May Sim, 35, content lead

When I was in college, a friend told me that she would set aside $5 notes every time she received it. Using this method, my friend saved nearly $350 in two months. I was inspired. But since I didn’t have a lot of money back then, I tried this with $2 notes instead. Every time I ate out or bought something, I would get very excited whenever I received a $2 note. I remember an incident when I paid for a chocolate bar with a $50 note, but the shopkeeper saw that I had a few $2 notes in my wallet and asked me to give him those. When I explained that I can’t give it to him because I had to save it, he laughed at me and said, “How much can you get by saving $2?” Well, I managed to save $250 in three months. This might not sound like much to many, but for someone who has never been able to save anything before this, I was very pleased with myself.Keshvinder, 26, sales executive

Smoking is an expensive (and bad) habit that I wanted to kick. A box of cigarettes cost at least $14, and I would go through a box of cigarettes every two days. That meant that I was spending about $200 every month on cigarettes alone. To incentivise myself to quit, I decided to tie my bad habit to a good habit – saving money. I told myself that whenever I had an urge to smoke, instead of buying a box of cigarettes, I would transfer the money into another savings account. In 2 months, I managed to save $900 (there were a lot of urges to smoke!). Though I couldn’t completely kick my smoking habit, I was curious to see how much money I could save and whether I could force myself to quit smoking cold turkey.Sabrina Wong, 26, community manager

Many couples keep their savings in their individual bank accounts before marriage since no one is 100% sure about whether we’ll end up getting married, or not. After much consideration with my then-boyfriend (who is now my husband), we decided to set up a joint account even before we got married. As unconventional as it was, we believed that being able to practice good budgeting and financial planning would help in the future when it comes to matters involving both of us such as wedding planning and planning for a family. This is how we started a joint account where we agreed to deposit a fixed sum into the account every month for our large purchases such as our home down payment and renovations. The accountability helped us to be more disciplined in our savings to date! For the smaller expenses that we wanted to save for such as gifts and our vacation fund, we both use a savings app that automates our savings so that we don’t have to manually track every little thing.Tracy, 31, partnerships manager

Like many others, I used to go crazy during sales periods. Everything seemed like a good bargain, so I used to buy a lot of clothes. My wallet and closet would pay the price. My closet was full of clothes, and I realised how wasteful I had become with my money. So, I told myself I had to stop. That is when I started the one-in-one-out approach. This means that whenever I want to buy something, I have to sell or give away an item that I have first. I would sell my old apparels online and use that money to fund my next purchase, or save it for a bigger goal. If I didn’t manage to sell or gift an item, I would not buy a new one. This approach helped me become more intentional with my spending and helped me save more money each month.Alyssa, 28, account manager

I’ll admit that I have never been good with money or with budgeting, my salary would finish before the month was up. The last week of the month was always the hardest because I would have used up all my money by then. After a couple of year of struggling to save money, I told myself that enough was enough. Since I knew I had trouble controlling my spending, I needed to find a way to trick myself into saving money. This is what I did: When I got my salary every month, I immediately paid off all the necessary expenses such as my rent, utilities, debts, and so on. Then, I would immediately take $500 and set it aside in a separate account. With this method, I tricked myself into thinking that I had less money than I actually did to spend. Out of sight, out of mind! My bank account balance will still end up at $0 at the end of the month but the difference now is that there’s a portion of my money stashed away somewhere else for my future.The Simple Sum Community

Challenges make saving fun, as there is a competitive element to help you stay accountable. You can even set a reward for if or when you achieve your target. Over the course of several months, The Simple Sum challenged our community to reduce their spending on certain expense categories with Spend Less with TSS so that they can save more money. Participants either axed an expense category for a week, such as online shopping, snacks or drinks, or reduced their air-conditioning usage to save on electricity. To help them keep track, participants used templates to mark whether they were successful in reducing their expenses each day. At the end of the month, participants would calculate the total savings by reducing their expenses.Variety is the spice of life

As saving money for a better financial future is a long-term goal, people might find themselves lacking the motivation to keep saving money along the way, especially when their budgeting methods get stale. So, to make things exciting, get creative and don’t be afraid to follow unorthodox methods of saving. Hey, if it works, it works!Content sponsored by Hugo

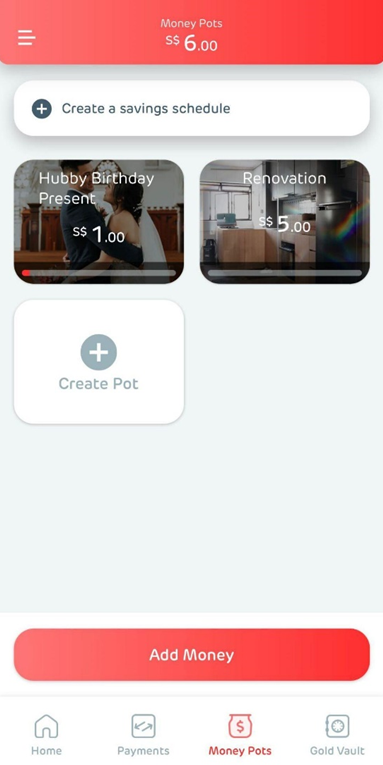

A message from our sponsor: Unconventional is the name of the game at Hugo, who is always pushing the boundaries, finding ways for what your money can do for you. Hugo uses technology-enabled but tried and tested ways of helping you save money. Hugo Roundups makes saving second nature. Every time you spend on your Hugo debit card, Hugo rounds up your purchase to the nearest dollar and puts the excess into savings. You’ll hardly even notice the tiny amounts that you will be saving each time you buy your favourite coffee with your Hugo card. What’s more, Hugo will analyse your spending habits and will provide recommendations on how you can improve and save more. Each week, the accumulated Roundups will be invested into your Gold Vault automatically. We basically do the saving and investing for you. Hugo Money Pots on the other hand allows you to set financial goals and targeted deadlines and will track your progress to ensure you achieve your goals on time. You can even opt for Shared Pots, which makes managing shared goals and saving together, such as a wedding or vacation, a breeze.

Take it from Sabrina, who’s using Money Pots to save up for her household expenses:

“We set up individual Money Pots and saving schedules for each of our planned expenses. It makes saving for our goals much more convenient and easy to track! On top of this, we like to spend and save via Hugo, which rounds up our transactions to the nearest dollar and saves our spare change in gold. We think that’s a really neat way to build up savings habits!”

Hugo helps you save, invest and achieve your financial goals.

Hugo Money Pots on the other hand allows you to set financial goals and targeted deadlines and will track your progress to ensure you achieve your goals on time. You can even opt for Shared Pots, which makes managing shared goals and saving together, such as a wedding or vacation, a breeze.

Take it from Sabrina, who’s using Money Pots to save up for her household expenses:

“We set up individual Money Pots and saving schedules for each of our planned expenses. It makes saving for our goals much more convenient and easy to track! On top of this, we like to spend and save via Hugo, which rounds up our transactions to the nearest dollar and saves our spare change in gold. We think that’s a really neat way to build up savings habits!”

Hugo helps you save, invest and achieve your financial goals.