Financial Planning | Personal Finance | Article

Your Burning Questions about Life Insurance Answered

by Sophia | 19 Aug 2021 | 11 mins read

This article is sponsored by FWD Singapore.

Choosing your insurance can feel like getting lost in a huge department store: there are a lot of policies to choose from, and you may have some trouble finding the ones that suit you best.

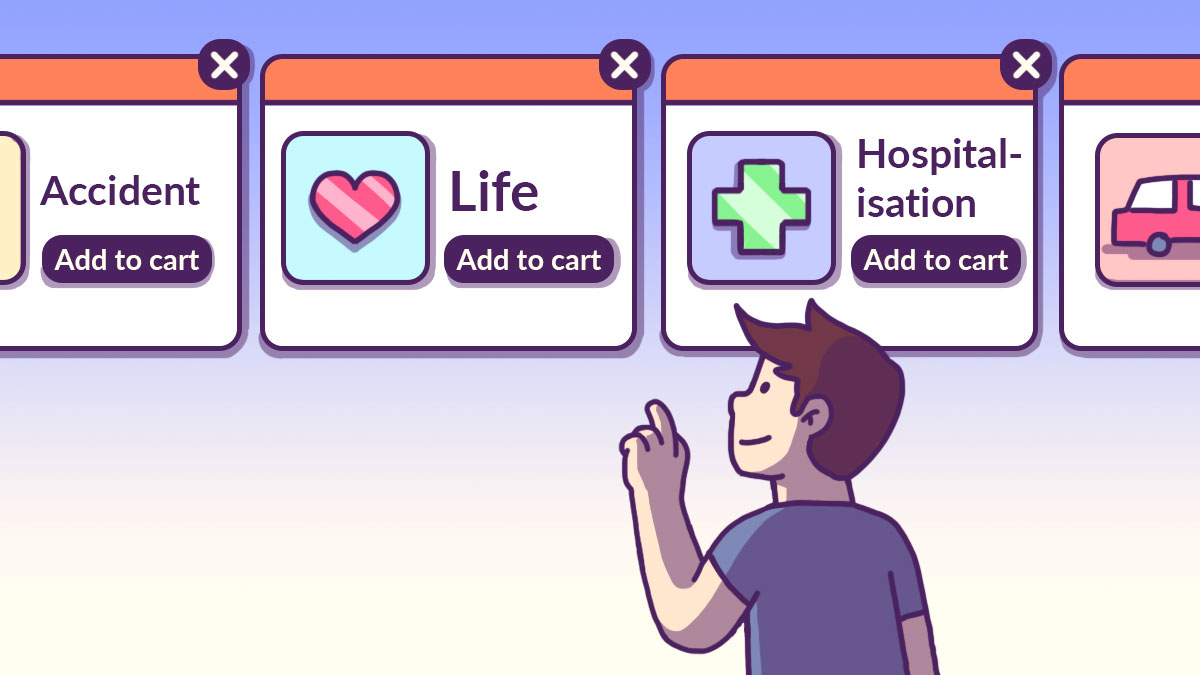

Take, for instance, life insurance. In Singapore, you would have likely come across two main types of life insurance: term life and whole life insurance. You may find it hard to tell the difference between these two types.

You might even wonder, “Is life insurance something I really need right now?” You might have more than a handful of burning questions about life insurance.

So, to clear your doubts and help you figure out your next step, we’ve pooled some of these burning life insurance questions together from millennials and Gen Zs (especially those who’ve started working for the first time) and got some experts to weigh in on the matter.

Q1: What’s the biggest indicator that I need life insurance?

Right off the bat, it’s your dependents (and whether you have them or not) that determines if you need life insurance. Dependents are people who, as you can tell from the term, depend on you financially. This could be your ageing parents, your newborn baby, or even your stay-at-home spouse who’s taking care of the kids.

Of course, if you don’t have any dependents at all you might not need life insurance yet. However, it’s always wise to think about upgrading your insurance coverage to eventually include term life or whole life insurance as you progress through different life stages.

As you grow older, you might take on more responsibilities, whether it’s the folks at home getting older and depending on you more, or when you decide to settle down and have children. Even as a single person who’s allergic to children, you might buy your own home in the future — meaning you’ll have to take on a home loan. These are all added financial responsibilities you’ll have to account for, one way or another, making life insurance almost a non-negotiable part of your coverage.

And speaking of upgrading your life insurance, you might want to consider tacking on riders for total permanent disability or critical illness coverage – these riders can pay out living benefits if you’re unable to work after a mishap or accident, so just keep that in mind!

Related

Q2. What’s the difference between term life and whole life insurance?

Make no mistake, both types of life insurance policies cover the same things, namely:

- Death

- Terminal illness

- Total permanent disability

- Critical illness (depending on the policy and insurer)

But not every term life or whole life plan will always cover the same things listed above. It’s always prudent to check the fine print or clarify things with your insurance agent.

The main difference between term life and whole life is the coverage period you’ll receive. Term life covers you only for a specific period. Whole life can cover you till you reach age 99.

Additionally, a whole life participating plan typically has a cash value component, for ‘savings’ purposes. The ‘savings’ component is pretty straightforward: the cash value of your whole life insurance plan grows year on year, based on how much the insurer’s bonus payouts are on your policy.

Having an added savings component might sound like a great deal, but hold your horses. Just because it’s the “whole” package doesn’t mean it would make the most financial sense to you. Because of these added cash value components, your whole life premiums cost more than with a term life plan. Without that cash value, you’ll pay a cheaper premium. So, make sure to check with your agent or a financial advisor to see which plan suits you best.

Q3: Which plan is cheaper, term life or whole life insurance?

Term life insurance is cheaper, though it will still cover you for the same things as mentioned above. If you’re not fussed about having a cash value component* to your insurance coverage like whole life participating plans offer, or you prefer to simply save and invest your money independently, then term life insurance might be the one for you.

In other words, term life is cheaper because it’s purely about protection. Whole life is more costly because there’s the added savings component to it. And if you’d prefer your savings to be invested for long-term financial goals such as retirement, then term life may be the way to go.

*Do note that term life insurance does not have cash value, while whole life insurance does. What does this mean? Well, if you terminate your term life coverage early, you won’t be getting any money back. For whole life insurance, with a cash value attached to it, you’ll get back a portion of your accumulated cash value if you choose to terminate your whole life coverage early.

Q4. Why should I get life insurance when I’m younger? Can’t I wait till I’m older (and able to afford premiums)?

When you’re fresh out of university and taking on your first job, you may feel invincible; that no disease can touch you. You may even have the misconception that life insurance is for people who are much older than you are — people who are more at risk when it comes to contracting terminal illnesses.

But if COVID-19’s taught us anything, it’s that young people are every bit as susceptible to pandemics, terminal illnesses, and fatal accidents. Even cancer is becoming more prevalent among young adults, such as colorectal cancer. You’ll want to purchase life insurance before disaster strikes, and that means buying it as early as possible once you’re able to afford it.

You also can’t deny that you’ll pay less insurance premiums when you’re younger than if you were to obtain coverage later down the line.

For example, getting insurance at age 25 versus at age 35 makes a huge difference, at least financially. For a life insurance plan that gives you a sum insured of $100,000, in addition to $50,000 for total permanent disability and $50,000 for critical illness, buying your insurance at 25, or 10 years earlier, could mean saving up to $4,152 in premiums.

But, it’s not always about whether something is cheaper when you’re younger. Consider also your financial obligations and whether you have dependents before making that decision.

Q5. If I have a spouse, should we both get life insurance?

The answer’s going to be a yes if you both have existing financial obligations like repaying home loans, or if you’re parents. That way, if something happens to either one of you, the life insurance payout can kick in and help your surviving other half to tide over debt repayments and child-raising expenses (not to mention continuing to support your ageing parents, if any).

If only one spouse is working and the other is staying at home, then life insurance will be that much more vital. Should anything happen to the working spouse, the only stream of income for the household will be affected. Let’s face it: struggling financially on top of emotionally after something untoward happens to your spouse is more than just being stuck between a rock and a hard place. It’s gruelling.

Of course, just because you’re unmarried and still dating, without any kids, doesn’t mean that life insurance isn’t crucial. Again, consider other financial obligations or other dependents in your life, and make your decision from there.

And as for how much your life insurance coverage should be… As a rule of thumb, according to the Life Insurance Association Protection Gap Study 2017, one should aim to have life insurance coverage of about 9x their annual income.

Q5. If my parents don’t have life insurance yet, should I convince them to get it? How?

This depends on whether your parents are still working and supporting you, their child. If they’re at a point in their lives where they don’t have to work and support their kids or even pay off their home loans or other outstanding loans, and are depending on retirement savings to fund their lifestyle, then they may not need life insurance coverage.

On the other hand, if you’re still relying on your parents financially, or if you have younger siblings in school that do, then life insurance is a good hedge against the risk that something might happen to them, rendering them unable to provide financial support to the family.

Q6. How do insurance companies determine your premium?

Insurers typically consider the following factors when assessing your profile and coming up with the number for your premiums. These factors include:

- Age

- Gender

- Lifestyle

- Health risks

- Employment type

- Type of coverage for riders

- Amount of coverage

- Coverage term

These factors contribute to risk (as in, the risk of you getting into a mishap, dying early, or contracting a terminal illness), which in turn influences your premium amount. This is why an older person’s premium can far outweigh a young person’s — because older people are riskier to insure.

In a similar vein, men tend to pay higher premiums because of a lower life expectancy than women.

If you’re young, single, and working a desk-bound job in a relatively safe industry, you might find that your premiums are more affordable than other people’s, which is good news for your wallet!

Q7. When should we ever think about changing our life insurance policy?

Remember what we said about progressing through different life stages, and letting that guide your decision-making where life insurance is concerned? It’s pretty much the same deal here.

Let’s say that you bought a life insurance policy as a fresh graduate entering the workforce for the first time. You might not need a huge amount of coverage since your only dependents are your ageing parents who have healthy retirement funds.

But then five years pass, and you’re married with kids on the way — twins, perhaps. Your spouse has agreed to stay at home to look after them. This is probably when you ought to relook your life insurance coverage, and possibly increase the amount of coverage since you now have ageing parents, a spouse, and two kids to take care of.

TL;DR: Should your financial responsibilities increase, then your life insurance coverage needs to follow suit!

The earlier, the better

As you can probably tell, there are a lot of factors to consider when thinking about getting life insurance coverage. But one thing is certain — it pays to kickstart your protection earlier on in life. The earlier you get a life insurance policy, the lower your insurance premiums will be. So, if you don’t want to end up paying more down the line, it might be time to start thinking about getting that life insurance policy today.

A message from our sponsor

If you’re already thinking of getting life insurance for yourself, but you don’t know where to start, insurers like FWD can provide quotes 24/7 on their website. Once you know what coverage you need and how much you’ll potentially pay in premiums, you’ll be able to make better-informed decisions about your policies. Remember, when you’re ready for your next life goal, you’re definitely ready to review your life insurance coverage!

From 20 to 30 September 2021, get 25% off your first-year premium for FWD Term Life Plus when you use the promo code “SIMPLESUM25“.

Do note that this article is for general information only and does not constitute financial advice.

Buying a life insurance policy is a long-term commitment. You should consider if this policy is suitable for your needs, or you may wish to seek advice from a qualified financial adviser before making a commitment to purchase this policy. Switching from an existing policy to a new one may have potential disadvantages.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC).

This advertisement has not been reviewed by the Monetary Authority of Singapore.