Financial Planning | Personal Finance | Article

What is Inflation?

by Sophia | 16 May 2019

Imagine waking from a year-long coma. You celebrate by buying your favourite $1 cup of coffee. But it now costs $10,000,000.

Even worse: now, your life savings are worth less than a cuppa coffee.

Even worse: now, your life savings are worth less than a cuppa coffee.

This effect is called hyperinflation, a maniacal increase in costs. Hyperinflation is defined as prices increasing by 50% a month. It is an extreme form of inflation that renders the act of saving – and savings – useless. But breathe easy, hyperinflation is extremely rare and only happens when a country’s economy totally collapses.

However, normal inflation will occur. While nowhere near as extreme as the above scenario – its creeping effects can be just as crippling. Inflation is when goods and services begin to cost more over time. This means as the years go by, prices will increase. And if one’s income stays the same, one cannot buy as much stuff as before.

Inflation types

So here are the types of inflation and some examples of its causes.

Demand-pull inflation

When Shake Shack arrived at Jewel, the collective population went just about nuts. The sprawling queue showed the demand for their burgers were sky high. Let’s say in response to the crazy demand, Shake Shack’s management decides to double the prices. Confident suckers customers would still pay for it.

That’s demand-pull inflation. Prices are pushed upwards when demand is higher than supply.

Cost-push inflation

Imagine Netflix decides to pay higher salaries to all its employees. However, to do so and maintain profits, they would need to earn more money. So Netflix increases its subscription costs. We end up paying more for the same service.

This is cost-push inflation, where the increased cost of running the business is passed to the customer.

How does this affect me?

After reading the above, it can still be murky how these specific examples translate to an overall increase in the prices of things we buy. The key takeaway is things we purchase do not inflate at a uniform rate; food prices will not inflate at the same pace as the prices of medical services; doctor salaries might increase at a higher rate compared to restaurant managers.

So in Singapore, inflation rates are derived from a weighted average inflation rate across prices of goods and services that matter to us, from food to transport, and even recreation. It is called the Monetary Association of Singapore (MAS) core inflation rate

In Singapore, this rate has averaged 2.51% each year since 1961. So what does this mean for us? A cup of bubble tea cost $4 today, but at a 2.51% rate of increase, this happens:

The cost of bubble tea in 2059 – $10.74

So, forty years down the road, a medium-sized bubble tea will almost triple. Now extend that to transport, food, shopping… everything.

Inflation sucks (your money)

By now, one can see inflation does not directly benefit us as consumers. Inflation benefits businesses, allowing companies to increase prices yearly. In theory, if businesses do well, they should reward us, their employees, by increasing wages. This will allow salaries to rise with inflation.

Well, supposedly, anyway.

If salaries don’t follow suit with inflation, then we’re going to have to fork out more money as time goes by. Its effects are worse upon retirement; a retiree does not have income from salary and has to depend on savings from the past, when they earned less.

So you might be asking, what do I do with this information?

- Monitor inflation annually: this data can be found online and is periodically announced.

- Have your income match the pace of inflation

- Plan for your future needs with inflation in mind especially for retirement, using our historical rate of 2.51%. Here’s a calculator.

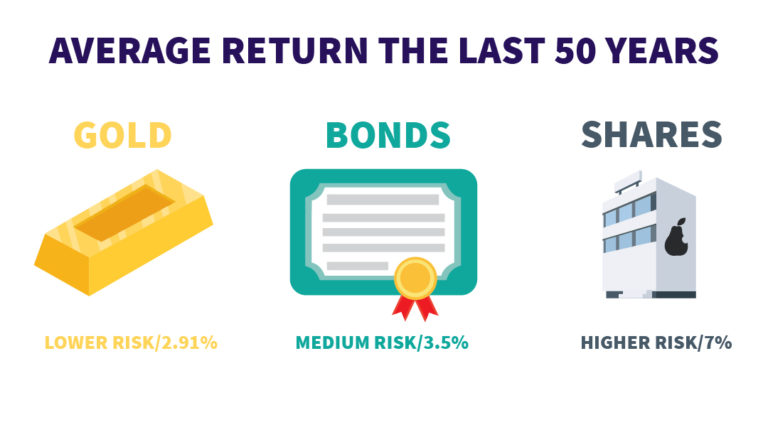

- Use 2.51% as a baseline to find ways to invest. Beating, or at least matching inflation, reducing the burden on savings.

In Conclusion

When saving for retirement – or any goals twenty years down the road – it’s always important to consider the rate of inflation. It’s also important to note it does not happen by accident, it’s actually planned into modern economies, so it will happen. UK and US governments try to manage inflation to a rate of 2% Here’s our government’s stand:

MAS does not have an explicit inflation target. Nevertheless, MAS has concluded that, on average, a core inflation rate of just under 2%, which is close to its historical mean, is consistent with overall price stability in the economy.

So, this is something we all have to deal with, and if we’re to stay afloat as prices rise, then understanding inflation is key – especially if we’re digging into investments to protect and grow our money in the years to come.