Investing | Article

A Guide to Investing in Gold: Why and How to Do It

by Ooi May Sim | 10 Nov 2021 | 8 mins read

This article is sponsored by Hugo. Get started investing in gold the easy and smart way here.

While stock prices fluctuated wildly at the height of the COVID-19 pandemic last year, another asset class saw more and more investors flocked to it – gold!

Gold’s price hit an all-time high of US$2,063 (S$2,786.35) in August last year, its highest since 2011. And some experts predict gold’s price could climb even higher.

We probably shouldn’t have rolled our eyes at grandma when she bought that thick gold necklace. (“It’s so old-fashioned!”). Well, investing in gold is trendier than ever now.

The beauty of gold

People value gold because of its unique properties as a precious metal; it doesn’t corrode, rust or tarnish, and has a beautiful colour and shimmery qualities.

In ancient times, people used gold as money and as recent as 50 years ago, gold was used in a system to value the world’s currencies. Regardless of geographic borders, culture and time period, gold is still valuable and can be sold or traded as needed.

But gold is scarce, which only adds to its appeal and value. And people pass it down from generation to generation, giving it an added sentimental value.

Gold doesn’t really go out of fashion

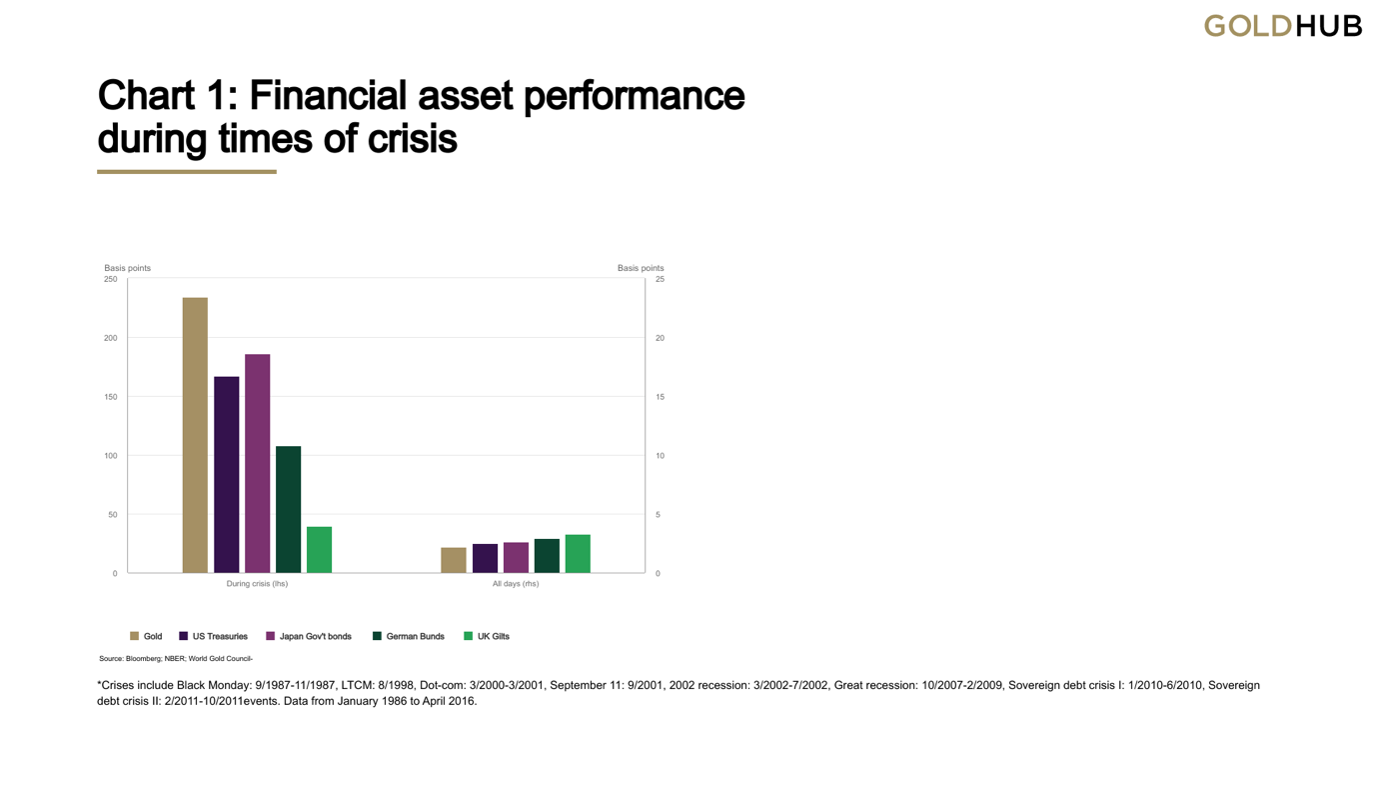

For the very reason that people value gold, gold becomes an important investment asset, especially during times of crisis.

In financial crises, such as during COVID-19, companies can face significant business risks, uncertainties, huge losses and see their stock prices tank. With more uncertainty, investors tend to gravitate towards investments that they know will hold its value no matter what happens, such as gold.

People (and governments) also tend to hold more gold when a currency’s value drops. For instance, gold prices often go up as the value of the US Dollar goes down, which makes gold a good hedge against inflation.

Related

Gold’s increasing relevance in an uncertain world

Current market and economic uncertainties are part of the main reasons gold is trendy again.

Governments and central banks are still trying to stimulate their economies post-COVID-19, which means they will be “printing more money” to be injected into the economy. This increases the supply of money, hence, the threat of inflation and currency devaluation. And the question on the minds of many investors is, “How I can preserve the value of my dollar?”

While some argue that cryptocurrencies could be an alternative store of value, crypto’s volatility doesn’t make it a reliable store of value for the long term, especially for a risk-averse investor. Gold, on the other hand, is the low-risk safe haven asset that more and more investors are re-visiting during this period.

Ways to invest in gold

There are three ways to purchase gold: as physical or digitised assets, shares or exchange-traded funds, or through gold futures.

Buying physical gold

This is the most straightforward way of owning and investing in this precious metal. You can buy physical gold in bars, coins, and jewellery.

Gold bars are a good way of storing large amounts of wealth in a small space, while gold coins work well for new investors, due to their smaller value. But gold coins tend to have an added minting fee.

Purchasing gold jewellery may be visually appealing but you’re paying more gram for gram because of the markup for design, craftsmanship and marketing costs. The markup can be anywhere from 20% to over three times the value of the raw material itself. Plus, the value of gold jewellery decreases if there are scratches, dents, or defects on it.

But buying physical gold might be out of the question for investors who may not have a lot of money to start with. A single kilogram of gold is valued at $76,000, at the time of writing. Not to mention, it’s risky to keep physical gold at home. You don’t want it lying around in your house for anyone to pick up. This means you’ll need to store it in a vault and buy insurance on it, incurring further costs.

Digitised gold

Solving the problem of storage, investors can buy digital gold, the electronic form of physical gold. Backed by gold reserves, the gold itself is safely held in vaults by private companies. Investors then prove ownership through digital records.

Owning gold digitally also makes it easy to trade. In this form, investors can determine where, when, and how they would like to obtain and trade their asset.

As trading is done online, digital gold is highly liquid – unlike physical gold, you don’t have to wait for the jewellery store, or the bank to open. It can be traded round the clock. Plus, as there is no lock-in period, investors can buy and sell whenever they see fit.

Investors can also opt to buy it in smaller quantities, making it extremely affordable and accessible.

Gold ETFs

Exchange-traded funds (ETFs) allow traders to track gold prices without having to buy physical gold. Gold ETFs operate as trusts that hold physical gold and issue shares for it. Buying a share means owning a portion of the gold held by the trust. As these ETFs hold physical gold, their prices vary according to gold market prices.

Gold-related stocks

Buying shares from companies that are directly linked to gold, such as gold-mining companies or gold producers is another way to invest, without your having to buy the metal directly.

The main advantage of this is that returns are tied to gold prices. Some stocks even pay dividends. But as these stocks aren’t backed by physical gold, they are susceptible to market fluctuations, and you may lose your investment if the company’s performance is affected.

Gold futures

As its name suggests, gold futures are contracts through which a buyer agrees to purchase a specific quantity of gold at a predetermined price and date in the future.

This is one of the riskiest ways of investing in gold as it is a form of speculative investing. As futures contract is based on predetermined conditions, it does not account for current market rates.

Related

Things to take note of when investing in gold

Unlike stocks that might pay its shareholders dividends, physical gold doesn’t provide a steady income stream. Instead, its value is largely tied to its price. So, when investing in physical gold, you’re investing in a store of value that could appreciate over a longer period of time.

Buying physical gold comes with an added risk; there is always the possibility that your gold bar or coin can get damaged or stolen. But these risks can be reduced by buying gold in a different form.

Digitised gold, gold ETFs, or gold stocks are other ways you can invest in gold without having to worry about where you store your gold.

But make sure that you do your homework when choosing an investing instrument. For example, you’ll need to research the platform that you’re buying gold on, check the credibility of the fund managers that created a gold ETF, or analyse the financials of a gold mining company before buying its stock.

When is a good time to buy gold?

Gold prices are determined by several factors: supply and demand, inflation, interest rates, international gold prices, currency fluctuations and geopolitical issues.

In the short-term, gold’s price does fluctuate based on current events and economic conditions. But dollar cost averaging into gold over the long term can be one way you can increase your allocation in gold while reducing your exposure to its short-term price fluctuations.

David Fergusson, Co-founder of Hugo adds, “Our view is that you should buy gold throughout the cycle and while in the savings mode of your life. The only time you should not buy gold is when you are more generally dis-saving, that is when you’re living off your retirement income”.

The bottom line

Inflation, financial crises, external shocks, and uncertainty are events that will inevitably impact your investments over the long term. One way to reduce risk in your investments to diversify your portfolio with gold.

Some experts suggest having 2% to 10% of your investments in gold. This way, when the rest of your investments are affected, gold’s increase in value can reduce the volatility in your portfolio’s value, and limit your exposure to losses.

With a proven track record that has stood the test of time, gold is a valuable asset to own. So, irrespective of your investment profile, you might want to consider including gold in your portfolio.

Content sponsored by Hugo

A message from our sponsor:

Hugo is a digital platform that helps you spend, save and invest, starting with gold. Hugo is your Wealthcare® Buddy who takes care of your financial wellbeing.

Hugo’s Gold Vault provides gold investors with a highly liquid, accessible, and safe way for everyone to invest in physical gold. You can buy or sell gold from as low as $0.01. You can also monitor live gold prices within the app, then make informed decisions on when to trade.

Together with Roundups, Hugo makes investing in gold a very convenient and intuitive process. You can also schedule monthly savings to be invested in gold, making it part of your long-term investment plan. Aside from Gold Vault, Hugo also has Money Pots to help you save for and achieve your goals sooner.