In anyone’s first foray into investing, they will likely come across something called the Singapore Savings Bond (SSB).While it’s not an instant meal ticket to Warren Buffet-level riches, it’s a solid investment vehicle for Singaporeans, and can be a great entry into investing with the big boys one day. Here’s how it works.

What is the SSB? What is a bond?

Imagine lending $50 to a friend for a week to fund his comic book addiction, with a guaranteed return of $70 by Sunday. Bonds work exactly like that, representing loans that investors give to borrowers (either corporate or government bodies).Bonds exist to fund projects or grow businesses, and are generally seen as reliable instruments for investing.

The Singapore Savings Bond is one such example, and is issued by our very own government.

SSB perks and advantages

The SSB is a great way for Singaporeans to invest and get into long-term savings, because of its unique perks that keep things flexible. With the government’s AAA credit rating, the SSB is one of the safest products one can invest in.

Here are a few key benefits and advantages one can enjoy:

- Holding onto the SSB longer gurrantees a higher interest rate, until maturity (10 years).

- Pulling out of the SSB before maturity will not incur penalties or further expenses, keeping one’s investment money liquid in case of emergency.

- The minimum amount to invest in the SSB is $500, which means almost anybody can hop on board and get started.

Interest rates and maturity

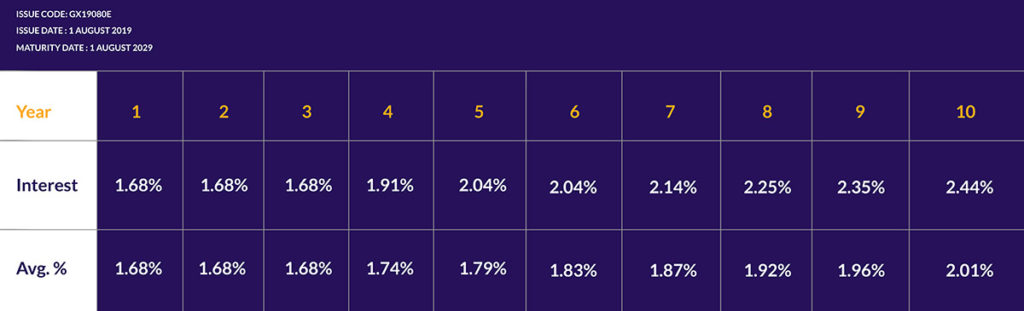

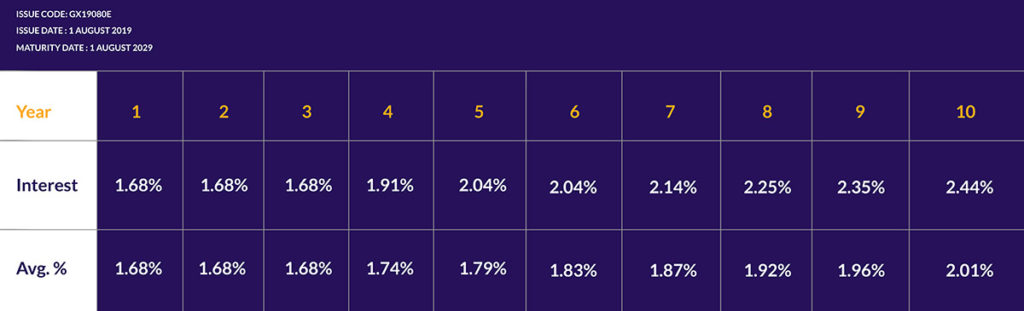

OK, so what exactly are we going to get back from investing in the SSB? Here’s a breakdown of one’s projected interest rates if they

bought into the SSB this month

According to this data projected by the MAS, if one were to hold onto their bonds for the maximum period of 10 years, they would earn an average of 2% in interest per year.

While cashing out early before maturity is a viable option, it may be more effective to simply hold onto the SSB for as long as possible to maximise one’s gains.

However, for short-term investing options, even 1.68% is nothing to sneeze at for rates that can compete with bank fixed deposits – but without banks requiring your money to be locked up.

How do you purchase SSBs?

So, how does one go about attaining their first SSB purchase? The process is fairly simple.

Step 1: The essentials

Any hopeful SSB investor should have the following ready prior to investing:

- A local bank account (DBS, OCBC, UOB, etc.)

- A CDP securities account linked to the bank account that is being used to invest with

Step 2: Applying for the SSB

- Apply at any local ATM;

- Apply via Internet Banking (under Singapore Government Securities)

Use the CDP account number when applying, and remember that investment begins from a minimum of $500, and can only be increased in multiples of $500. Each transaction has a $2 fee attached to it.

Note that new bonds are issued monthly, so there’s no need to fret if the deadline has been missed. View MAS’ issuance calendar

here.

Step 3: Wait for results

Results of SSB applications will be released after the last application date, after which one’s money will be invested. If there is an oversubscription, the remaining amount will be credited back to the investor’s bank account.

Step 4: Receive interest every 6 months

From the date of issue, investors can then expect to receive interest payments every 6 months from then on. Interest will be automatically credited to bank accounts. Easy!

With the flexibility of withdrawals for the SSB, one can utilise it to

store emergency funds while taking the first step before deciding if

investing is for them.

The first step into investing doesn’t have to be mind-boggling or highly technical. All it takes is a couple of steps, a bank account, and some money to spare. As with any other investment, it’s always good to know what one might be getting into. With this understanding, informed decisions can be made, and it’s off to a fruitful start!

According to this data projected by the MAS, if one were to hold onto their bonds for the maximum period of 10 years, they would earn an average of 2% in interest per year.

While cashing out early before maturity is a viable option, it may be more effective to simply hold onto the SSB for as long as possible to maximise one’s gains.

However, for short-term investing options, even 1.68% is nothing to sneeze at for rates that can compete with bank fixed deposits – but without banks requiring your money to be locked up.

According to this data projected by the MAS, if one were to hold onto their bonds for the maximum period of 10 years, they would earn an average of 2% in interest per year.

While cashing out early before maturity is a viable option, it may be more effective to simply hold onto the SSB for as long as possible to maximise one’s gains.

However, for short-term investing options, even 1.68% is nothing to sneeze at for rates that can compete with bank fixed deposits – but without banks requiring your money to be locked up.