Managing Debt

Is BNPL Helping You… Or Hurting You?

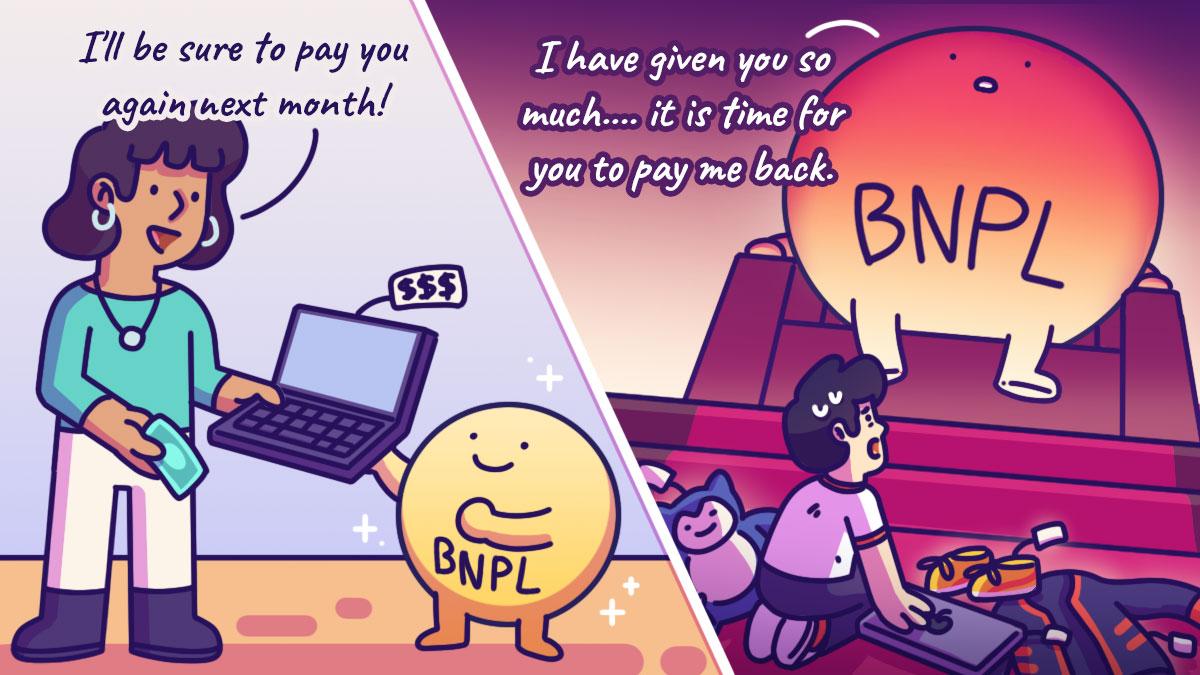

It’s 11.55pm and you’re in bed. You keep telling yourself to go to sleep because tomorrow’s going to be a long workday. But here you are, still doom-scrolling. Then, an ad suddenly pops up on your feed. It’s for wicked-looking shoes that are going for 40% off. Even with the discount, they’re still pretty pricey. And if you’re being honest, you don’t really need another pair. But you click on the ad anyway, just to take a closer look.That’s when you see it: “Just pay $25 today.” You can settle the rest later. Suddenly, those shoes don’t feel expensive anymore – they seem affordable and within reach. I mean, $25 is just the price of a takeaway meal. It’s practically a steal!So, you make a few more clicks and just like that, you’ve entered the world of Buy Now, Pay Later (BNPL). Okay, But How Does BNPL Really Work?Instead of paying the full price of an item upfront, BNPL lets you split your purchase into smaller instalments. This can be as short as 1 month, or spread out over 3, 6, or even 12 months, depending on the provider and the plan. Shorter plans are often interest-free – as long as you pay on time. But if you miss a payment? That’s when late fees (and in some cases interest) can kick in.And here’s what many people overlook: certain longer repayment plans may charge interest from the start – even if you never miss a payment. That’s why reading the terms and conditions really matters.Why Does BNPL Have A Bad Reputation?On the surface, using BNPL feels harmless. In fact, the smaller payments can help with your cash flow every month.But here’s the catch: BNPL doesn’t make things cheaper – it just makes them feel cheaper.For example, a $300 item feels expensive. But break it down to $30 a month, over 10 months, and suddenly it feels affordable. Spreading out payments changes your perception of how much an item costs, even though the price of the item hasn’t changed at all.And because BNPL is so easy to use – they often don’t have credit checks, and barely any paperwork – it’s super accessible. People who might not qualify for traditional credit like students, freelancers, and gig workers can all use it.Which is great… until it isn’t. Because it can sneak up on you.One BNPL purchase? Fine. Two? Still fine. But what about five? Six? Or seven?While each individual payment feels small, stacking them can quickly add up. And it’s easy to get carried away, because it is “just a few small payments”. Keeping up with multiple payment schedules across different platforms only add to the headache.This is how many people end up with BNPL debt.But BNPL Isn’t The VillainIn reality, BNPL isn’t bad. In fact, you can actually use it to your advantage.Sometimes, we need a little help affording things upfront, especially for bigger purchases. Maybe you need a laptop for your first job. Or maybe your phone died unexpectedly. BNPL can make these purchases possible without disrupting your work or wiping out your savings. It helps you manage cash flow while still getting what you need.But before you click on the “Pay Later” button, just keep these in mind:Treat instalments like bills - Don’t ignore them or they will pile up and can cause bigger problems down the road.Check the fine print- Read the terms and conditions so you are not caught off guard by ‘surprise’ interests and fees.It’s not free money- Just because you don’t have to pay it today doesn’t mean you don’t have to pay indefinitely. It’s still money that future you has to pay.Question yourself- Ask yourself if you’d still buy the item if you had to pay the full amount today. If the answer is yes, then great! But if the answer is “maybe not”, then that’s your sign to pause.Use it sparingly- BNPL is a tool, not a lifestyle. So, don’t make it your default payment method or use it for things you can comfortably afford to pay for upfront.Remember, BNPL itself isn’t the problem. It can be a helpful financial tool if used responsibly, but when used carelessly, it can quickly eat away all your future income. At the end of the day, the outcome depends on how you use it. And that choice is entirely up to you.

Are You Ready To Take Your Relationship With Your Partner To The Next Level?

Here’s How To Use Credit Without Letting It ‘Use’ You

I Ended My Relationship Because He Had 10 Active BNPL Purchases

A Millionaire At 39, But Money Didn’t Make Me Happy

My ‘Claw Machine’ Addiction Clawed $5K Out Of Me

A Christmas Carol That Spooked His Bank Account

I Ended Up Borrowing Money From My Parents To Pay For My Buy Now Pay Later Highs

Buy Now, Regret Later: My Love-Hate Relationship With BNPL

5 Questions To Ask Yourself Before Taking A Personal Loan