Things to consider

Here is an additional bonus point to consider if you are thinking about utilising CPFIS for a richer retirement:

From Oct 2020, commission charges for CPFIS investments will be abolished. Investment wrap charges – such as Asset Under Management fees – will also be lowered, thus reducing the cost of investing through CPFIS.

| Before Oct 2018 | From Oct 1 2018 | From Oct 1 2020 | |

| Sales charge (for new CPFIS purchases) | 3% | 1.5% | 0% |

| Wrap fee (for new/existing accounts) | 1% | 0.7% | 0.4% |

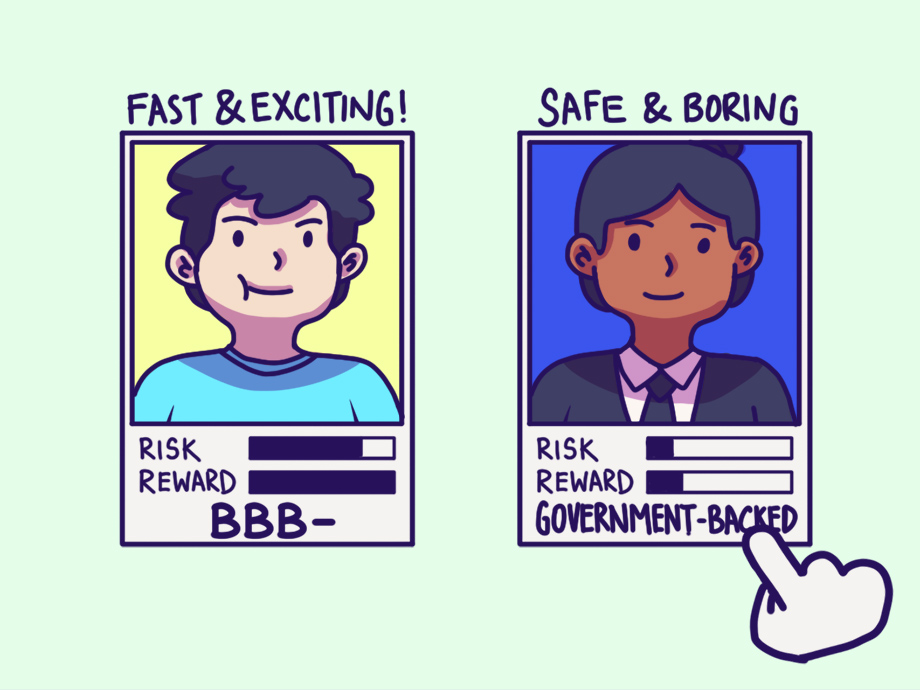

But in the end consider your personal risk appetite, current financial situation, and personal investment knowledge and acumen.

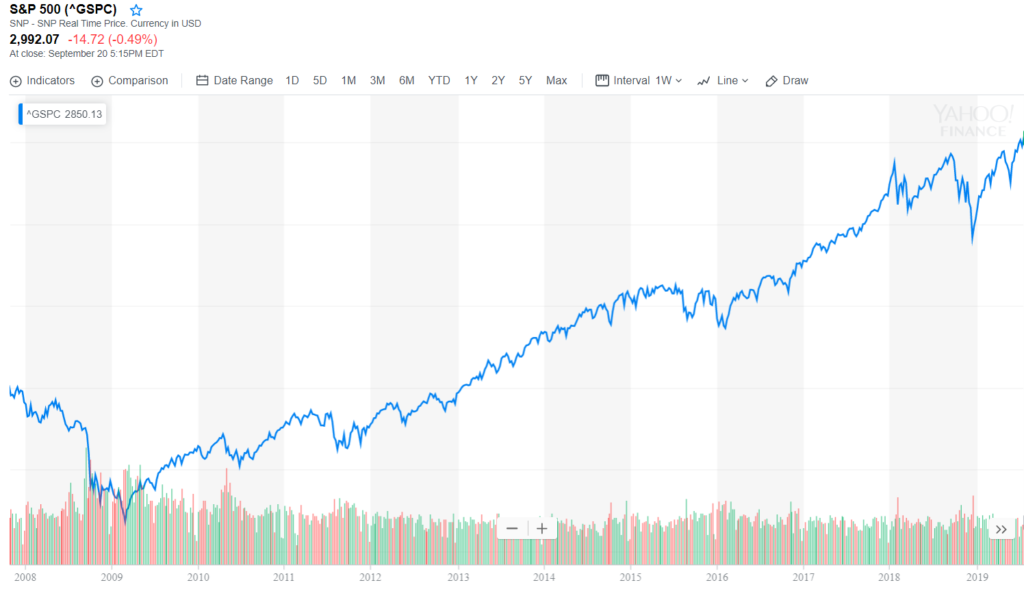

With the lowering of sales charges, coupled with murmurs of a possible recession in 2020, it might be prudent to adopt a wait-and-see approach if one is considering dabbling with investing with their CPF investments. One luxury CPF investing provides is the rare occasion that you are still rewarded for not doing anything with your money, as your funds are still enjoying a 2.5% growth within your OA.

This strategy reduces the risk of entering a too high investment price, and one can save on the sales charges once the new rules kick in.

Having that much money waiting for you in your golden years means worrying less about things like going back to work even after age 65 or even depending on your children in old age. It all depends on your personal goals at the moment, and what you hope to achieve in the future.