Investing | Article

You Are Using Robo-Investors Wrong

by Sophia | 6 Feb 2020 | 8 mins read

Robo-investors first hit the scene in 2016, but 2019 truly saw an explosion: There are now 11 robo-investors in Singapore, with DBS, OCBC, MoneyOwl, Syfe, Squirrel Save being the latest entrants.

Sure, robo-investors have higher costs versus doing-it-yourself, but if robos get you to start investing at all, we think these costs are a good problem to have.

In general, the game-changer robo-investors bring to the market is by making investing frictionless. It’s so easy to get on board; it’s so easy for investment newbies to finally start.

But we think making it too easy to sign up can be a double-edged sword.

To be fair, most robos have blogs and outreach events that educate potential entrants on the investment mantra that underpins periodic and passive investment.

But if you are diligent and have read up and internalised the strategy, this article isn’t for you — it’s for those whose eyes glazed over the wall of text and then skipped the tutorial.

“You Mean I Can Lose Money?”

We heard someone ask this after they had started with a robo-investors. And yes you can lose money, but why do people think otherwise?

Personally, I have friends that are ecstatic about the gains they had made — in mere months — with robo-investors, and based on that, they’re encouraging others to sign up.

Perhaps we can’t fault this emotion. After all, the times have been good. The S&P 500 — the index that tracks the top 500 American companies — has surged by 30% in the last year.

But good times might not last; crashes have happened before and will likely happen again — those who think otherwise will be unprepared to face temporary losses.

They are also likely panic-sell to make these losses permanent. Severe stock market drops happen because of panic-selling — so it is a certainty that investors do behave this way.

Let’s use the S&P 500 as a reference because it is an index that many local robo-investors invest in.

The U.S market saw 35 drops since 1945. Out of those, eight of them saw an average 27% decline. The last big one was one of the worst in 2008, where the S&P500’s value got wiped in half.

So yes, you can lose money, the great gains today can morph into be the great dips of tomorrow, but how can a newly fledged robo-investor deal with it?

What Can You Do About It?

Structure Your Financial Life

How do you ensure that you do not quit investing, and lock in losses in the bad times? Simple, don’t get retrenched during a recession, which usually comes hand-in-hand with a market crash.

Okay, so you might have no control over this.

So one important safeguard to put in place before you begin robo-investing is to ensure you have a ready emergency fund.

In the event that you are laid-off, you will not need to liquidate your investments to pay for your next meal, and give you some breathing space before looking for your next job.

Understand Asset Classes

Many of the robos-investors have an asset class allocation; most of them balance a portfolio between stock and bonds.

Why the different asset classes? Well, typically, in bad times, investors flee riskier stocks to the safer haven of bonds.

If we return to the crash of 2008, here is the comprehensive chart by New York University on the annual returns of the different sub-classes of bonds compared to equities during the crisis.

| Year | S&P500 | Short-Term Government Bonds | Government Bonds | Corporate Bonds |

| 2008 | -36.55% | 1.37% | 20.10% | -5.07% |

So while even corporate bonds went negative, the key point is that it still did not crash as badly as the index.

If such a crash happens, your portfolio will still sink (and stink), but the presence of bonds ensures your total portfolio value does not sink as much — acting as a stabiliser for your portfolio, and more importantly, your mental health.

So allocating your money between stocks and bonds is part of risk management, or rather, psychological management. This reduces the chance you might rage-quit your robo-investor during the worst times.

Understand The Investment Horizon Required

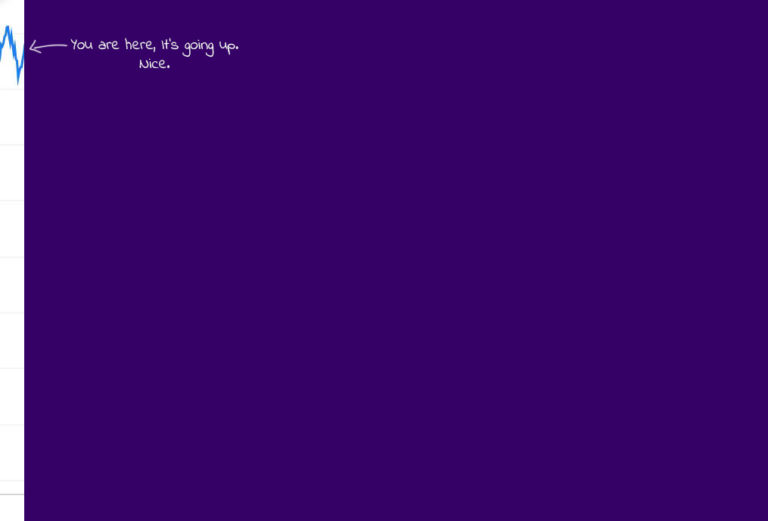

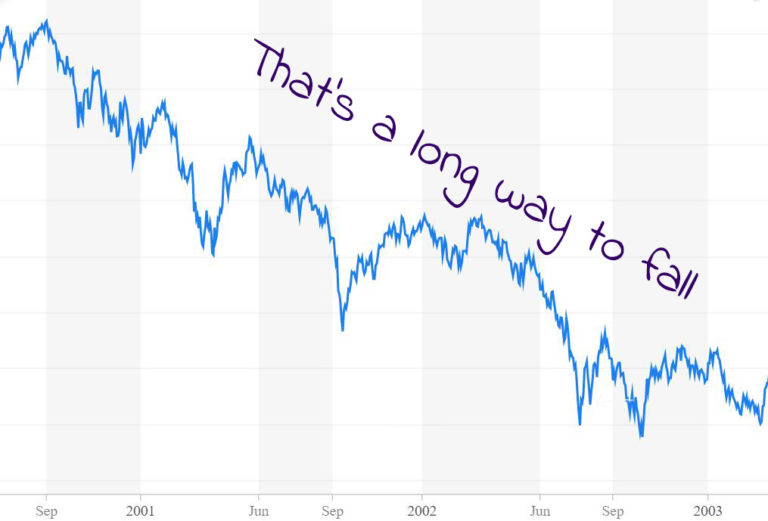

Imagine that it’s the year 2000 and it’s the turn of the millennium.

Specifically, it’s August 2000 and you decide to start periodically investing at $1,000 a month into the S&P 500.

But immediately, the Dot-com crisis hits — your stomach sinks as you see the index tumble.

But you keep buying.

A year later, the twin towers fall — and the index follows.

At this point, you feel slightly foolish to keep buying a falling investment. But you keep at it!

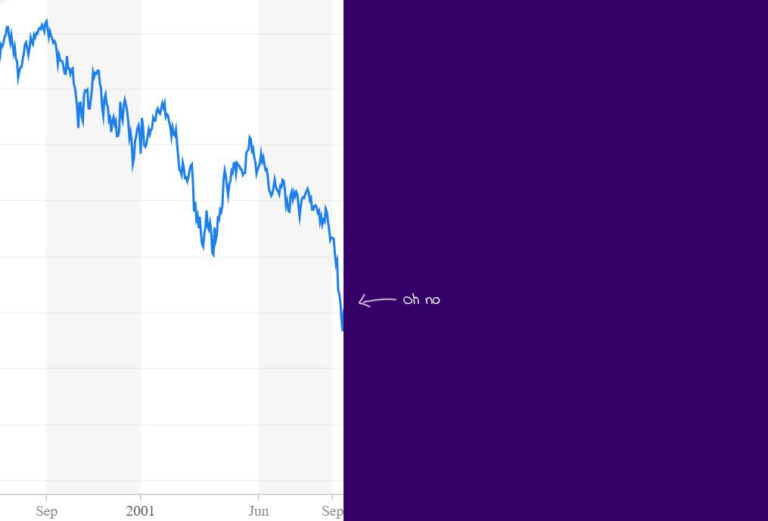

Two years later, you are raging, this time for seemingly no reason as the stock market has crashed again!

At this point, you feel like the captain of the Titanic — going down with your ship. But just like the string band on the deck of the ship, you kept playing.

You stay the course!

But even by the third year, specifically, February of 2003, it still looks like this.

Now let’s put that in context. That was a 30-month long tumble — precisely, two-and-a-half years.

Imagine seeing your investment vehicle sink over that time and the damned robo-investor is still making you buy into a falling (and failing?) market!

If you started in August 2000 and needed your money within 30 months you’d have been better off stashing it in a bank account.

But back to the unlucky investor scenario.

You grudgingly stick to it, and 8 months later at the end of 2003, your investment would have broke even — an even better, month after month you see its value climb.

| $1,000 a month into S&P500, starting from Aug 2000 | ||

| Date | Total Investment | Value |

| Feb 2003 | $30,000 | $23,302 |

| Dec 2003 | $40,000 | $41,482 |

| Dec 2004 | $52,000 | $59,376 |

| Dec 2005 | $64,000 | $75,896 |

| Dec 2006 | $76,000 | $99,362 |

| Dec 2007 | $88,000 | $117,228 |

Year after year you see your returns grow. Finally, you think, this passive investing thing is paying off!

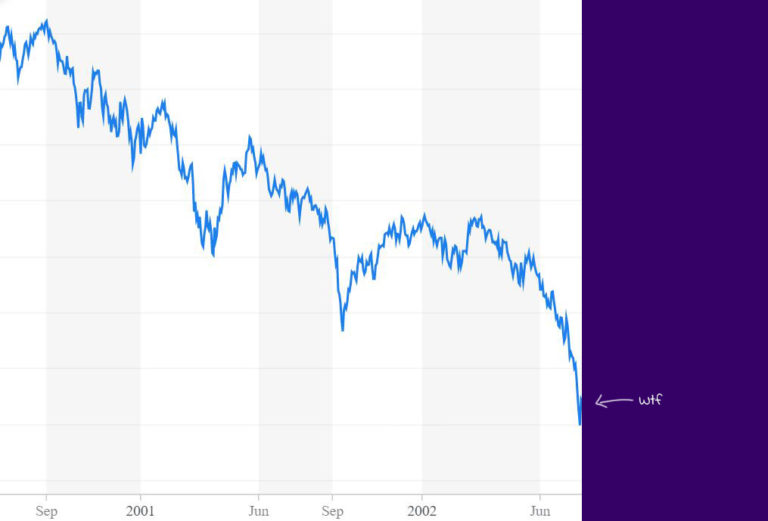

But remember what comes next?

It’s eight years from when you started and 2008 rolls by — bring along one of the greatest market crashes of all time.

| $1,000 a month into S&P500, starting from Aug 2000 | ||

| Date | Total Investment | Value |

| Feb 2003 | $100,000 | $79,781 |

Boom. Over 20% gone.

Of course, this is all historical data; such events might not happen again. But if a scenario close to this repeats itself, even with an eight-year investment horizon (that starts from the year 2000), you’d have lost money.

This exercise highlights one point, with robo-investing you need a long investment horizon to ride out market volatility and events.

But if you had orbs of steel and kept at it? Your investment of $240,000 would be worth over $650,000 today.

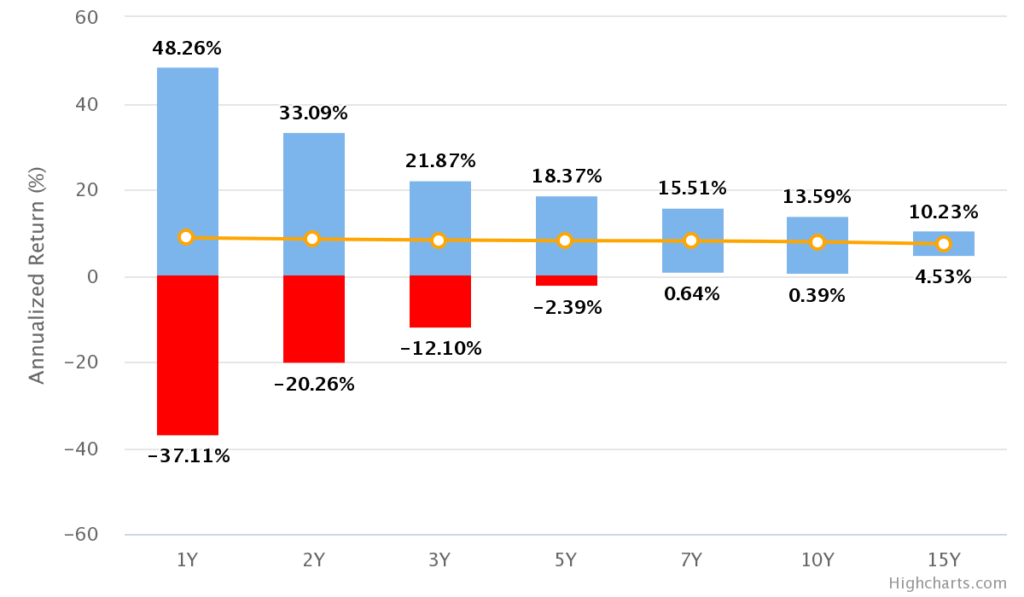

Multiple studies have shown that the longer your investment horizon the more likely you will come out ahead.

Historical analysis of the rolling returns of the 3-fund portfolio — an investment strategy similar to the one used by robo-investors — show that over 15 years of investing, your annualised returns would sit between 4.53% to 10.23%.

But note that with even a 10-year horizon, you might still only have a chance of simply breaking even. If we throw in costs, that return will be negative.

So if you are putting money that you might need within 10 years into a robo, you might need to think twice. 15 years seems to be a safe bet.

Understand How To Exit

So — according to history, at least — a long time frame of periodic investing can help an investor ride out short to medium-term swings.

But in the end, it does nothing for the risk of your final exit in life (we mean retirement, BTW).

To explain this, let’s say you are investing for your retirement today and you managed to accumulate $650,000.

But what if the market crashes by 50% tomorrow, and your investment shrinks to $325,000?

If you have just retired and need to liquidate $32,500 of your portfolio to fund your expenses, you are essentially permanently deleting 10% of your portfolio, compared to just 5% pre-drop.

Many robos do not address this risk that looms at the end of the journey.

If this happens to you, it will be up to you to decide if you need to extend your working life further — hunkering down for a long, painful wait — and hold on to the hope that your investment will crawl back upwards.

There are some strategies to mitigate the impact of this risk, such as being more invested into bonds as you transition to your retirement years — as their prices do not fluctuate as wildly. As many robos market their platforms as retirement solutions, hopefully, this feature of shifting of one’s asset allocation — when one is closing onto one’s retirement date — will be available in the future.

In Conclusion

Yes, robos promise a swift and smooth entry into the world of investing, and will allow even the greenest investing newbie to get started on what is ultimately a long journey ahead.

But just because investment has become automated does not mean that we as investors are safe from devastating financial events or crises, or even just periodic market dips as is typical of a market.

Investing with a robo does not absolve you from the risks involved with investing. So yes you can lose money if you don’t know what you are doing!

Without knowing the basics and going through the much-needed tutorial, it will be hard to navigate the investing landscape once things start to go south (if and when they do), and we may fall prey to our emotions as a result of a lack of understanding. So, it’s not just the robo-advisor that does the work for you — you have to pull your weight as well.