Life

Trapped In A Suffocating Cycle, Impulse Spending Gave Me Emotional Damage

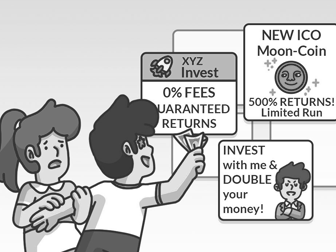

This is the last time. I tell myself. But the moment comes when I just must get this dress that is on sale. Someone tries to grab it too, and in a frenzy, I snatch it off the shelf. It’s mine now! Then comes me taking out my credit card for the swipe. Beep! Then comes the realisation that I was only chasing instant gratification, only to suffer for the rest of the month. That’s me when it comes to impulse spending. I know that going over budget to buy things I don’t actually need is harmful, yet I still can’t seem to stop myself. Just take the tinted sunscreen I bought a few days ago. (What?!) Stuck on a never-ending loop of buy, regret and repeatIt all started with temptation. I was just passing by when I noticed that one of my favourite sunscreen brands was having a roadshow. They were promoting a new tinted sunscreen that was said to be ultra-light and could brighten the skin tone. Then came infatuation.Do I need a new sunscreen? No. Do I have money to splurge on this? No. But my mind kept thinking of how my skin would look so good. Not to mention, it was 30% off! And just like that, the purchase happened. At first, I was really excited to try it out. The sunscreen worked exactly as it promised, and I was happy using it. But regret soon crept in, as I realised I screwed up my budget for the month.I would then spend the next few days regretting my purchase. That money could have gone to better use — groceries, paying off my college debt, or even setting aside extra savings to replace my worn-out light bulb.Instead, I spent it on sunscreen that I already have, just because I want to indulge the thrill of trying new things.Every month, I go through the same cycle, from the temptation all the way to regret. I understand that I have let myself stay trapped in it for far too long.I am aware of my lack of self-control when it comes to splurges, so I have made plans to break out of this cycle.I started applying the 24-hour rule by postponing my purchases for a day. It doesn’t always work, but at least I have a mental checklist for me to take a step back before diving in nose deep.I’m also limiting my impulse splurges to cash only, which helps lessen credit card bill shocks.This article is part of TSS Confessions, a weekly column where we delve into personal finance topics that are unscripted and genuine real accounts from people.

Help! Trending Plushies Have Taken Over Our Homes, And Our Wallets!

I'm Preparing For Retrenchment, Even Though I'm Not In Danger — Yet

Chasing The 5Cs Left Me Tired And Miserable

Can I Still Get Married Before 30?

I Was Harassed By Loansharks Because Of My Own Sister

I Bought My First Luxury Watch Thinking I Could Afford It, Only To End Up With Very Tight Cashflow

Is Leaving The 9-to-5 Life Really The Dream We Think It Is?

Cos Now I’m Stronger, Than Yesterday: Gig Workers Edition

I Didn’t Take A Single Sick Day For A Year And My Boss Still Didn’t Care