Budgeting | Life | Personal Finance | Personal Stories | Article

3 Mistakes You Shouldn’t Make When Buying Groceries

by Cherry Wong | 14 Mar 2024

When I started taking over the household responsibilities from my Mom, grocery shopping was an adventure fraught with pitfalls and lessons learned. The aisles of the supermarket, a well-organised path to restocking my kitchen and home, became a terrain filled with temptation and potential financial missteps.

In my journey, I’ve stumbled upon three mistakes that have made my home escapades into costly endeavours. It’s in these pitfalls that I discovered the importance of strategy, foresight, and a keen eye for value.

Here are my shopping blunders and how I spun these around to become a savvier shopper:

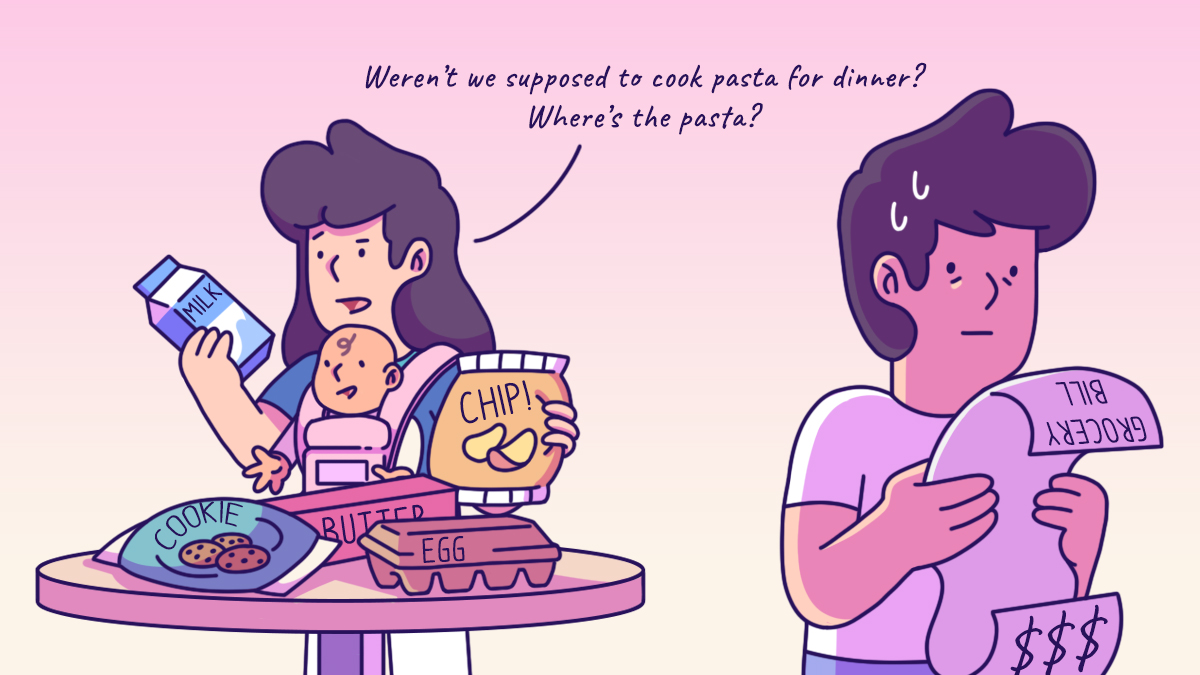

Mistake 1: Doing groceries without a shopping list

I used to stride into the grocery store with a mental inventory of what I needed. However, by the time I got to the counter, my shopping cart would be brimming with items, many of which I don’t need. To make matters worse, I would always forget a crucial ingredient or two and would have to make another trip to the store.

To avoid that, I began planning my meals a week ahead. I would look at all the ingredients I had in my fridge then plan dishes based on those ingredients. If I needed extra ingredients, I would jot these down on a shopping list and take that with me on my next grocery run.

Going shopping with a list not only streamlined my shopping experience, but also kept me focused on buying only what I truly needed, so I didn’t make impulse purchases. I also kept an eye on weekly promotions and discounts to capitalise on these cost-saving opportunities.

By making these changes, I not only slashed my grocery bill but also dodged those last-minute splurges that used to wreak havoc on my household budget.

Mistake 2: Being loyal to a select few vendors

Loyalty, a virtue that is celebrated in life, didn’t serve me well when it came to grocery shopping. I used to only frequent a few stores to collect loyalty points, but this unwavering allegiance led to many missed opportunities and inflated bills, prompting me to reevaluate the true cost of loyalty.

Now, I’ve broadened my horizons. By comparing prices across different stores and exploring alternative options, I’ve found that the best deals often lie beyond the familiar aisles.

Before committing to any purchase, especially big-ticket items, I make it a habit to compare prices across different stores. It was eye-opening to see how prices vary, and I realised that being loyal to one place isn’t important – getting the best deal is.

Related

Mistake 3: Buying items solely on the price tag

The price of an item used to be my sole focus whenever I bought something, leading me to overlook another important metric – it’s weight! Ignoring this crucial metric meant that I would often go home with what I presumed was the best bargain, but in reality, it wasn’t.

I learnt that although something might look cheap upfront, when you break it down by weight, it’s a whole different story. By assessing the price of each product by weight, I realised that those flashy deals weren’t always what they seemed.

Although these price differences might seem small and insignificant, they add up. By always comparing the cost per unit, I am ensuring that I am getting the most for my money.

So, the next time you’re tempted by a flashy price tag, take a moment to compare the weight of each item to uncover the true price of what you are buying. Trust me, your wallet will thank you for it in the long run.