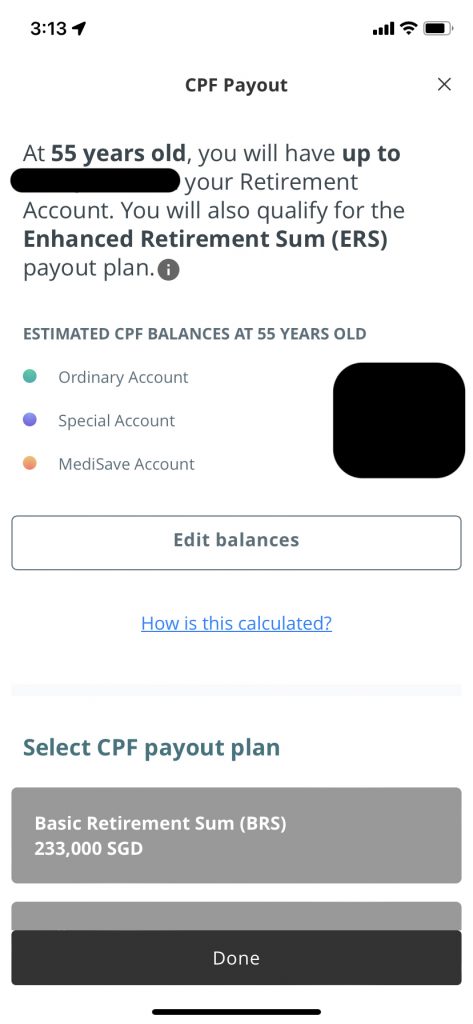

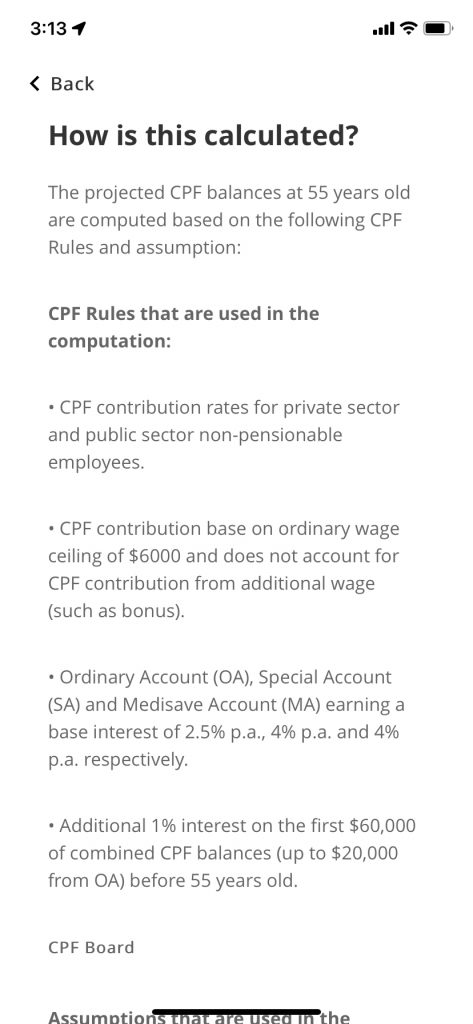

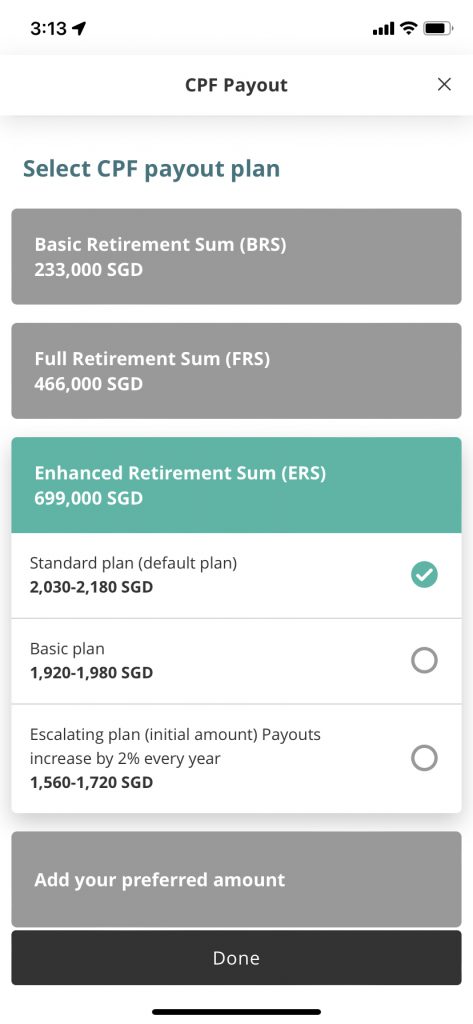

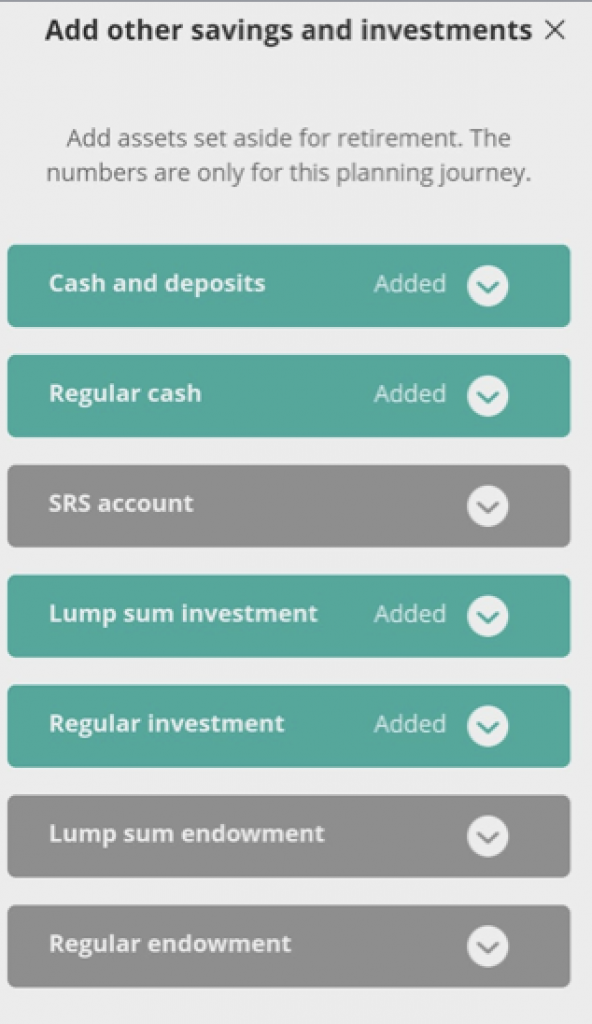

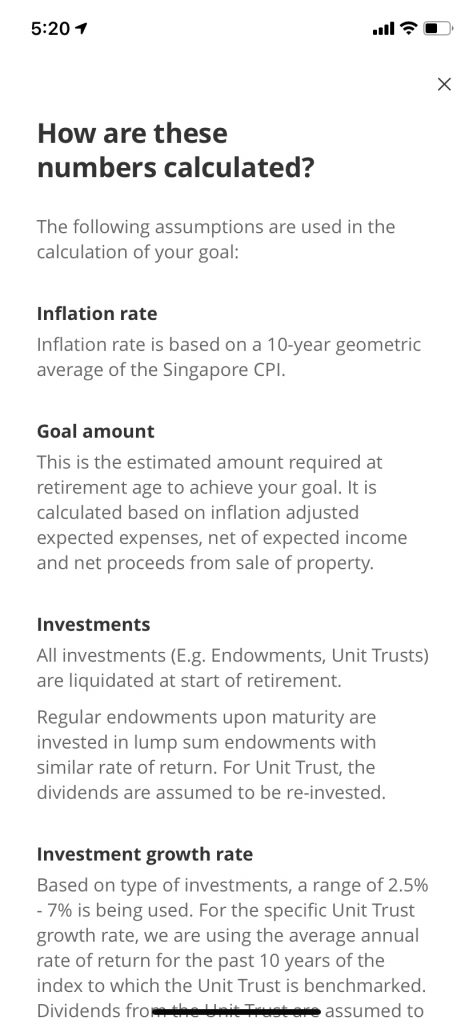

Planning for one’s retirement can be daunting and exhausting as there are many components to take into consideration in the calculation. With OCBC Financial OneView, the feature can automatically project how much you’ll have at retirement using the pre-populated data from your CPF savings, SRS accounts, unit trusts, SGX CDP accounts, bank accounts, and even your tax bill. This means that you won’t have to manually input the data on the app to project your retirement income (but you have the flexibility to edit the amounts to simulate various situations).

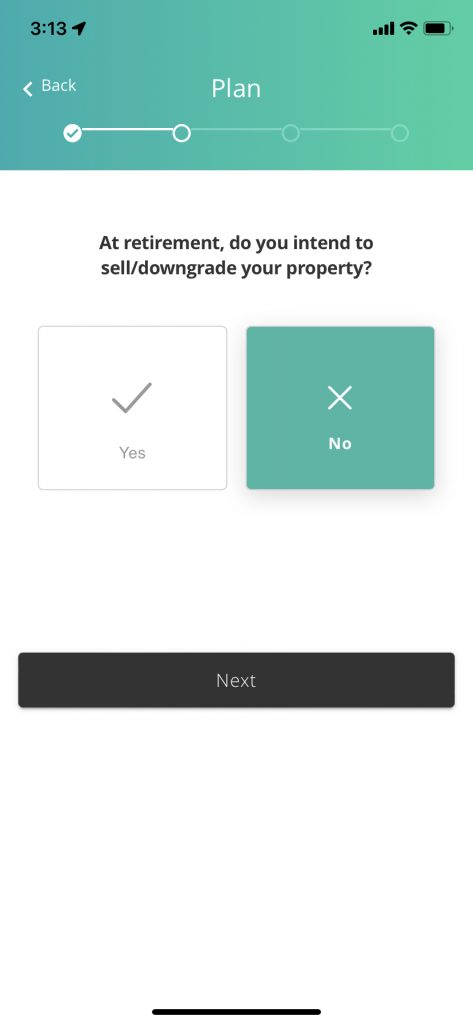

It even asks if you intend to sell or downgrade your property, as this will affect your overall net worth.

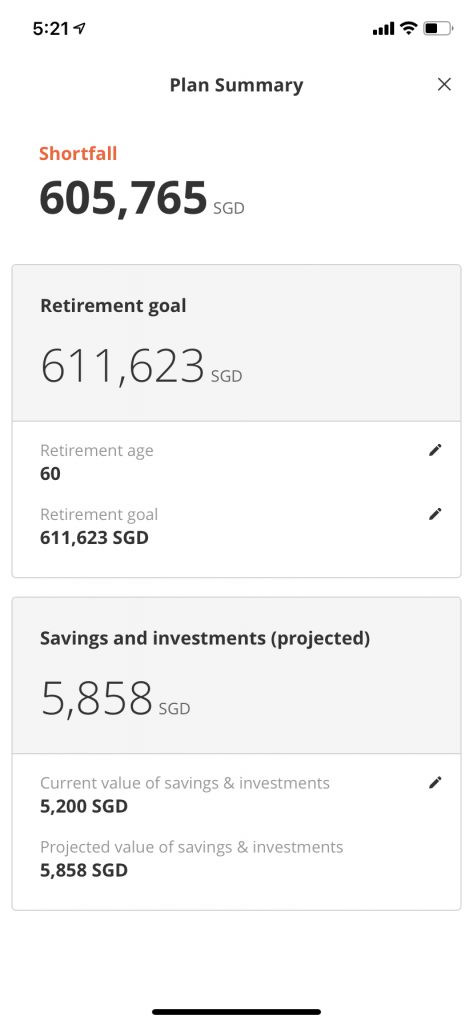

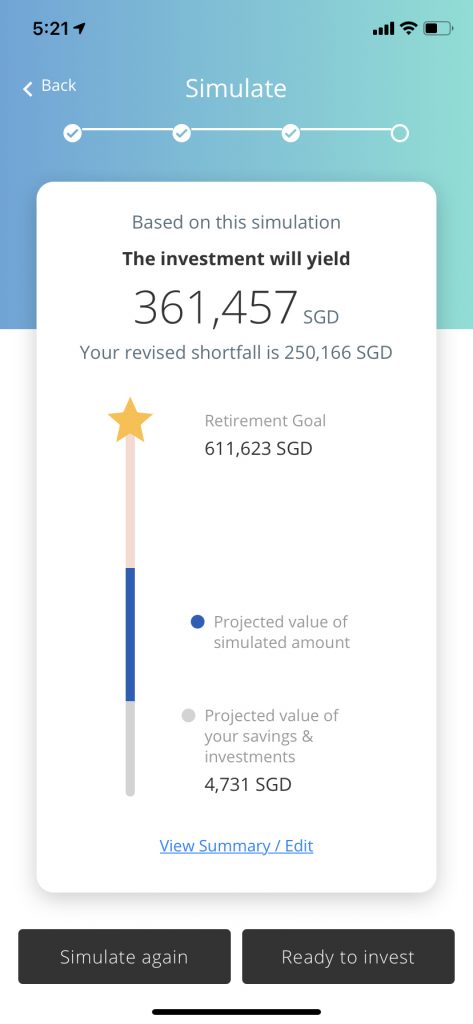

Once all these numbers are keyed in, OCBC Financial OneView projects the amount you will need for your retirement.

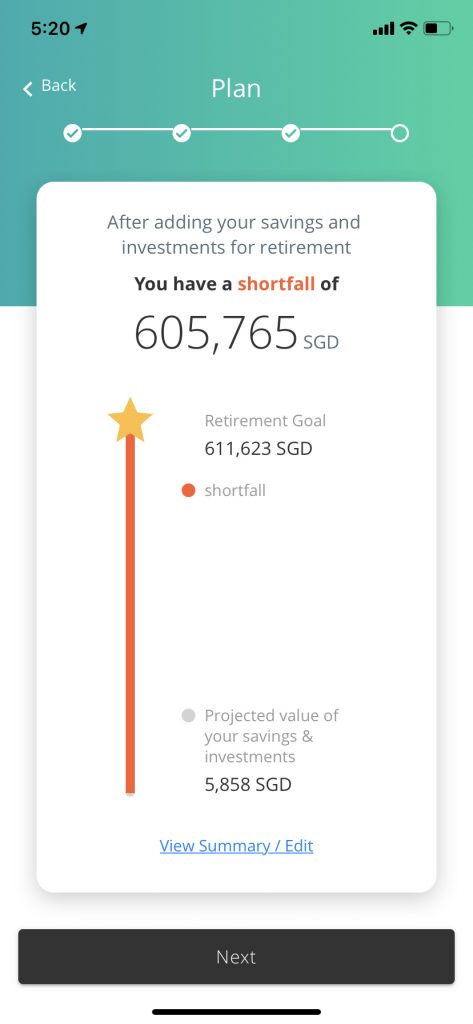

Then, it will inform you if you have a surplus of funds, or a shortfall.

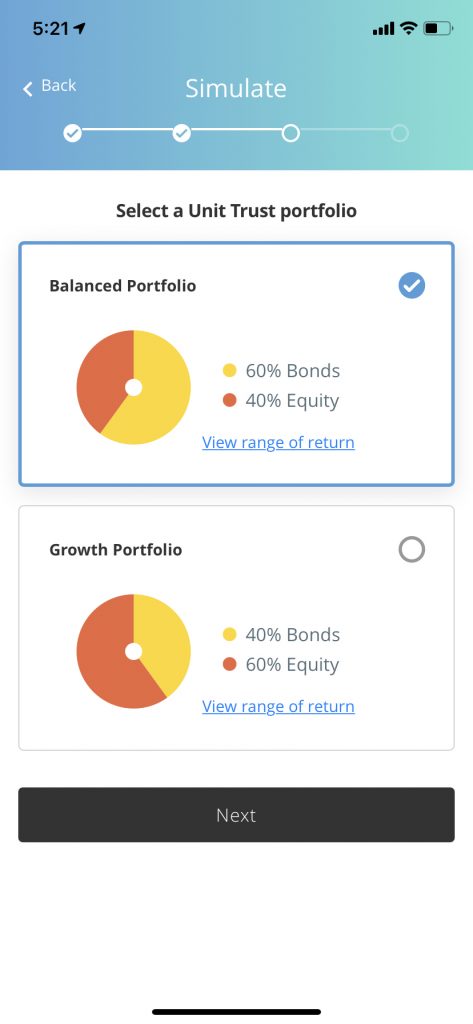

This is where things get interesting. For those who have insufficient retirement funds or “a shortfall”, instead of letting you figure it out on your own, OCBC Digital simulates various investment options which can help you to achieve your goal.

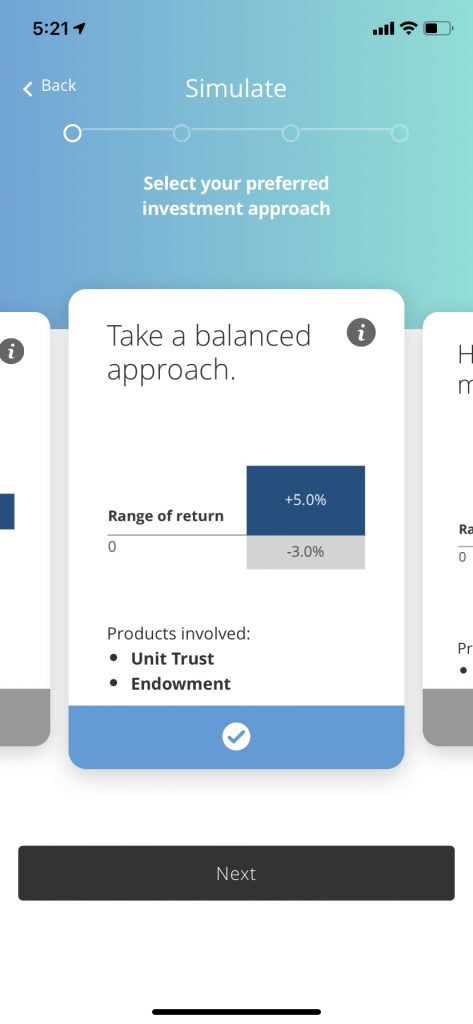

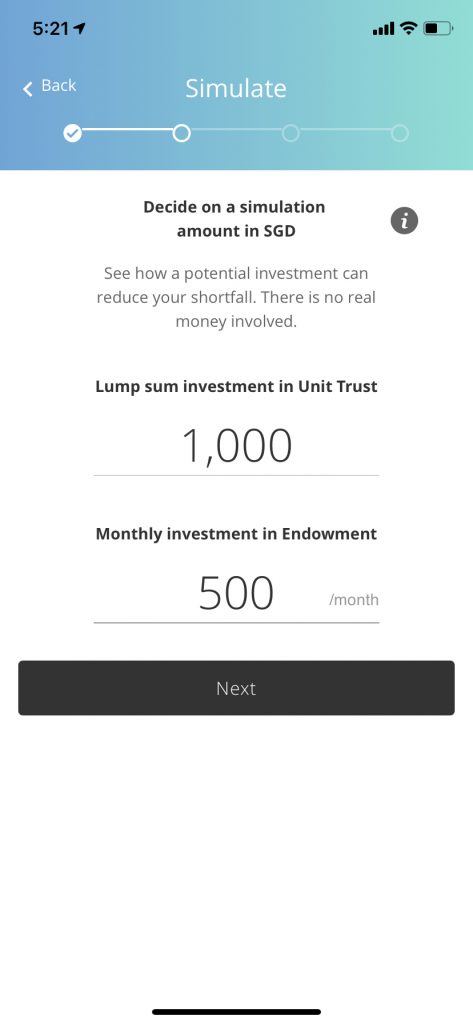

Investment options for different risk appetite will be offered – high or low risk. The simulation feature then projects how much money you may be able to make using these different investment options. You can then decide whether to continue with the suggested investment with OCBC, or you can just use the insights and build your own investment portfolio elsewhere.

How to sign up?

- For new OCBC Financial OneView customers – To obtain a holistic view of all your finances, click on this link which will direct you to OCBC Financial OneView on OCBC Digital app or Internet Banking.

- For existing OCBC Financial OneView users – To stay on top of your latest finances, click on this link which will direct you to OCBC Financial OneView on OCBC Digital app or Internet Banking.