Investing | Article

The Bo Chup Way to Invest

by YuanDuan | 12 Jul 2019 | 7 mins read

If you already have an emergency fund and know your retirement goal amount, you need to start investing money towards that goal.

But hold your horses, you might say, I don’t want to take risks with investing. I also don’t want to be like my dad glued to the teletex — I want a life.

We got you fam. In that case, we’re going to talk about the first — and last — investment strategy you might ever need.

First, What to Invest In?

There’s an absurd amount of things one can invest in, from property, shares, bonds, gold, oil, even luxury goods like watches and wine.But shares are a great investment cornerstone for the average salaryman, that’s because it’s possible to be a share investor with just $50. Much more attainable than a five-figure downpayment required for a property, that’s for sure.But to recap the basics, buying a share means to become a part-owner in an actual company. The value of your shares grow and shrink depending on the company’s profitability.So, owning shares will allow you to take part in a company’s successes and lay claim on their profits, instantly turning you from brainless consumer to fat cat capitalist. Great!

There Are No Original Thoughts

At this point, a thought might cross your mind: I love Apple products, looking up from your iPhone X. Everybody does! Look at the queues when a new iPhone drops, investing in Apple’s a sure win!So why don’t we all just buy Apple shares?Well, that thought probably crossed the thousands of Apple fanboys in the queue. Also, the stock market is an open ocean, and we are swimming in the same pool as sharks — from investment bankers in Wall Street to CBD.This means that due to demand and faster fingers, Apple’s share’s price could have already been driven up, not leaving headroom for further growth in price thus profit. But that’s the least of one’s worries, if we are talking about Apple, remember Nokia? Could that happen to Apple in 10 years?Nobody knows for sure.So if you don’t know what you’re doing, you can easily lose money stock-picking if a company goes down or underperforms.But, if shares are so risky, why are we even talking about them then?

Diversifying to Manage Risk

This is because as a whole, shares have performed well over time. Locally, Singapore’s top 30 listed companies shares have, on average, grown about 7% per year since 2002.Looking overseas, in the U.S, the top 500 listed companies have averaged 10% in returns over the last 40 years. These results are even after accounting for 2 major global economic crisis in 1997 and 2008.So the biggest companies — as a collective whole — has consistently beaten inflation handily. This is based on the belief that economies always trend upwards as the human race will keep improving over time — economically speaking, at least.And this is reflected in the stock market, 40 years ago, if one bought $100 worth of shares in the top 500 American companies, it would be now worth $4,500.So diversification is a big thing in investing, don’t put all your eggs into a single basket; to prevent the risk of picking a wrong share, buy ALL the shares.But you might be thinking, “Even I know you need a lot of money just to buy 500 different company shares!”

Enter ETFs

With just $100 you can buy the shares of the top 30 companies in Singapore. Even better, with that same amount, you can even buy into the performance of over a thousand companies across the world.This can be done by Exchange Traded Funds (ETFs), a type of investment which can track indexes. And what are indexes? Simply put, indexes are rules.And the ones we mentioned earlier do actually exist:

- STI: The top 30 companies in Singapore

- S&P 500: The Top 500 companies in the U.S

- MSCI Core World: A spread of 1,636 companies representing economies across the developed world

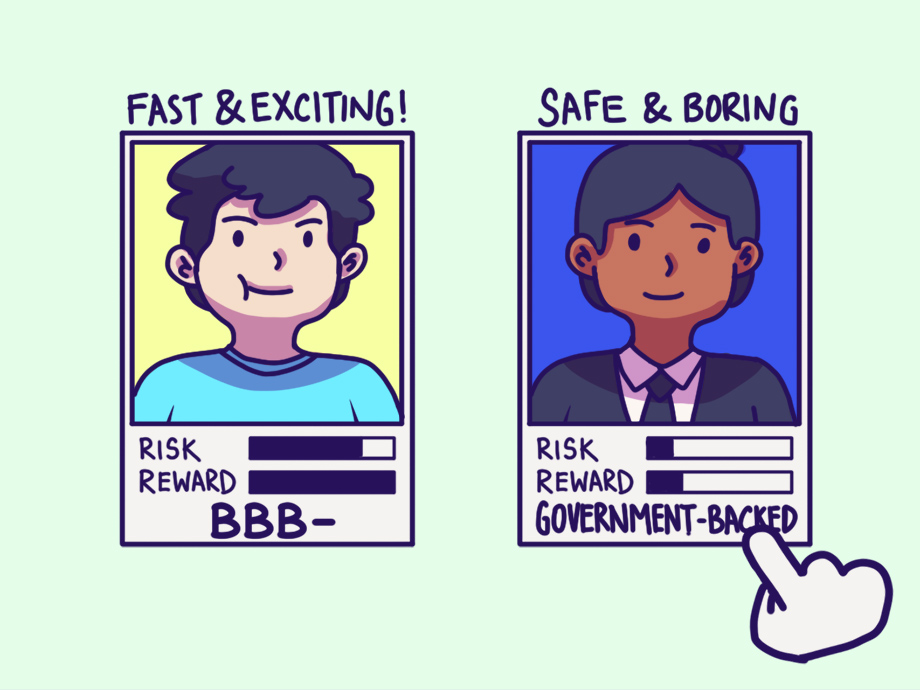

So ETFs track these indexes. This means buying a single unit of an ETF exposes you to a broad index of multiple companies.But not all ETFs are created equal, the ones you should be interested in are those outlined above, that follow one, or several developed national economies, also known as broad-based indexes.

Control Investment Costs

And on the topic of risk of losing capital, what’s another sure way to not lose money?Well, simply not spending too much of it! And this goes for investing too, when you buy shares you will have to pay middlemen — from the banks to brokers and fund managers, the capitalists must get their fee.And fortunately for us, most ETFs tick the cost-effective box.This is because ETFs simply “follow-the-index”, so they do not need to be actively managed by a well-paid financial person. This savings on lower operational costs are passed to you, the investor.To evaluate whether an ETF is cheap, look at the expense ratio of an ETF. These are the fees charged by the ETF fund manager. You can find this in an ETF’s fact sheet.

It’s easy to find funds with expense ratios below 0.3%, and of course, the cheaper the better.

The Earlier You Start The Better

This strategy only cares about the continuous growth of economies in the long term — think 10-20 years. So getting money ASAP into the market for it to grow is key; the more time your money spends in the market, the more its potential growth.For the average salaryman, this might mean investing just a few hundred dollars each month.

But this can be a good thing, as investing periodically helps you avoid the pitfalls of trying to perfectly time when to buy a share — which can be just as difficult as stock picking.The periodic investments mantra primes you to ignore market conditions and just continuously invest in the index, rain or shine. Headlines screaming “economic doom” will not keep the periodic/paycheck investor up at night.Over time, this investing style will keep you buying when the market is cheap — during economic downturns — and also when the market is soaring during the good times. In essence, what’s achieved is the averaging of the price of investment over time.This method is suitable for someone who wants a life outside work, not having to sieve through market data and financial report (also known as the responsible way to stock pick).

Downsides & Risks

Sounds good so far, so what’s the catch? Here are some of the downsides to this plan.

- You will never beat the market, as indexes follow the market — so don’t expect to get rich quick off this, it’s a boring style of investing.

- It requires being disciplined and staying the course, but this is easier said than done when exciting or nail-biting market movements are combined with investor fear or greed.

Passive Investing

So now you know all about index ETFs, and more importantly, the basics of a popular style of investing called passive investing. But if you’re still not convinced, don’t take our word for it, instead, take it from one of the greatest investors that ever lived.“If you invested in a very low-cost index fund — where you don’t put the money in at one time, but average in over 10 years — you’ll do better than 90% of people who start investing at the same time.“If you like spending 6-8 hours per week working on investments, do it. But If you don’t, then dollar-cost average into index funds. This accomplishes diversification across assets and time, two very important things.”

— Warren Buffet

In our next article, we go through the specifics on the nuts and bolts of how to invest with this strategy in Singapore.This article does is not investment advice, please your own due diligence to ensure an investment or an investment strategy is right for you.