Managing Debt

A Quick Guide To Education Loans, Home Loans, And Personal Loans In Singapore

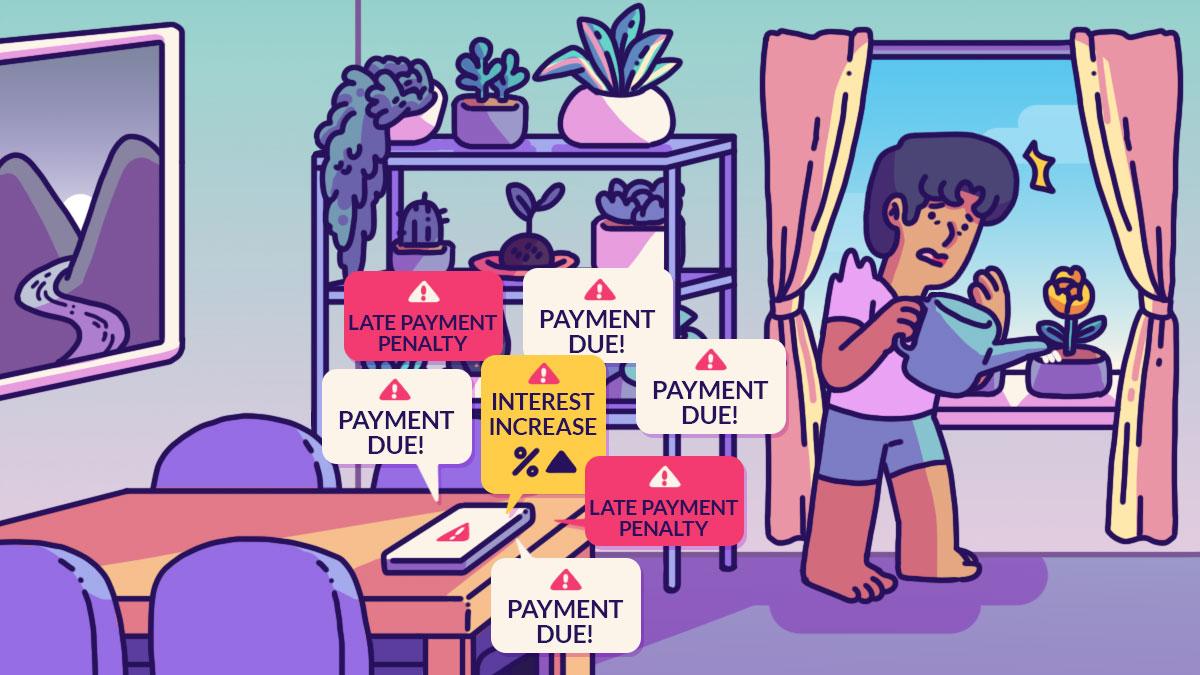

You might be in the market for a loan to finance big life moments: funding your education, starting a business, buying a home, or renovating your house.But Singapore’s loan market isn’t exactly a walk in the park. With so many options and terms, what should be a step in the right direction can quickly turn into a stressful search in the jungle. Don’t worry, though – this guide will help you get up to speed on your loan knowledge and compare loan packages so you can make the best decision for your borrowing needs. But first things first, remember that borrowing comes with its own set of financial implications – you’re going into debt, which is a legal commitment. So, before you borrow, ensure you have a plan in place and can confidently manage the repayments.Education loansAn education loan is designed to help cover the cost of your tuition fees for tertiary education, whether you're studying at local institutions or private universities (in Singapore or overseas).Ministry of Education (MOE) loansThe MOE offers a Tuition Fee Loan for Diploma or undergraduate students enrolled in subsidised programs at polytechnics, local universities, and local arts colleges. This loan covers up to 95% of the subsidised tuition fee and offers a repayment period of up to 20 years, depending on the institution or programme. Eligibility for this loan is restricted to Singapore citizens or Permanent Residents (PR).The MOE also offers a Study Loan, which helps cover up to 25% of subsidised tuition fees and provides up to $3,600 a year for living expenses, only after you’ve taken up all other loan schemes and still require financial assistance. The repayment period can also extend to 20 years, depending on the institution or programme. Eligibility for MOE Study Loan is limited to Singapore citizens or PRs, and international students with a gross monthly household income of less than $2,700 and $1,200 respectively.Effective 1 April 2024, the interest rate for the MOE education loan is 5.1% per annum, with a late payment interest charge of 0.675% per month.Bank education loansBanks also offer education loans for both local and overseas tertiary education. Loan amounts can start from as low as $1,000, with loan tenures of up to 10 years. Only Singapore citizens or PRs are eligible for these loans. Interest rates on bank education loans typically start from 4.5%. Be mindful of processing fees and potential penalty fees if you decide to repay the loan before the tenure ends.Current education loan packagesBelow are some education loan packages available in the market as of July 2024:BankMaybank Education LoanOCBC Frank Education LoanPOSB Further Study AssistInterest RateFrom 4.5% p.aFrom 4.5%From 4.38%Maximum Repayment period10 years 8 years10 yearsMinimum Loan Amount$5,000$1,000$20,000Processing fee 2.25% of loan amount, (min. $300)2.5% of loan amount (min. $1002.5% of loan amount (min. $100Late payment fee3% + interest rate$50$30Partial Repayment penalty1% on prepaid amount 1% on prepaid amount No chargesFull repayment penaltyUp to 2.5% on prepaid amount 1% on prepaid amount No chargesHome loanHomeownership is the Singaporean dream, but not all of us can afford to fork out six figures in cash to pay for a house. Hence, the need for home loans to finance our property purchases. Home loan rates in Singapore vary depending on the type of property you buy—whether it's a Housing Development Board (HDB) flat or a private property. HDB flats are affordable public housing in Singapore but come with certain restrictions that impact eligibility. For example, if you're under 35, you must buy as a couple, and both partners must be Singaporean citizens or permanent residents. On the other hand, while private properties are more expensive than HDB flats, they have fewer eligibility requirements.HDB loan or bank loan?HDB loans are specific to HDB flats and often come with different terms and interest rates compared to loans for private properties. Bank loans can be used for both HDB flats and private properties, but each bank has different borrowing limits and interest rate structures.The amount you can borrow depends on the type of home loan you choose. For HDB loans, you can borrow up to 80% of the property value. While bank loans allow you to borrow up to 75% of the property’s value. The remaining balance is your downpayment. You can use cash, Central Provident Fund (CPF) Ordinary Account (OA) or a combination of both to fund your downpayment. However, the actual amount you can borrow is also influenced by your ability to service the debt (pay it off), as determined by your mortgage servicing ratio (MSR) and your total debt servicing ratio (TDSR) set by the Monetary Authority of Singapore (MAS).The tenure of a home loan typically ranges from 10 to 35 years. Current home loan interest ratesFor HDB loans, the concessionary interest rate from 1 January 2024 to 31 March 2024 was 2.6% per annum. This rate is pegged at 0.10% above the prevailing CPF Ordinary Account interest rate.When taking out a bank loan, you can choose between fixed-rate loans that lock in your interest rate for 2 to 5 years or floating-rate loans that fluctuate based on market conditions. In Singapore, floating rates are typically pegged to the Singapore Overnight Rate Average (SORA). Bank interest rates currently range from 3.7% to 5.5% but can go even higher depending on your creditworthiness and other eligibility factors. All major banks in Singapore offer home loan packages with both fixed and floating-rate options. If you’re considering a bank loan, you’ll need to contact the banks directly to assess your eligibility and find out the specific rates available to you.Personal loansA personal loan is an unsecured loan that you can use for various personal financial needs. Unlike secured loans such as home or car loans, personal loans do not require collateral, which makes them a flexible option for borrowers. Uses for personal loansPersonal loans can be used for a wide range of purposes, including but not limited to:Education: Funding tuition fees or educational expenses when specific education loans are not a viable option.Business: Covering startup costs, expanding operations, or managing cash flow for small businesses.Home Renovation: Financing home improvement projects, repairs, or renovations.Debt Restructuring: Consolidating multiple debts into a single loan to simplify repayments and potentially secure a lower interest rate.While personal loans can be versatile, we’d advise you to compare them with specialised loans for education, business, or home renovation, as these might offer better rates and terms tailored to specific needs.Things to know about personal loansBanks frequently offer special promotions on personal loans, with interest rates currently starting from as low as 2.88% per annum. It's important to note that the monthly repayment is calculated based on the original principal amount, not the outstanding balance. This means the effective interest rate (EIR) will be higher than the stated nominal rate.To illustrate, borrowing $10,000 over a one-year tenure at a nominal rate of 4%, you’ll need to pay a total of $400 in interest throughout the loan period. The effective annual interest rate of the loan is 7.3%. The minimum personal loan amount starts from around $500, with a repayment period of up to 10 years, with a maximum amount that’s two to six times your monthly income. Most banks have a minimum income requirement, typically $30,000 a year, for personal loan applicants. This is to ensure that borrowers have the financial capacity to repay the loan.When taking out a personal loan, be aware of various fees and charges that may apply, such as processing fees, late payment fees, and full repayment penalty fees. Always read the fine print, all of it, and ensure that you are fully aware of all the terms and conditions before committing to a loan agreement.Here’s a quick comparison of some personal loan packages currently on the market in July 2024:BankDBS Personal LoanUOB Personal LoanCIMB Personal LoanAnnual Interest RateFrom 2.68% From 2.88% per annumFrom 2.8%Effective Interest RateFrom 5.43%From 5.43% per annumƑrom 5.28%Maximum Loan Tenure5 years5 years5 yearsMinimum Loan Amount$500$1,000$2,000Processing fee1% Waived1%Late payment feeFrom $100$100$100Full repayment penalty$250S$150 or 3% of outstanding loan amount$250 or 3% of outstanding loan amountIt’s a financial commitment so prepare wellTaking on debt is an important financial commitment, so make sure you can handle the repayments and understand what’s involved. Doing your homework and comparing different loan packages will help you find the best fit for your specific situation. Remember that borrowed money is not free money, debt should be used consciously as a type of investment, used for assets and necessities that form part of your financial plan.Regardless of what the loan is funding, it's crucial to understand the details — like interest rates, borrowing limits, and repayment terms as well as your own financial picture. Always take the time to read the terms and conditions carefully, and don’t hesitate to ask questions and seek professional advice if you need it.Borrowing responsibly can be a key step towards reaching your goals. By doing your research and budgeting effectively, you’ll be better equipped to manage your financial commitments and make informed decisions.This content is part of the Temasek – Financial Times Challenge, a financial literacy education series in Singapore for youths.

SUBSCRIBE

STAY UPDATED!

And join our communityPOPULAR

© Copyright 2024 The Simple Sum. All Rights Reserved.