Investing | Article

The Bo Chup Way to Invest Part 3

by YuanDuan | 26 Jul 2019 | 10 mins read

In this installment, we will go through how to go about purchasing shares and bond exchange-traded funds (ETFs) for the 3-fund portfolio.

ETF categories

Local Shares ETF

Local Bond ETF

Global Shares ETF

For the average bo chup person, the objective would be finding the simplest ways to invest. But we also need a way to do so cheaply. As mentioned in the previous article, low costs are essential in maximizing your returns over a long investment horizon.

Regular Savings Plans

For the local ETF duo, there is a clear solution. The Regular Savings Plan (RSP) scheme, offered by local banks and financial institutions.

The Regular Savings Plan is aptly named: treat investments like savings, put aside for the future and not fussed over during the short-term.

With internet banking getting started is easy, most RSPs allow you to start investing with just a few clicks online. Once set, it automates the investments on a monthly basis. The minimum amount to start is a humble $100.

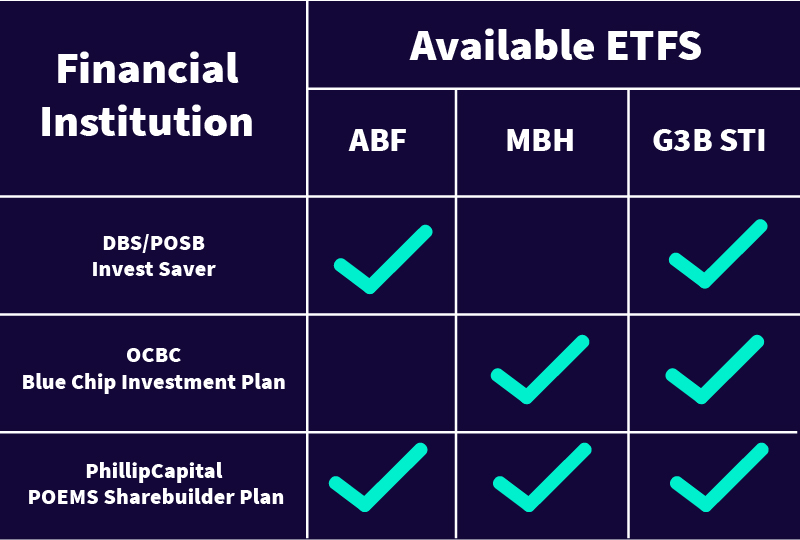

Here are the RSP Programs with suitable ETFs to execute the bo chup strategy.

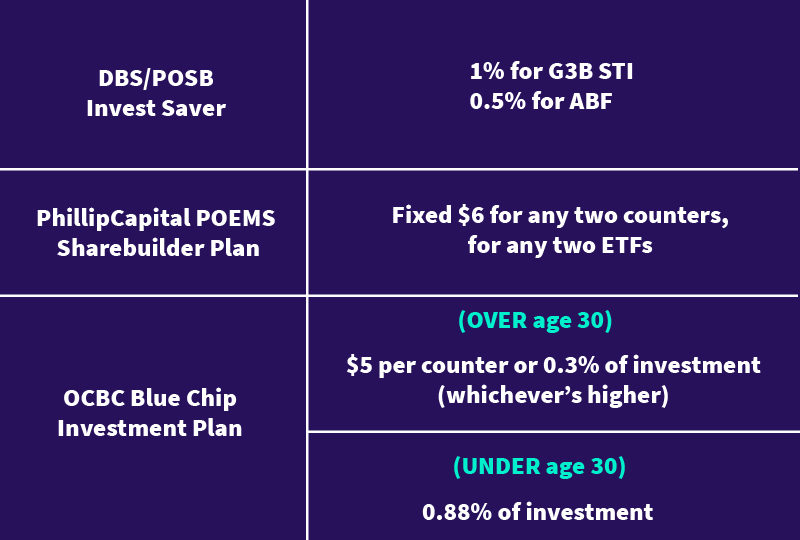

Now let’s examine the cost structure of each institution’s RSP.

Long story short, for smaller investment amounts, DBS is cheaper. For larger amounts, PhilipCapital’s POEMS platform makes more sense.

You have to do the math to see which is the most economical according to your allocation strategy and your monthly investment amount.

HOT TIP: For another layer of cleverness – without much additional effort – you can save on taxes, all while investing in your future! This is done with a Supplementary Retirement Scheme (SRS) account.

SRSLY good

SRS accounts were introduced in 2017 to encourage Singaporeans to save for their retirement. Cash contributed to one’s SRS account – up to $15,300 each year – is left untaxed. SRS accounts can be opened online with all the major banks.

How do you take advantage of this? Simply transfer your monthly investment funds to an SRS account – and then set up the RSPs from there.

Tax is only applied when you withdraw from your SRS account at the statutory retirement age (currently age 62, but will be raised in the future), and only 50% of withdrawals are taxed.

But even then, Singapore’s income tax regime only kicks in above $20,000 in annual income. This effectively means the first $40,000 of your SRS withdrawals are tax-free. (If you solely depend on SRS funds for your retirement income.)

Sweet.

However, this is unsuitable for those who are relying on their investments for early retirement; Any withdrawals before 62 will be fully taxed, and a 5% penalty imposed. Ouch.

But for those planning a “conventional” retirement ages at 62-65. This strategy can save a few hundred dollars off the yearly tax bill. DBS has an SRS calculator you can use to see how you can save in taxes.

Currently, only OCBC and PhilipCapital offer the suitable local ETFs for this SRS and RSP two-punch combo.

Note that OCBC charges an additional – but small – 0.37¢ fee per transaction when using SRS funds for investment.

Choosing a broker for global ETFs

Now the last part, how to purchase Global ETFs.

This is where it gets slightly tricky: We have to look for an investment brokerage. You might have heard of some, DBS Vickers, UOB-Kay Hian, and PhilipCapital are well known local brokerages.

Historically, a broker was someone you called on to make investment transactions on your behalf. However, with the arrival of the internet, that professional is mostly gone. Now, brokerages exist as online investment platforms and mobile apps. Just log in and execute the investments yourself.

The first prerequisite for us is that the brokerage has to have access to the London Stock Exchange (LSE) to take advantage of Irish tax-exempt ETFs.

Then the next factor we would be concerned with is, once again, cost.

Trading costs differ from broker to broker. There are many ways brokerages structure their fees. Here are some types you should look out for.

Transaction fees

This will be the meat of comparison between brokerages. This fee is charged when an investor buys or sells their investments. Most brokerages have a minimum transaction fee per trade. Some provide better rates if you trade more often, or if you make bigger trades.

Foreign exchange rates or forex

Brokerages also charge commissions for currency exchange. As you will be exchanging SGD to USD to invest in global ETFs. This, of course, affects cost.

Custody or Assets Under Management (AUM) fees

Custody fees are charged yearly, as a percentage of your total investment portfolio. For this strategy, this is a no-no. Because a $500 monthly investment can potentially snowball to over $200,000 in 20 years.

Even 0.1% of that equals $200 each year in unnecessary fees, that you have to pay for even throughout your retirement years.

So which is the cheapest?

You have to take a holistic look at how the different transaction fees and foreign exchange rates add up for each broker. It really depends on the amounts and frequency you choose to invest.

Popular brokerages with access to the London exchange includes Standard Chartered’s trading platform and Interactive Brokers. Here is a cost comparison for both. Both do not charge custody fees.

Interactive Brokers fees

- US$120 a year subscription fee: This can be offset with trading fees.

- If using an exchange rate of US$1 : S$1.364, this equates to S$13.64/month, at minimum, in trading fees.

Standard Chartered fees

- S$10 per trade, or 0.25% of trade, whichever is higher, and add 7% GST.

- Essentially this means any trade below S$4,000 costs a flat S$10.70.

So this means a difference of S$2.96 a month in trading fees between brokerages in Standard Chartered’s favor. Now let’s go on to exchange rates.

Standard Chartered exchange rate

- S$1.375 for US$1

Interactive Brokers exchange rate

- S$1.364 for US$1.

(Specific rates at the time of writing this article )

This means standard Chartered has a 0.8% higher-priced exchange rate. So at monthly investments of S$370 and above, Interactive Broker’s competitive exchange rates will negate the $2.96 a month difference between the two platforms. So any investment amounts higher than $370 with Interactive Brokers will nett you more in savings.

But this does not indicate a defacto winner.

Consider that if one chooses, instead of a monthly investment period, a yearly lump-sum investment of S$4770 (S$370×12) with Standard Chartered. That equates to S$11.88 in transaction fees and roughly USD$28 lost to the poorer exchange rate compared to Interactive Brokers.

However, in total, this would still be significantly less than Interactive Broker’s USD$120 a year in minimum trading fees.

But, the above comparison is depending on the strength of the US dollar, the stronger the US dollar in comparison to the Singapore dollar, the more expensive Interactive Broker’s rate will be.

For a safer estimation, over the last 28 years $US1 has averaged S$ 1.50. If using this as a guideline, Interactive brokers would retain its advantage over Standard Chartered for investments amounts above S$600.

So as you can see, in this case, it really depends on the frequency you choose to invest. Some prefer dollar-cost averaging annually, half-yearly, or even quarterly to save on transaction fees.

But of course, for less frequent and wider-spaced transactions, the question then is: do you trust yourself to not spend the investment money before actually investing it? At some point, staying invested is more important than bean-counting!

How about setting and forgetting it, like RSPs?

Sorry bochup-bois, unfortunately, there is currently no low-cost way to set up a recurring transaction for Global ETFs in Singapore. But to smoothen the process, one can at least set up an automated FAST transfer of funds from your bank account to your chosen brokerage each month.

Then, all you have to do it login to the app on a monthly basis to execute the investment.

Protection

Of course, the safety of your funds is paramount, you should choose a brokerage that has a solid reputation and has been in the industry for some time.

Procedurally, client brokerage accounts are supposed to be ring-fenced and left untouched by the brokerage. However, there have been instances where brokers have committed financial fraud by “borrowing” from client accounts during crisis periods.

So again, pick a brokerage with a good track record and longevity in the industry.

What about the worst-case scenario if a reputable brokerage goes bust? Well, because investment assets are legally under your name, your investments will be transferred to another broker.

For an additional layer of security, most brokers have their client’s cash and investments protected by insurance, it is worthwhile to check what kind of protection your chosen broker has on your assets

For American brokerages, it is common to have the U.S government-mandated Securities Investor Protection Corporation (SIPC) protecting investor funds (even foreign investors) up to US$250,000.

When to Trade

On a side note, you should only make trades for foreign ETFs when the market you are trading in is active. Any decent brokerage platform will indicate if the market you are trading in is open and operating.

Essentially, this means making the trade during the working hours of the foreign exchange, this is because trading volumes drop after hours. Without being too technical, a lack of activity (or liquidity) can lead to mispricing spikes of an ETF (or any other investment).

Luckily for us, the time zone difference means that the 4.30pm closing of the LSE in UK time equates to 12.30pm in local time; Ample time to make the monthly investment after work – no need to hide in the office toilet to execute your trades.

Conclusion

Ah finally! But still, this isn’t the end of studying.

Sorry.

If you do commit to this strategy you will eventually need to read up on how to draw down on your investment when you reach the finish line called retirement. What do you do when the market plunges into a crisis the year you decide to retire, massively devaluing your retirement/investment nest egg by 30%?

But if you’re in your twenties and thirties – you still have lots of time to figure that out. We will cover that in future articles.

Hopefully, this series has given some idea of the first, and perhaps even last investment portfolio you will ever need.

But before jumping head-in and opening your brokerage accounts, read up more to understand more about the 3-fund portfolio and figure out if it’s really for you. While the execution strategy is simple, it’s only suitable for investing towards a long-term goal like retirement. So, this strategy requires long term commitment for it to work. Stay the course!

It’s also unsuitable for those who get panicky when the value of their portfolios goes south during intermediary drops in the market – and markets WILL drop – this strategy ignores short-term market movements and instead looks towards the far horizon of retirement.

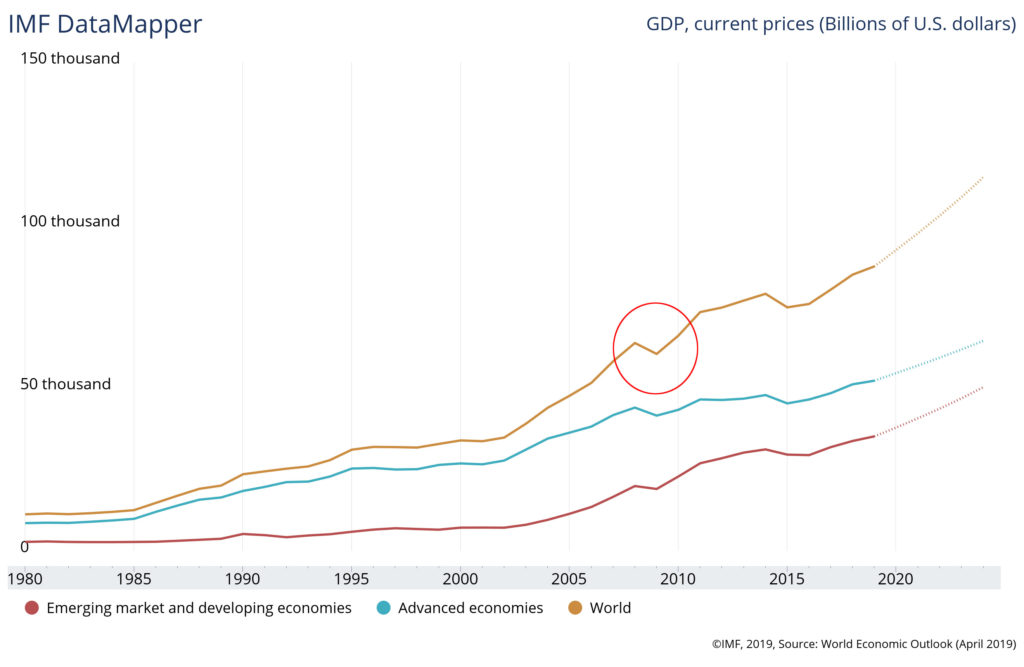

Lastly, we have to state that in the world of investing, results can never be guaranteed, while the performance of this style of investing has worked so far. But we need to disclaim – past performance does not guarantee future performance.

But it does at least leave some clues.

In the end, inflation still chugs along year-on-year, in Singapore, inflation was 1.7% (MAS core, 2018). So the world is naturally against you, something has to be done to grow your money.

This article does is not investment advice, please your own due diligence to ensure an investment or an investment strategy is right for you.