Financial Planning | Personal Finance | Article

Learn How Much You Need to Retire

by Sophia | 25 Jun 2019 | 4 mins read

Unless the Fountain of Youth has been discovered, there will come a day where one has to kick back on that rocking chair and fully retire.

Look back on the years of hard work, settle into a cushy retirement nest egg – but wait, how much is enough?

It’s chilling to think that one’s retirement fund might fall short of rapidly rising economic rice prices. To escape this fate, crunching numbers now is vital. Here’s how to figure out how much is needed for a breezy retirement.

Figuring out the golden number

No two people retire the same way – so there isn’t a one-size-fits-all retirement plan. Someone might want to travel the world, while another might dream of affording fish in their cai fan till their dying day.

Well, whatever the dream is, it takes a steady retirement fund to make it happen. For most, it’s hard to visualise a specific amount for retirement.

And the first step to figuring out how much is needed is to first look at one’s monthly expenses – with the goal of maintaining the same quality of life, even in old age.

Here’s an example profile we can work off of:

- Age: 25

- Desired age of retirement: 65

- Life expectancy: 85 (caveat: life expectancy may increase as the years go by – but hey, you have to start somewhere)

- Monthly expenses: $1,500

Taking into account the core inflation rate of 2.5%, here’s how the monthly expense amount will grow over the years:

2019 (age 25): $1,500

2020: $1,537

…

2059 (age 65): $4,128

2079 (age 85): $6,765

By retirement, the original monthly expense of $1,500 will have more than doubled. And even then, inflation will continue to take effect during the 20 years of retirement. In total, across 20 years, the total retirement fund needed sits at $1,346,644

Save this Google sheet that you can use to project your needs for a ‘typical’ Singaporean retirement at 65 (till 85) with a 2.5% inflation rate.

Scary, right? But have no fear, CPF is here!

CPF and retirement

In Singapore, think retirement and you think CPF.

When it comes to CPF, there are three retirement schemes prepared for Singaporeans as they approach the age of retirement.

Presently, these are the minimum retirement sum amounts for each scheme:

The good news is that the payouts start from 65 (for now) and last as long as you live.

But the bad news is that inflation does not stop for you upon retirement, it keeps going when you’re 70, 80 etc.

So after a few years, your CPF payouts won’t keep up, and if you tried our calculator above, you’ll know just CPF ain’t enough!

Minus CPF

Following our chosen profile, assuming one gets on the Full Retirement Scheme (FRS) at age 65, the total payout for 20 years can be calculated as such:

($2,832 x 12 months) x 20 years (65 to 85) = $679,680

Now, remember the total retirement needs calculated earlier, based on monthly expenses after inflation?

$1,346,644 (total retirement fund) – $679,680 (CPF payouts) = $666,964 shortfall

This final figure is the amount one needs to save in anticipation of a comfortable retirement, after offsetting retirement savings with CPF payouts.

We won’t go over how to get that amount in this article – but investing helps. For example, stashing $6,750 a year (or around $560/month) for 40 years into a 4% interest investment would return the required amount.

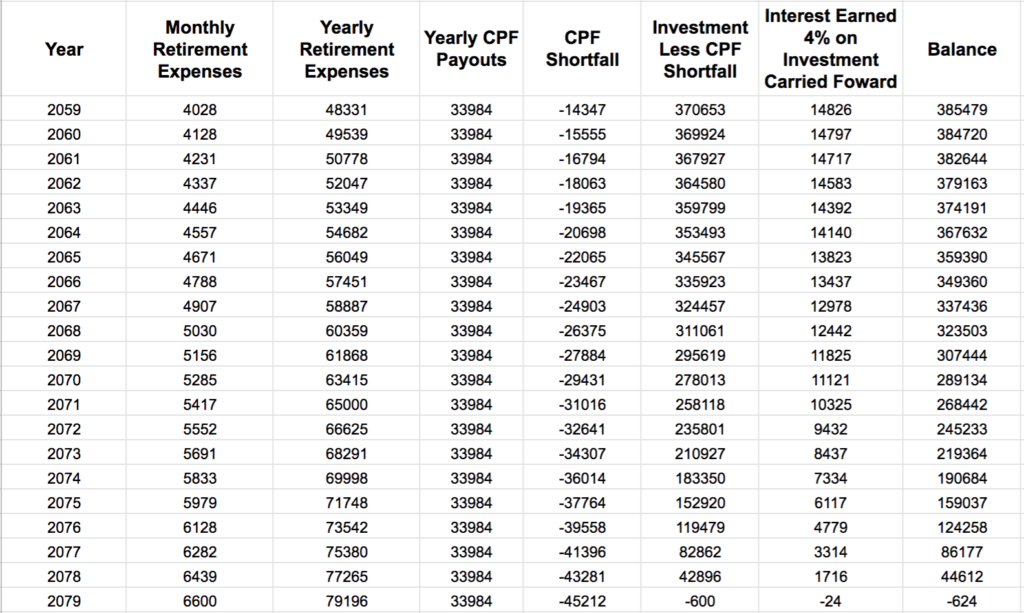

How to properly withdraw funds for retirement

Still sounds daunting? Well, this sum can be lowered even further if you consider that fact that when you retire, you shouldn’t take every single cent out of your investments immediately. After all, you just got to the starting line of the last – and hopefully – best days of your life, so don’t splurge it all on a Ferrari.

You should only convert it to the amount of cash you need for the year’s expenses; keep the rest in there and growing at 4%! We ran the numbers for a 4% interest scenario and using a staggered withdrawal (to make up for the CPF shortfall), only $385,000 is required to be saved by 65 instead of the original $666,964.

A significantly less sum for sure.

For a happy ending, the work must begin now, and in the grand scheme of things, crunching some numbers is just a small price to pay to get ready. We hope that this article helped you get an idea of the basic framework required for retirement planning!