Financial Planning | Personal Finance | Article

Why Your Twenties Will Suck (Financially)

by Sie Jie Lim | 15 Nov 2019 | 5 mins read

After years of hitting the books, you have finally got your degree. Well, congratulations!

But don’t let your guard down — the hardest years of your life are now ahead, and here’s why.

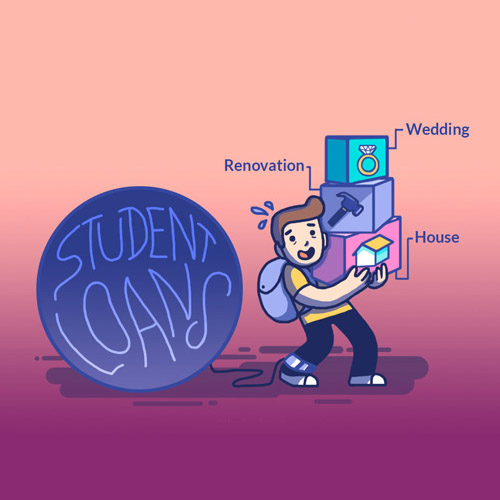

Your Student Loan

Unless you are a prodigy, you’ll finish your formal education in your early twenties, and while you might be done with studying, studying ain’t done with you.

If you don’t have a scholarship (or generous parents), you’ll have a 5-figure student loan to clear, and if you chose to study overseas, the amount could easily reach 6-figures.

A Barrage of Big Ticket Items

But that’s not all, as you enter into adulthood, you now have a series of big-ticket items awaiting you. These include your wedding, honeymoon and housing costs. Each will add to your financial burden. Let us give you a rough rundown.

Wedding & Honeymoon

A typical wedding will cost between $30,000 to $50,000. Toss in another $3,000 to $10,000 for the honeymoon.

A Home

It’s after the wedding, carry your new wife/husband back to your future home! However, a 4-room BTO can cost between $300,000 to $ 500,000. The good news is that you can use the money in your Central Provident Fund (CPF) account to pay for your flat, but the flip side is that the mortgage payments will act as an anchor — dragging on your CPF account, and those funds will be needed for retirement.

Renovation

You can’t live in an empty home! So prepare up to $40,000 for renovation costs, and around $30,000 for mid-range furnishing, all payable in cash of course.

So, in just a few short years after graduation, a Singaporean graduate could easily take on over half a million dollars in debt and expenditures — while earning paltry starting salaries.

The Dilemma

So the twenties is when you will have to make some of the largest financial decisions you will ever make in your life, all while being relatively inexperienced in the matters of money management. And when your peers are spending monster amounts on their homes and nuptials, it’s easy to think that you too will make it work out, somehow.

It’s just hard to fully appreciate the impact of these decisions further down the road of life, but here are some tips that can help you start out on a good foot.

How to Deal?

Pay Off Your Debts First

The first thing you should do when you enter into adulthood is to first clear your student debt ASAP. That’s because interest payments, if left unattended, can easily snowball in no time. There are no two ways about it, the faster you clear your loan, the less in interest you pay.

Read about the ‘Snowball Ice Cream or Avalanche Ice Kachang’ method of clearing your debt.

Choose Your Home Wisely

Because very little cash is required when flat-shopping, it’s tempting to max out your loan eligibility get the biggest HDB flat possible. After all, when we are firmly within the 6-figure territory, another $100,000 can’t hurt, right?

However, your flat effectively acts as an anchor, dragging down on your CPF Ordinary Account (OA). This will return to haunt you when you need your CPF funds for retirement.

A good rule of thumb is to select a HDB loan quantum that you and your spouse can to fully service with only CPF monies each month — without any cash top-ups.

For example, if a couple earns a combined $5,000 a month, their OA contributions of $1150 will be roughly enough to cover the monthly mortgage for a $300,000 HDB flat (after a $45,000 Enhanced Housing Grant).

This rule guarantees any future salary increments will allow a trickle of money to flow into your CPF-OA accounts. This gives your CPF savings a chance to accumulate and compound as soon as possible.

Avoid Debt

You (or your parents) might have a dream wedding all planned out, but try your best to avoid going into debt to fund your wedding or honeymoon.

Sit down with your partner and jot down a wishlist, then make some calls to figure out how much it all costs.

Set a goal date of when the wedding is to be held. Then take a hard look at your budgets; Is it possible to set aside enough in savings within the desired time frame? If not, consider delaying your plans until you have enough, or start cutting things out of the list.

Or heck, break convention and do away with an expensive wedding altogether! Here are some couples that managed a wedding below 5-figures.

Glow Up!

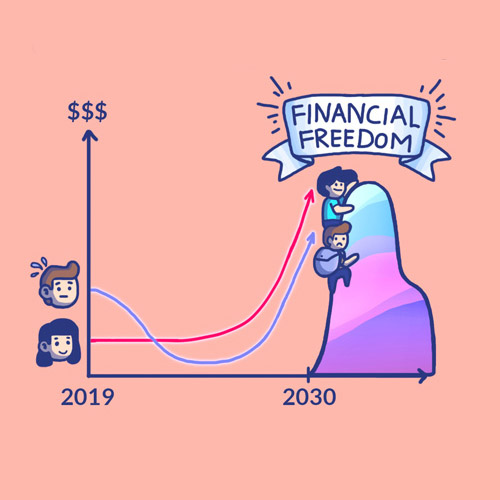

But it’s not all doom and gloom, if you can avoid taking on debt and start saving, you have a tremendous benefit that money cannot buy — time.

The earlier you start figuring out how to invest or find good places to stash some money, the faster your money will snowball.

For example, if at age 25, you started stashing away $100 each month into a 4% investment vehicle, you would have accumulated $118,5914 at age 65.

But if you started at 30 instead, you need to instead invest $170 a month to the get the same amount at 65! Simply put, that’s 70% more money required to make up for 25% less time. Compounding does not have a linear relationship with time — so the longer you wait, the more you will put yourself on the wrong side of the equation.

S0 while it’s true your twenties can be the toughest period of your life, but if you can make prudent decisions, it can be a period of great opportunity. So, what will it be for you?