Financial Planning | Life | Personal Finance | Personal Stories | Article

Retiring Young: A Singaporean on FIRE

by Katrina | 12 Mar 2019 | 10 mins read

The world is your oyster.

You can do anything you set your mind to.

As a fresh-faced graduate just starting to explore the opportunities of the world, you probably truly believed that you could live life on your own terms and achieve the desires of your heart, no problem.

Then you landed your first job. Your unbridled enthusiasm quickly gave way to confusion, then disappointment, and finally, a weary sense of resignation.

As it turns out, at least one in every two Singaporeans will end up going down this path. According to JobStreet.com’s Job Happiness Index 2017, 45 percent of respondents were found to be unhappy at work.

How nice it would be if we didn’t have to work—if we could do the things that we loved, while not having to worry about having enough money for our daily necessities (not to mention education and housing loans).

Yes, it certainly sounds like a pipe dream. Crazy, even.

You know what’s crazier? That there is an ever-growing community of people out there who are living out this exact dream.

Welcome to the FIRE (financial independence, retire early) movement. The concept is exactly what its name suggests: live frugally, save and invest wisely, and then retire on passive income at the ripe old age of about 30-40 years old, or, two to three decades earlier than the usual retirement age.

Sounds simple enough—so much so that when former banker Mr. J, in his 30s, (who has requested to remain anonymous) chanced upon it, he couldn’t quite believe it.

“The idea that there’s a very clear and simple way to guarantee the growth of your wealth in the long run—no tricks, gimmicks, or get-rich-quick schemes—fascinated me,” he recalls. “I was even more drawn to it when I learned that I could do it relatively quickly—within 10 years—by just increasing the rate at which I was saving.”

So, if all goes well, Mr J aims to retire comfortably by his 40s.

Back in 2016, having recently left a failed startup behind, Mr. J was looking for something “less risky, more systematic and [that] requires very little maintenance.” As such, he began to do a lot of research on investing, trying to find a better way to grow his wealth.

The road to FIRE

He dug into articles and books on investing, “I went from Random Walk Down Wall Street, to Intelligent Investor, to Elements of Investing, and then Bogleheads Guide to Investing,” he recounts.

From there, Mr. J moved onto Reddit, where he stumbled onto the subreddit r/financialindependence.

“When I was reading the subreddit, I was thinking, you mean I don’t have to work until I’m 65?! That really resonated with me, so I dove in to learn as much as I could about how to implement it in my own life.”

For Mr. J, this concept didn’t require as large a stretch of the imagination as you would imagine. Ever since he was in primary school, his father had always preached about the merits of investing and starting a business to him.

“He was always giving me books like Rich Dad, Poor Dad,” he recounts. “You could say that my dad really gave me this drive for success.”

As such, the FIRE movement was a natural fit for him. But not just because it seemed like a means to become rich. To Mr. J, the FIRE movement was really all about freedom.

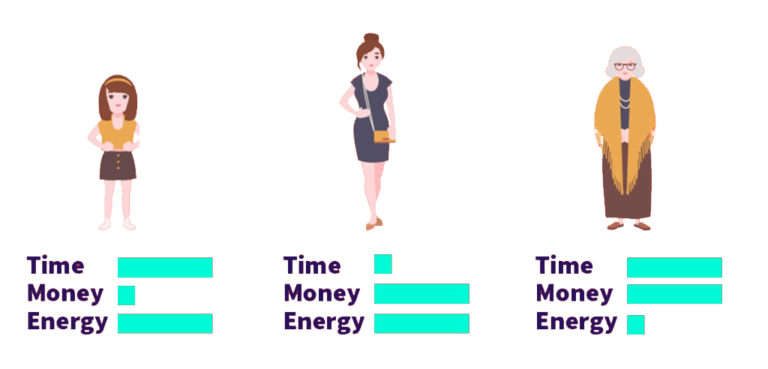

“It’s about having absolute freedom to choose what to do with your life and with your time. Because money isn’t the limited resource, it’s our time,” he explains. “Each of us has a limited amount of time on this planet, and we should not be spending the majority of it doing things that we don’t find important, or doesn’t bring us joy.”

A system that works

Mr. J’s goal—or as he puts it, his “magic number”—is to have S$2,162,162 in investments to retire early. (This amount varies from individual to individual, depending on desired retirement lifestyle)

Why such a specific number? “This would allow me to withdraw S$6,000 each month—or S$72,000 per year—at a 3.33 percent withdrawal rate,” he explains.

A withdrawal rate is basically the rate at which you can withdraw from your investments every year, such that you have a high probability of never running out of money. This happens when there is enough remaining in the investment fund to regenerate withdrawals – via investment growth.

The plan, according to Mr. J, would more than cover his yearly expenses, setting him up for a comfortable retirement. How does he intend to achieve this ambitious goal? Just putting aside money in savings obviously isn’t going to cut it.

Instead, Mr.J invests heavily into index funds.

What are Index funds?

Index funds can be purchased from the stock market – just like typical shares.

But while purchasing stock means investing in a single company, purchasing an index represents investing in a basket of shares from several companies. The companies that sit in the basket are determined by what the index is designed to track.

What indexes tracks vary, for example, Singapore’s Straits Times Index (STI) tracks the share value of the top 30 local companies.

So, investing in a single share of STI effectively means you are investing in the value of the top 30 companies in Singapore.

Broad national indexes, such as the aforementioned STI (or USA’s DJI) usually track the top companies in a country. If a country’s economy grows, the index’s value generally follows suit. So in a nutshell, countries with strong economic fundamentals are a reliable bet. But because stable economies usually expand incrementally year-on-year, this will never get you rich quick.

Also, Index funds are considered cheap to invest in because they are passive – meaning that because indexes track simple rules (ie. the STI – Top 30 only) you don’t pay for an expensive financial guy to crack his brain, actively deciding what to invest in for you.

Mr. J believes that “long-term, passive, broad-based index investing is the surest way to make money in the stock market.” He goes deeper into detail in his blog, FIRE-Path Lion.

Mr J uses a portfolio structure called the 3-Fund Index Portfolio, a strategy advocated by many in the FIRE movement. He invests into 3 funds that track broad indexes. This further diversifies his investments.

- An International Index

- A Singapore Index

- A Bond Index

How does this look like on a regular day? When he receives his salary at the start of each month, Mr. J has a system that keeps him from overspending, and hence allows him to keep money flowing into his investment portfolio. Every month, 65 percent of his salary automatically gets transferred (immediately) into his investment account.

65 percent might seem like a huge proportion of your salary to set aside for investment purposes. However, Mr. J doesn’t find it too difficult. Often, he doesn’t even spend as much as 25 percent of his monthly salary, giving him a consistent little boost to his main account.

In fact, he still goes on vacation every year.

Yet, he doesn’t consider himself as a very frugal person—at least, not to the extent of other bloggers in the FIRE community.

“I’ve made the conscious tradeoff between reaching FIRE sooner, as opposed to enjoying some things now,” Mr. J elaborates. “I don’t have a strict daily budget, but I know how much I can spend during the month knowing that I’ve already ‘paid myself first’ by locking in the amount I will be investing.”

He shares that he does still enjoy a comfy Grab ride or a hot cup of expensive coffee once in a while, but only as long as he still has money in his spending account.

10 years and beyond

Since he started on this journey in 2016, Mr. J has accumulated about S$140,000, “which is around 6 percent of my goal.”

The biggest challenge he has faced so far? Having to put off his investment plans for three months in order to get married.

(Of course, he has no regrets about that.)

Mr. J firmly believes that, as long as he keeps “buying the index and staying the course,” it will take 10 years for him to reach this goal. The question is, what’s next for him after that?

Very few people in the world have any issues with the former part of FIRE, which is financial independence. Many are less convinced by the latter: retire early.

They ask the same question that I just did: what’s next after retirement? Is it really that great to retire early, and not having anything to work towards in life?

Mr. J believes that these people misunderstand the purpose of the FIRE movement.

“The purpose of FIRE is to give you the freedom to choose what you want to do with your time,” he emphasises. “Contrary to popular belief, once you are financially independent, you don’t have to retire. We’re not the retirement police, and we cannot force you to stop doing what you love to do.”

In fact, Mr. J thinks that if you truly love your job, or find your life’s purpose in your work, you should carry on doing it. If you happen to fall into the other half of Singaporeans that hate their job, however, then FIRE might make sense for you.

“What you get with FIRE is choice,” he continues. “You continue to work because you love it, and wouldn’t want to have it any other way, but not because you have to work. Just because you can afford to stop working, doesn’t mean you must.”

Mr. J does acknowledge that there are people who lose all sense of meaning once they’ve managed to achieve their FIRE goals. One reason for this that he puts forth is that we’ve been trained all our lives to be motivated by income.

“So if you have no other interest other than money, you may become lost once you’ve reached FIRE because you no longer know what else motivates you,” he says.

Because of this, it’s important for anyone who is considering embarking on this journey to carefully consider what FIRE means to him or her.

“Ask yourself, what do I want to do after I’ve become financially independent?” Mr. J recommends. “Having an answer to that question before you reach FIRE will help the transition become easier.”

Bringing the FIRE to Singapore

That said, Mr. J does believe that the FIRE movement would be an attractive concept for millennials in particular. “Millennials tend to be more independent, take pride in their individualism, and prefer taking the unconventional path and challenging the status quo,” he adds.

With FIRE-Path Lion, he hopes to spread the word about FIRE and build the community in Singapore “to become just as large and dynamic as it has become in the US.”

Why FIRE-Path Lion?

“‘FIRE’ represents the FIRE movement, and Lion represents Singapore and Singapore Residents—the residents of the Lion City,” he explains. “Initially, I wanted ‘FIRE Lion’ but that has been taken, so the next best was ‘FIRE-Path’ which still represents the journey and steps I am taking towards FIRE. Since the domain was available, I just ran with it!”

We hope you enjoyed our story on FIRE-Path Lion’s journey towards financial independence!

We at TSS would like to stress that before you get excited and emulate any investment strategy, it is important to DYODD (Do your own due diligence) to ensure that an investment is right for you. Everyone has their own risk-appetites and investment goals.